Investing in stocks is widely recognized as an effective long-term strategy in the world of finance.

While the investment landscape offers a myriad of options, such as collectibles, fine wines, or real estate, all of which may increase in value over time, the straightforwardness and historical success of stock investments stand out. Stocks are remarkably easy to acquire and have consistently demonstrated their ability to deliver notable returns over the long haul.

Practically speaking, stock investors who plunked a mere $1,000 in the S&P 500 back in 1970, and didn’t contribute another cent, would still be sitting on $171,550 as of the end of 2022 (and even more today). That compares to just $47,338 for gold, $30,598 for bonds, and a mere $9,895 for short-term Treasuries!

Yes, past performance has no bearing on future returns. But by their very nature, stocks have the potential for higher returns than many other assets, now and in the future—and the longer you hold, the more compounding can do the wealth-building work for you!

If you’re embarking on building your investment portfolio, you’ve come to the right place. In this article, we’ll delve into some of the most reliable long-term stocks that are ideal for holding over many years, possibly even decades. Alongside this, we’ll cover some fundamental principles of stock investing and address several frequently asked questions about the stock market.

Disclaimer: This article does not constitute individualized investment advice. These securities appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: Tabular data presented in this article is up-to-date as of Oct. 15, 2024.

Featured Financial Products

Table of Contents

Why You Should Invest in the Stock Market

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market.

But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

But the bottom line is that, whether you invest in stock mutual funds, stock ETFs, or a few stocks individually, these assets are among the best long-term investments for several reasons. Among them:

— They have higher rates of returns than just about any other asset class.

— They can be held in numerous types of investment accounts.

— They’re easier to understand than many other types of investments.

A stock is simply a piece of ownership in a company. It allows you to profit from a company’s success—most commonly, from price appreciation in shares of the stock, but in several cases, also from cash distributions (dividends) the company makes to shareholders.

Growth Stocks or Value Stocks?

Growth stocks are companies that are expanding their profits and sales at a steady clip. Typically, growth stocks are firms that have either an attractive product they are bringing to new markets or a steady drumbeat of new items they can sell to existing customers to open up new revenue streams.

Technology companies are typically the most common example of growth stocks, as they bring new gadgets to market that are better or faster than previous products.

Value stocks, on the other hand, are companies that might not be expanding rapidly but have a strong underlying business. Think of a local bank or a utility company that might have trouble doubling in size over the next few years, but doesn’t face a lot of competition or disruption to its business model. These kinds of companies are often more stable thanks to the underlying value of their businesses.

The best long-term stocks cover both camps. Reliable growth can result in significant gains over many years, but alternatively, a rock-solid value stock will most commonly weather any market disruptions much better than a company that relies on enterprise spending trends or consumer confidence to drive its sales.

What About Dividend Stocks?

Dividend stocks (which commonly are value stocks, but can be growth stocks) are great ways to drive long-term performance of your portfolio. These companies pay a regular flow of their profits directly back to shareholders, meaning you receive some sort of return regardless of the ebb and flow of share prices.

Stocks that can both grow and pay dividends are the ultimate long-term stocks given just how much in additional returns they can generate over the long term.

Related: 10 Best Dividend Stocks to Buy [Steady Eddies]

