Best Robo-Advisors

|

3.7

|

4.4

|

|

$4/mo., or 0.25%/yr. AUM fee*. Premium: 0.65%/yr. AUM fee.**

|

SoFi Invest: Free; no commissions on equity and ETF trades. SoFi Robo-Investing: 0.25%/yr. AUM advisory fee. SoFi Plus: $10/mo.

|

Robo-Advisor Runner-Up: E*Trade

Robo-Advisor Comparison

| Apple App Store Rating / Best For | Fees | Promotions | |

|---|---|---|---|

Betterment Betterment | ☆ 4.7 / 5 Passive investors seeking tax-loss harvesting capabilities | $4/mo., or 0.25%/yr. AUM fee | None |

E*Trade's Core Portfolios E*Trade's Core Portfolios | ☆ 4.6 / 5 Smart beta + tax-loss harvesting | 0.30%/yr. AUM fee | Account deposit bonus commensurate with contributed funds ($50-$6,000 value) |

M1 Finance M1 Finance | ☆ 4.7 / 5 Passive investors | No-commission equity trades. $3/mo. if balance <$10k | None |

Robinhood Strategies Robinhood Strategies | ☆ 4.3 / 5 Investors who want to invest in individual stocks in their robo-advised account. | 0.25%/yr. AUM fee (capped at $250 for Robinhood Gold subscribers) | None |

Wealthfront Wealthfront | ☆ 4.8 / 5 Investors seeking a robo-advisor with low minimum balances | 0.25%/yr. AUM fee | $50 deposit bonus |

Public.com Public.com | ☆ 4.7 / 5 Investors seeking traditional and alternative investments | 1-3 symbols: $0.49 per recurring purchase 4-10 symbols: $0.99 per recurring purchase 11-20 symbols: $1.99 per recurring purchase Cryptocurrencies (any amount): 1.25% of order amount Premium: $10/mo. | None |

Acorns Acorns | ☆ 4.7 / 5 Passive investors | Acorns Bronze: $3/mo. Acorns Silver: $6/mo. Acorns Gold: $12/mo. | $20 bonus for making your first investment ($5 minimum investment) |

| * Apple App Store Rating as of Jan. 19, 2026. | |||

1. Betterment: Best for Tax-Loss Harvesting

- Available: Sign up here

- Price: $4/mo., or 0.25% annual fee*. Premium: Additional 0.40% annual fee.**

- Account minimum: $10

- Platforms: Desktop web app, Apple iOS and Google Android

If you’re a fan of diversifying your portfolio with ETFs, a Betterment account could be a good choice. This robo-advisor platform allows you to invest in a narrow series of low-cost ETFs with different themes and purposes. For instance, you could choose to invest in its Social Impact or Climate Impact portfolios if you care deeply about social justice or the environment. Betterment also offers crypto-focused ETFs for investors interested in decentralized finance, including an ETF specifically focused on the metaverse.

Although Betterment is a robo-advisor, it does offer access to human advisors, too. This is a big plus to me—I’m a self-directed investor, but even if I convinced myself to lean on a robo-investor, I’m the kind of person who wants to learn what I can, and I’d prefer to be able to receive guidance from a financial pro. This sets Betterment apart from many other competing robo-advisors.

Alternatively, though, Betterment is primarily a robo-advisor, so this isn’t the best choice for hands-on investors.

While Betterment accounts (individual and joint taxable brokerage accounts, and Traditional, Roth, Inherited, and SEP IRAs) do have a minimum required deposit, it’s tiny, at just $10. Betterment does charge fees, however. Its accounts start at $4 a month, but that changes to a 0.25% annual fee if your balance is more than $20,000, or if you set up recurring monthly deposits that total $250 or more. Also, you can upgrade to Betterment Premium for an additional 0.40% add-on fee to receive on-demand support from a Certified Financial Planner™. Upgrading requires a $100,000 minimum balance required in cash, stocks, bonds, or crypto holdings.

The assets under management (AUM) fee might justify itself in taxable brokerage accounts through Betterment’s tax-loss harvesting feature. It works by selling positions with losses to lock in short-term capital losses and can both offset realized capital gains and potentially lower your taxable income up to $3,000 per year (any unused loss rolls over to future years indefinitely) while taking your proceeds and placing them into a similar investment. As you can see, by lowering your tax impact, the service can pay for itself.

Betterment led the way for robo-advisor services, growing from a small business to what now represents a significant book of business. Using Betterment has become a popular choice for people looking to invest toward specific goals without the need for any investing experience for a reasonable fee.

Visit Betterment’s site by clicking “Get Started” below to see if it’s the right fit for you.