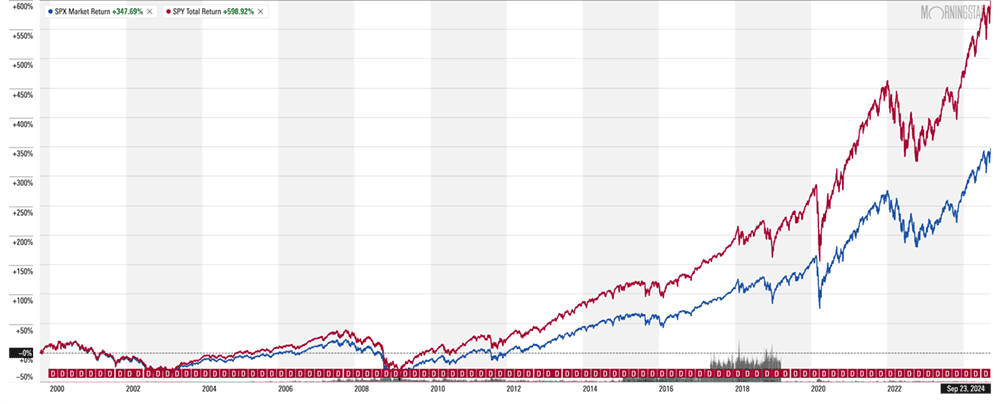

The above image is a look at the return someone could expect if they received just the price returns from an S&P 500 over the past 25 years.

But What If I Reinvested My Dividends?

Now look at the above chart to see how much better the return is when you factor in dividends had you had reinvested those dividends back into the S&P 500 (returns illustrated by an S&P 500-tracking ETF; note that expenses are included in performance).

The price return is a little less than 350%. The total return (price plus dividends) is almost 600%!

Related: The 7 Best Closed-End Funds (CEFs) That Yield Up to 11%

The best long-term stocks tend to be companies that aren’t overly dependent on specific trends in the global economy, and companies that can deliver returns in any environment. Dividend growth stocks (companies that pay larger dividends over time) tend to check both those boxes, proving they have operations that generate significant profits, and are growing those profits enough to deliver larger paydays to shareholders each year.

Consider getting some stock picking help by Motley Fool Stock Advisor

What’s a Diversified Portfolio?

The best long-term stocks are part of an investment strategy that prioritizes stability and risk management over risky short-term bets that might pay off—or leave you in tears.

There are plenty of investment strategies that, after the fact, look wise simply because they worked out. But your personal financial situation matters. Ask yourself this: Would you bet $10,000 on a 50/50 chance of either doubling that money or losing every penny instantly?

If your answer is “no,” then there are certain strategies you should never consider in your toolkit, and others you should stick with even if it means your returns are not as dramatic.

One low-risk strategy that many investors deploy is the notion of a diversified portfolio that spreads your risk around in multiple vehicles. The easiest way to do that is through mutual funds and ETFs, which hold dozens if not hundreds or even thousands of stocks, bonds, and other assets. And you can keep your costs down by purchasing index funds—mutual funds or ETFs managed not by humans, but effectively a rules-based algorithm.

However, you can also look beyond the typical offerings out there and build your own diversified portfolio by hand-picking a basket of long-term stocks.

If you want more control or customization in your portfolio, there’s nothing wrong with picking individual stocks—in fact, it often makes sense to put a few individual stocks alongside the mutual funds and/or ETFs in your portfolio.

Just make sure you’re doing your research to ensure you have the best stocks available, and that you are keeping an eye on diversification.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

Top Picks to Consider for Long-Term Holding

If you’re looking beyond mutual funds and ETFs to build your own portfolio of the best stocks to hold for a long, long time, it’s crucial to both understand your personal investing goals as well as to do your own homework before buying (and selling!) an individual company’s shares.

That includes looking at stocks for specific strengths, like their market share or their annual earnings trends compared with their peers, as well as how a given stock performs against the broader market at large.

There’s no one-size-fits-all approach to anything on Wall Street, so you should always look at the latest numbers and do your own personal analysis before making any trades. But to get you started, here are a few standout companies that are among the best long-term stocks to buy based on share performance, earnings trends, staying power, and other factors.

Featured Financial Products

1. Johnson & Johnson

— Market value: $388.7 billion

— Dividend yield: 3.1%

— Sector: Health care

If you’re after the best long-term stocks, Johnson & Johnson (JNJ) is a great place to start—if not to buy the stock itself, then at least as an illustration of what you should be looking for.

Johnson & Johnson is a massive, diversified health care company that was founded back in 1886. JNJ has for decades been referred to as a “widow-and-orphan” stock because its defensive, income-generating characteristics make investors feel like they can buy shares almost as an insurance policy to ensure their family’s wealth for many years to come.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

That’s in part because of its dominance and size; J&J typically finds itself among the 20 or so largest stocks on Wall Street. That’s also because of the general resilience of the health care sector, which enjoys reliable sales regardless of macroeconomic pressures or consumer sentiment—after all, regardless of what the economy’s doing, people still have to buy medicine.

That reliability fuels consistent JNJ dividends. The health care giant has raised its payouts for 61 years running—one of the longest track records on Wall Street (making it a Dividend King, or a stock that’s reliably paid and increased its dividend payout each consecutive year for at least 50 years). And Johnson & Johnson is spending less than half of its profits on dividends, which is a healthy ratio that signals more potential for dividend increases going forward.

Many investors have held JNJ stock for their entire lives, and the company continues to appear worthy as a long-term buy-and-hold stock. If nothing else, it’s a representative example of the kinds of companies investors should consider when their holding time is measured in years, and not just a few months.

Like Young and the Invested’s content? Be sure to follow us.

2. DaVita

— Market cap: $13.5 billion

— Dividend yield: N/A

— Sector: Health care

One of the most durable long-term growth investments you can make is to bank on the continued expansion of the healthcare sector as demographics both at home and abroad are fueling a tailwind that will last for decades to come.

DaVita (DVA) illustrates that point perfectly, with a business focused on dialysis treatment for patients with chronic kidney conditions. With more than half a million dialysis patients in the U.S. needed regular care, DVA has a big pool of patients that depend on it.

Related: 10 Best Vanguard Funds for the Everyday Investor

DaVita also has the backing of Warren Buffett’s Berkshire Hathaway, which first took a stake in the stock back in 2011 and has increased its position steadily to account for more than 35% ownership in the firm. That will provide a strong foundation for shares, as institutional investors like the so-called “Oracle of Omaha” are far more likely to buy and hold than churn their shares based on short-term trends.

With a big tailwind for the underlying business and long-term investors that will provide a firm floor for shares, there’s a lot of structural reasons to like DaVita.

Related: 7 Best High-Dividend ETFs for Income-Minded Investors

3. Alphabet

— Market value: $2.0 trillion

— Dividend yield: 0.5%

— Sector: Communication services

A very different example of a long-term stock to buy and hold is Google and YouTube parent Alphabet (GOOGL). One of just a handful of trillion-dollar tech stocks, and a member of the Magnificent Seven, Alphabet is a digital advertising powerhouse that not only provides the go-to search engine for most Americans, but also the infrastructure to serve display ads across all manner of content.

Alphabet is not just resting on its laurels, either. Alphabet has seen its sales gains pick up in each of the past four quarters. Q1 revenues, reported at the end of April, were up by double digits, and analysts project a continued gain in 2024 sales. Amid this tailwind of top-line growth, Alphabet also has gotten serious about efficiencies and the bottom line, too. Last January, Alphabet laid off about 12,000 workers, roughly 6% of its workforce total, claiming a “different economic reality” in 2023 after a pandemic-driven boom in hiring. (It has announced smaller rounds of additional layoffs since then.)

Admittedly, 2023 was a good year for many stocks, with the S&P 500 Index up 24%. But GOOGL more than doubled that figure with a 58% gain in the same time frame thanks to both strong top-line performance and a more scrutinizing eye on profitability.

Beyond the core digital ads biz, Alphabet is also embarking on some game-changing technology, including its Gemini AI chatbot, a Google Fiber high-speed internet service that is challenging traditional telecoms in select markets, and other ambitious efforts.

There’s even a new dividend for shareholders, and growth is fundamentally in the DNA of this Silicon Valley leader—as evidenced by the fact shares are up 170% or so in the past five years, and more than 700% since 2013.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

Featured Financial Products

4. Microsoft

— Market value: $3.1 trillion

— Dividend yield: 0.7%

— Sector: Information technology

When it comes to a stock with scale and staying power, tech giant Microsoft (MSFT) is another tech giant that immediately springs to mind. The technology firm is synonymous with workplace productivity, with its Windows and Office 365 software products the gold standard for businesses around the world.