- The Betterment app gives you the tools, inspiration, and support you need to become a better investor.

- Start with as little as $10 and use the top-rated mobile app to set up automatic investing into diversified ETF portfolios.

- You can also invest in diversified preset cryptocurrency portfolios.

- Customize your risk tolerance and investment goals with guidance available at any time.

- By upgrading to Premium, you can unlock unlimited financial guidance from a Certified Financial Planner™.

- Hands-off investment management

- Diversified portfolio that automatically rebalances

- Low-cost investment selection

- Limited investment selections

- Limited crypto diversification in cryptocurrency portfolios

2. E*Trade’s Core Portfolios (Best for Smart Beta Investing)

- Available: Click “Open Account” below

- Price: 0.30% annual fee*

- Account minimum: $500

- Platforms: Desktop web app, Apple iOS and Google Android

E*Trade has long been seen as a leading stock trading app for retail investors. They’ve done so not only by equipping retail traders with the tools they need and access to numerous asset classes, they also provide investors access to educational resources that assist you with conducting investment research and analysis and diversifying your portfolio.

E*Trade, like most of the best stock trading apps, offers zero-commission stock, ETF, and options trading. It also has a leg up on some platforms by offering $0-commission mutual fund trading. Options still incur a 50- to 65-cent contract fee, however. Meanwhile, bond trades are $1 apiece, and future trades are $1.50 per contract per side, plus other fees.

But if you’re interested in E*Trade’s robo-advisory product, called Core Portfolios, you’ll face a different pricing structure that’s more in line with other robo-advisors. You pay 0.30% of your assets under management (AUM) with the platform on all balances $500 or more (you’ll need at least $500 to open a Core Portfolios account with E*Trade).

E*Trade’s Core Portfolios uses a simple account setup process with a straightforward planning questionnaire that asks for the type of savings goal you intend to achieve with the robo-advisory product. The majority of the questions are used to determine your risk tolerance and investment time horizon.

The product offers three different portfolios that exclusively invest in ETFs, all based on the principles of modern portfolio theory:

- Core Portfolios ETF asset allocation based on your risk profile (built with responses to your questionnaire) without any additional considerations

- Socially responsible investing ETFs that emphasize environmental, social, and governance (ESG) concerns

- Smart beta ETFs that have more active management in an effort to increase portfolio performance relative to other ETFs

Lastly, E*Trade’s acquisition by Morgan Stanley also equipped the service with tax-loss harvesting capabilities. The potential reduction in tax-drag on your returns and income could easily negate the AUM fee paid for the platform.

For a limited time, E*Trade offers a new account funding bonus when you use reward code “OFFER25” in the following amounts:

- $1,000-$4,999 earns $50

- $5,000-$19,999 earns $150.

- $20,000-$49,999 earns $200.

- $50,000-$99,999 earns $300.

- $100,000-$199,999 earns $600.

- $200,000-$499,999 earns $800.

- $500,000-$999,999 earns $1,000.

- $1,000,000-$1,499,999 earns $3,000.

- $1,500,000-$1,999,999 earns $5,000.

- $2,000,000 or more earns $6,000.

To learn more about E*Trade’s Core Portfolios product, click “Open Account” below.

- E*Trade is one of the best online and mobile trading platforms among discount brokers, offering a full range of investments (including professionally managed accounts). It allows you to invest in stocks, ETFs, mutual funds, options, bonds, futures, micro futures, and futures options.

- $0 commission trading for online U.S.-listed stocks, ETFs, options, mutual funds, and Treasuries. (Options do have a 65¢ contract fee.)

- Opening an account is easy and only takes a couple of minutes.

- Bonus: Get between $50 and $10,000* when you click the box below, then open and fund a new investment account using promo code "OFFER25."

- Excellent selection of available investments

- No-commission mutual funds and Treasuries

- Automated portfolio builders and prebuilt mutual fund and ETF portfolios

- Separate apps for power users and casual users

- Limited availability of fractional shares (only in DRIP plans or robo-created portfolio)

- No direct cryptocurrency trading

3. M1: Best Robo-Advisor for a Personalized Investment Portfolio

- Available: Sign up here

- Price: No stock or ETF commissions, $3/mo. on accounts under $5,000.

- Account minimum: $0 (taxable accounts); $500 minimum deposit for IRAs

- Platforms: Desktop web app, Apple iOS and Google Android.

M1 (formerly M1 Finance) offers commission-free stock and ETF trades and provides automated stock trading according to your predetermined investment decisions. What we like most about this app is your ability to make recurring deposits that automatically get invested into your portfolio.