Microsoft isn’t without growth plans despite its already impressive scale, however. Its Azure cloud computing business continues to gather steam, its remote workplace tools like Teams have now become hardwired into enterprise operations in the wake of the pandemic, and its Xbox video game arm is a juggernaut in its own right after closing a $69 billion acquisition of software giant Activision Blizzard in October.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

With long-term investing, it’s all about trying to find certainty in an uncertain world. And the dominance of Microsoft seems incredibly likely regardless of geopolitics, economic cycles, or anything else.

Microsoft is one of the 25 largest corporations in the world as measured by revenue, and it’s the largest in market capitalization right now. And despite being a still-“growthy” tech company, it also offers a modest but rising dividend.

If you want stability and scale in a long-term stock investment, Microsoft is it.

Related: 5 Best Vanguard Retirement Funds [Start Saving in 2024]

5. United Parcel Service

— Market value: $115.3 billion

— Dividend yield: 4.8%

— Sector: Industrials

Cyclical businesses—companies that are heavily tied to the ups and downs of economic activity—are more difficult stocks to hold for the long term because of the inevitable swings. United Parcel Service (UPS) fits this mold, and has seen shares slump by double digits in 2023 thanks to fears of a consumer slowdown. But these short-term headwinds aside, it’s still an excellent buy-and-hold candidate.

Yes, UPS’s logistics business is cyclical, as package volume tends to rise and fall based on broader spending trends. But there’s a long-term megatrend lifting this stock that cannot be overlooked. And if you look around the front porches in your neighborhood, you’ll probably find proof of this trend yourself via all the boxes lying around.

Related: Best Schwab Retirement Funds for an IRA

In the age of Amazon.com (AMZN) and e-commerce, UPS is about as safe a bet as you can make. It’s a valuable part of the global supply chain, and it comes in at triple the size of competitor FedEx (FDX).

United Parcel Service has been around for more than 100 years. Relatively recently, it has made a more concerted effort to begin sharing its success with stockholders. UPS has provided shareholders with 15 years of annual dividend increases. Payouts are around 80% of 2024’s projected earnings; it doesn’t leave much room for hikes down the road without additional profit growth, but it’s a sustainable figure.

Related: 13 Dividend Kings for Royally Resilient Income

What’s more, UPS also announced a new $5 billion share repurchase plan in early 2023. By reducing the amount of publicly traded shares on the market, that naturally tips the supply-demand dynamics in favor of higher UPS stock going forward.

That’s just one more reason UPS is among the best long-term stocks to buy now.

6. Prologis

— Market value: $111.3 billion

— Dividend yield: 3.2%

— Sector: Real estate

Real estate is often seen as a store of value for many long-term investors, and for good reason. In the words of Mark Twain, “Buy land, they’re not making it anymore.”

That simple truth makes Prologis (PLD) a great long-term stock to consider because of its portfolio of specialized properties in key markets around the world. The global leader in logistics real estate with a focus on high-barrier, high-growth markets, PLD and its warehouses are a key part of the world’s supply chain.

Related: The Best REITs to Invest In for 2024

Prologis owns and/or operates 1.2 billion square feet across 19 different countries. Top clients include Amazon and FedEx, making these properties must-have hubs for distribution, but they’re just part of a diverse base of roughly 6,700 customers largely in business-to-business distribution and retail fulfillment.

With projected revenue growth in the low double digits for both 2024 and 2025, PLD is ramping up operations to become even more dominant in the years ahead. Dividends are now about three times what they were a decade ago; the company has increased its payout during the first quarter for years, so now’s a great time to buy into Prologis in anticipation of even higher dividends in 2024.

Related: The 9 Best Dividend Stocks for Beginners

It’s hard to imagine any upstart firm acquiring enough property quickly enough to compete with Prologis in the years ahead. And while spending trends wax and wane, the long-term nature of PLD leases with first-class corporations means its finances (and its dividend) are very secure for the foreseeable future.

Related: 11 Best Stock Screeners & Stock Scanners

7. Moody’s

— Market cap: $86.5 billion

— Dividend yield: 0.7%

— Sector: Financial services

Moody’s (MCO) is a global risk management firm that is best known for providing credit ratings. That includes credit scores for individual consumers as well as “official” rankings for major corporations and governments—including the United States, via its rating on U.S. Treasury debts. Additionally, the company also offers investor services that includes research and data to arm investors with information to make the best decisions.

Related: 10 Best Vanguard Funds for the Everyday Investor

In May, Moody’s announced an 85-cent quarterly dividend after increasing the dividend by more than 10% from the prior payout in February. Consider that in 2014, it paid just 28 cents per share—meaning over the last decade, MCO has increased its payouts more than three-fold. That’s part of a broader long-term trend of growth and success, too, with revenue that has surged from $4.8 billion in fiscal 2019 to a projected $7.1 billion for fiscal 2025.

The structure of the current financial system all but guarantees that consumers and businesses will need to go through Moody’s to get their seal of approval for loans. And given the history of revenue expansion and dividend growth in recent years, there’s good reason to bank on Moody’s delivering in the year’s ahead.

Related: 5 Best Schwab Retirement Funds [High Quality, Low Costs]

8. Constellation Energy

— Market value: $83.2 billion

— Dividend yield: 0.5%

— Sector: Utilities

When it comes to the best long-term stocks, the utility sector stands out as a natural place to look.

For starters, utility companies always have “wide moats,” which is a way of saying they have significant, established advantages that make it difficult to compete. Utilities are exceedingly capital-intensive businesses that are highly regulated, and thus competition is very difficult to come by—in fact, in many cases, U.S. utilities are de facto regional monopolies. Furthermore, electricity is a necessity for businesses and consumers that sees strong baseline demand even in a rough economic environment. That creates a measure of certainty for the sector, regardless of broader uncertainty or economic cycles.

Related: 5 Best Vanguard Retirement Funds [Start Saving in 2024]

If you’re looking for long-term investments, then, utilities are a natural choice. And in this sector, Constellation Energy (CEG) stands out as one of the larger and better-performing options in the sector.

Constellation is among the largest utility stocks on Wall Street. Based out of Baltimore, it sells natural gas and electricity service, with about 32,400 megawatts of generating capacity—enough to power 16 million homes and businesses. Its facilities include nuclear, wind, solar, natural gas, and hydroelectric assets.

Related: The 7 Best Vanguard ETFs for 2024 [Build a Low-Cost Portfolio]

It might not have as generous a yield as other utility stocks out there, but keep in mind that Exelon (EXC) spun off Constellation Energy at the beginning of 2022, and the dust is still settling. Still, it’s incredibly encouraging to see that distributions doubled in 2023 over the prior year, and skyrocketed another 130% so far in 2024. The fact that shares climbed 52% in 2023 to more than double the S&P 500 is also a big vote of confidence in favor of CEG stock.

Like Young and the Invested’s content? Be sure to follow us.

9. Costco Wholesale

— Market value: $393.9 billion

— Dividend yield: 0.5%

— Sector: Consumer staples

Generally speaking, retailers are hard to rely on as buy-and-hold investments because they tend to be subject to broader spending trends and changing consumer tastes. It’s also worth noting that brick-and-mortar retailers are anything but a sure thing in this age of e-commerce.

However, warehouse retailer Costco Wholesale (COST) is still worth a look as a long-term holding, since its unique model sidesteps most of these concerns. For starters, the chain operates more than 870 warehouses worldwide, with about three-quarters here in the U.S. It It appeals to bargain shoppers and the staples it sells typically have low margins, but it also has a regular membership fee that generates a ton of baseline cash every year. Costco boasts nearly 130 million cardholders in the U.S. alone—and at $60 per household and business memberships even pricier, that creates a tremendous foundation for this retailer.

Related: 13 Best Stock & Investment Newsletters for Inbox Alpha

What’s more, the company’s customers are true believers in its value-conscious offerings, and there’s a veritable cult of followers behind Costco’s Kirkland store brand. And if times get tough, even more customers might end up walking through the warehouse looking to save on their groceries and household goods as they pass over Costco’s competitors.

A low-cost approach might not set the world on fire, but providing affordable offerings to loyal customers is a pretty consistent business model.

Featured Financial Products

10. Lockheed Martin

— Market value: $144.0 billion

— Dividend yield: 2.2%

— Sector: Industrials

For better or for worse, defense giant Lockheed Martin (LMT) seems like one of those companies that will always have a sound financial foundation thanks to its focus on military matters and close relations with the U.S. Department of Defense.

Lockheed and its iconic “Skunk Works” developed many of the Cold War-era jets and missile systems that have become synonymous with modern military might. And more recently, conflicts like those in Ukraine and Gaza have sparked an increase in spending on its drone and missile defense operations.

Related: 10 Best Stock Picking Services, Subscriptions, Advisors & Sites

The for-profit nature of our military industrial complex might not sit well with some investors. But presuming you have no moral qualms about the kind of business LMT is in, this is definitely a long-term investment to consider because its business isn’t driven by consumer spending or even enterprise spending the way tech companies or apparel companies are. Instead, it’s driven by long-term contracts—and the long-term need for security amid geopolitical unrest.

Related: 11 Best Stock Advisor Websites & Services to Seize Alpha

11. Plains All American Pipeline, LP

— Market value: $12.4 billion

— Distribution yield: 7.2%*

— Sector: Energy

It’s no easy task to identify energy stocks with staying power in this age of climate change. However, one of the most stable stocks in the space is “midstream” energy company Plains All American Pipeline, LP (PAA).

Though one of the smaller stocks on this list, and much smaller than multinational Big Oil leaders, it’s important to point out that PAA isn’t an explorer drilling for crude. Instead, it’s an energy infrastructure company—one that’s operated as a partnership—that is focused on the capital-intensive nature of building pipelines, terminals, and storage facilities. This business model makes the company less volatile than energy exploration-and-production firms, or the various other energy stocks that are sensitive to market prices for petroleum products.

Related: The 7 Best Closed-End Funds (CEFs)

Plains All American Pipeline has been running terminaling, storage, and transportation infrastructure since its founding in 1981. It’s not a glamorous business, but it provides consistency that has helped to fuel a current distribution yield that’s well more than four times the S&P 500 right now. That distribution is growing, too; the company kicked off 2024 by announcing a roughly 19% increase in the payout.

If you want to make a swing trade on oil prices, PAA is not for you. But if you’re looking to invest in a low-risk, income-oriented fashion across 2024 and well beyond, this energy infrastructure player might have a place in your portfolio.

* Distribution yield is calculated by annualizing the most recent distribution and dividing by share price. Distributions are like dividends, but they are treated as tax-deferred returns of capital and require different tax paperwork.

Related: 11 Best Alternative Investments [Options to Consider]

12. BHP Group

— Market value: $150.6 billion

— Dividend yield: 5.0%

— Sector: Materials

Generally speaking, materials stocks don’t make the cut for most lists of long-term investments. Like energy stocks, they are cyclical investments that tend to rise and fall based on broad-based economic trends and industrial demand.

That said, with a little bit of research and a lot of patience, investors can still find good companies in this space that look like they can withstand the test of time.

Case in point: Australia’s BHP Group (BHP).

This is one of the largest materials and mining companies on the planet—a multinational company that operates on every continent and extracts everything from copper to iron ore to gold to coal.

Related: The 7 Best Index Funds for Beginners

BHP is also a leader in so-called “green metals,” a term that refers to a metal with lowest total carbon emissions over its lifespan. For instance, stainless steel is widely considered one of the most environmentally friendly metals out there because it is 100% recyclable. In fact, more than half of all the stainless steel materials in use today have actually been sourced from scrap materials rather than fresh ore.

With an unrivaled scale and operations that are increasingly taking into account the modern sustainability concerns of the global economy, it’s hard to imagine a world where BHP is not supplying raw materials to companies worldwide. And while BHP’s dividends can be irregular and volatile (and also paid twice a year instead of a fixed quarterly cadence), the massive yield of almost 6% makes it worth a closer look.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

13. BlackRock

— Market cap: $158.6 billion

— Dividend yield: 2.1%

— Sector: Financials

BlackRock (BLK) is one of the world’s largest asset management firms, boasting about $10 trillion in assets across its many lines of business. Individual investors know it well for both its BlackRock mutual funds and closed-end funds (CEFs) and iShares exchange-traded funds (ETFs). But it also manages money for institutional clients, including pension plans, foundations, charities, and insurance companies, among others.

With the exception of a few understandable hiccups (COVID, for instance), BlackRock has been in a pretty consistent uptrend since the depths of the Great Recession. That has come alongside similar progression in both the company’s top and bottom lines.

It’s difficult to find any Wall Street pros with something negative to say about BLK. Shares currently enjoy 13 Buy calls versus four Holds and no Sells, and the analysts’ consensus for long-term earnings growth sits above 13% annually.

Related: The 10 Best Fidelity Funds You Can Own

“We believe that BLK remains well positioned to deliver above-peer organic growth given its unmatched product breadth and distribution footprint (helped by its iShares franchise),” say Keefe, Bruyette & Woods analysts Aidan Hall and Kyle Voigt, who rate BLK at Outperform. “Also, its scale and demonstrated ability to generate operating leverage bodes well for future earnings growth.”

BlackRock has been a fount of dividend growth since the Great Recession, too. In the past decade alone, BLK has managed to average 10% annual dividend growth, though that pace has been slowing in recent years—its most recent hike, announced in January 2024, was a mere 2% bump to $5.10 per share. Still, a payout ratio just above 50% should keep investors plenty confident in the dividend’s health and its ability to keep growing.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

14. Bunge Global

— Market cap: $13.7 billion

— Dividend yield: 2.8%

— Sector: Consumer staples

Bunge Global (BG) is a leading agribusiness and food company, operating across the entire agricultural supply chain through its many subsidiaries. All told, its operations span roughly 23,000 employees across more than 300 facilities in over 40 countries.

Among other things, the U.S.-headquartered but Switzerland-incorporated firm is a leading global oilseed processor and producer of vegetable oils and protein meals. It sources, processes, and distributes grains such as soybeans, wheat, and corn. And it produces agricultural products such as fertilizers and sugars.

Related: The 13 Best Mutual Funds You Can Buy

Bunge is very much a “patience stock” right now. The company warned of a weaker-than-expected 2024, thanks in part to lower margins on crush (the process that produces soybean oil and protein meal). Moreover, its proposed mega-acquisition of Canadian grain handling business Viterra has run into a potential wall, with Canada’s Competition Bureau recently voicing concerns over the deal.

Wall Street’s pros appear patient, though. Coverage isn’t exactly thick at a dozen analysts currently, but of those, nine call BG shares a Buy, while three call it a Hold—no Sells are on the table. BMO Capital Markets analyst Andrew Strelzik did temper expectations and lowered his price target on shares, but maintained his Outperform rating, saying he “remain[s] constructive on earnings potential post-M&A closing.”

Bunge can pay investors at least a modest sum for their patience. The ~3% yield is more than a point better than the market average. And the dividend has grown by a total of 26% over the past three years. It’s as safe as you could want it, too, with Bunge maintaining an extremely conservative payout ratio of 17%.

Related: 6 Best Stock Recommendation Services [Stock Tips + Picks]

Do All Companies Pay Dividends?

Not all companies pay dividends. Some companies choose not to, while other companies cannot afford to.

Related: The 9 Best Dividend Stocks for Beginners

As you can tell by this list, the best dividend stocks are normally slow-and-steady companies that have consistent operations. While it might be possible for a small software company or biotech firm to double its share price overnight, these companies rarely pay dividends because they don’t have much in the way of profits—and what they do have, they want to spend on other things, like research and development to continue growing.

Like Young and the Invested’s content? Be sure to follow us.

How Often Do Companies Pay Dividends?

The cycle of paying dividends is always different depending on the company. While it’s generally true that most U.S. corporations opt to pay their shareholders a dividend once per quarter, the dates aren’t fixed.

Related: 5 Best Vanguard Dividend Funds [Low-Cost Income]

Specifically, one company might pay you on a January-April-July-October payment cycle while another opts for February-May-August-November.

Complicating things further, some companies pay dividends twice a year, some pay once a year, and some even pay “special” unscheduled dividends.

Want to learn more about investing, spending, taxes, and more? Sign up for Young and the Invested’s free newsletter: The Weekend Tea.

Are Stocks Affected by Interest Rates?

Yes! In multiple ways!

For one, as interest rates rise, the amount of interest paid on newly issued bonds tends to rise. When that happens, bonds (which are fairly stable, reliable investments) start looking more attractive compared to stocks (which have more potential but are riskier investments).

For instance, an investor who owns a bunch of 3% yielding dividend stocks might not look twice at a Treasury bond yielding 1%. But if that same bond started yielding, say, 5%, that’s a much more attractive proposition—even if that bond doesn’t have the same growth potential.

Related: 7 Best Fidelity ETFs for 2024 [Invest Tactically]

Also, rising interest rates make it more expensive for companies to fund their growth. Many companies will issue bonds to bring in much-needed dollars to pay for things like new equipment, research, and personnel. The goal: Make enough in profits from that growth that you come out ahead even after not just paying back the loans, but all that interest. But the greater the interest rate a company has to pay on its bond, the more difficult it is to come out ahead.

That’s why you’ll see, when the Federal Reserve raises its benchmark federal funds rate, stocks of corporations that borrow a lot to grow tend to take it on the chin.

Want to learn more about investing, spending, taxes, and more? Sign up for Young and the Invested’s free newsletter: The Weekend Tea.

What If I Need Help Picking Stocks? Consider Motley Fool Stock Advisor

Several stock picking services can help you build a portfolio, typically for an annual subscription cost. One of our favorites is Motley Fool Stock Advisor.

Motley Fool Stock Advisor is a stock picking service that focuses on stable companies with proven track records. Some of their previous picks include Zoom, Netflix, and HubSpot, all of which have gone up significantly since receiving a nod from the service.

Members have access to the service’s history of recommendations to see precisely how each of their suggestions has panned out.

The service targets stocks across a variety of industries, such as energy, industrials, transportation, financial services, technology, and healthcare.

Read more in our Motley Fool Stock Advisor review.

Related: 6 Best Stock Recommendation Services [Stock Picking + Tips]

Stock recommendation services are popular shortcuts that help millions of investors make educated decisions without having to spend hours of time doing research. But just like, say, a driving shortcut, the quality of stock recommendations can vary widely—and who you’re willing to listen to largely boils down to track record and trust.

The natural question, then, is “Which services are worth a shot?” We explore some of the best (and best-known) stock recommendation services.

Related: The Best Fidelity ETFs for 2024 [Invest Tactically]

If you’re looking to build a diversified, low-cost portfolio of funds, Fidelity’s got a great lineup of ETFs that you need to see.

In addition to the greatest hits offered by most fund providers (e.g., S&P 500 index fund, total market index funds, and the like), they also offer specific funds that cover very niche investment ideas you might want to explore.

Related: 9 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!