M1 acts as a singular personal finance app to assist with building wealth through automating your investments into diversified portfolios, having a bank account and linked debit card that provides market-beating interest rates and having access to valuable personal finance literature. Most importantly, investing with M1 can be as simple as depositing money, setting your stock and index fund selections and having the platform automate your investments on your behalf.

I’ve said it before, but this truly automates your investments if you set up recurring deposits, allowing your wealth to build. From there, M1 automatically rebalances your portfolio in line with your stated asset allocation targets. Doing this at regular intervals has been shown to improve overall portfolio performance. It moves outperforming funds into underperforming ones, capturing a value effect over time as returns revert to the mean.

Consider opening an investment account with M1. The app has no account minimum unless you choose to open an IRA, for which you’ll need to deposit at least $500. (It should be noted: if you maintain an account balance of less than $5,000, the service charges a $3/mo. fee.)

- The M1 investing app is a basic robo-advisory system that acts almost like a 401(k). You build a "Pie" by choosing the stocks and ETFs you want to invest in, as well as the percentage of your portfolio that should be invested in each "Slice," and M1 uses that information to allocate your money each time you contribute.

- If you want help putting together a list of stocks and funds, you can use M1's model portfolios, which cover goals such as general investing, planning for retirement, income earners, and more.

- Enjoy a 4.00% APY on uninvested cash.

- Get a line of credit against your brokerage's account value at low fees (currently 6.40%) compared to other brokerage lines of credit.

- M1 lets you open individual, joint, and custodial brokerage accounts; traditional, Roth, and SEP IRAs; trusts; and cryptocurrency* accounts. M1's monthly fee covers up to five individual or joint brokerage accounts, one trust, one crypto account, one traditional IRA, one Roth IRA, one SEP IRA, and unlimited custodial accounts.

- Robo-advisor with self-directed investing elements

- Attractive APY on uninvested cash

- Borrow against your assets

- Limited selection of investible assets

- Doesn't allow trading throughout the trading day

- Monthly fees for account balances <$10,000

4. Robinhood Strategies (A Robo-Advisory Done by People)

- Available: Sign up here

- Price: 0.25%/yr. AUM fee ($250 cap with Robinhood Gold subscription)

- Account minimum: $50

- Platforms: Desktop (PC), web, mobile app (Apple iOS, Android)

Robinhood’s M.O. over the years has always been putting a twist on traditional investment products. It offered brokerage accounts, but set itself apart by pioneering commission-free trading. It offered IRAs, but set itself apart by offering IRA matches. And it’s doing the same with Robinhood Strategies—a robo-advisory product that offers managed accounts … but light on the “robo.”

Robinhood Strategies works like many other robo-advisor products: You provide information about your risk tolerance, investment horizon, and financial goals, and Strategies whips up a portfolio tailored to those factors, then automatically rebalances regularly to ensure the portfolio is still aligned with those factors.

Where Robinhood Strategies primarily differs is that a team of human investment managers is making the decisions—not algorithms. Also, unlike many other robo-advisors that will build your portfolio with only funds, Robinhood Strategies will own not just stock and bond ETFs, but also individual stocks (as long as your account balance is at least $500).

They’re twists, but not a wholesale change.

Like most robo-advisors, you’ll have little input past the factors you list. This isn’t a true human-to-human advisory relationship, and you won’t have access to these managers or any other advisors. If you want changes to your portfolio, you’ll need to change your investor profile, though you can request certain stocks be excluded (and in time, Robinhood will let you use your dashboard to identify stocks you want to restrict). Portfolios are managed with tax-efficiency in mind; however, while the marketing alludes to tax-loss harvesting, Strategies does not manage tax-loss harvesting for you.

Robinhood Strategies is very financially accessible. You need just $50 to open an account. Annual management expenses are 0.25% of all assets under management, which is pretty much in line with most of its closest competitors. However, if you have a Robinhood Gold subscription ($5 per month), your fees are capped at $250 per year. You would reach that cap at a $100,000 balance—any balances higher than that reduce your AUM fee percentage. For instance, that $250 would represent a 0.25% fee on $100,000, but just 0.10% on $250,000 and 0.05% on $500,000. Strategies’ underlying investments are inexpensive, too; ETF-only portfolios average 0.10% in acquired fund fees, while ETF-and-stock portfolios average 0.06%.

Learn more or sign up for Robinhood Strategies through our link.

- Robinhood delivers its signature twist with Robinhood Strategies, a robo-advisory service managed by a human investment team.

- Provide information about your risk tolerance and financial goals, and the Strategies team will build you a portfolio of stock and bond ETFs, or a mix of stock ETFs, bond ETFs, and individual stocks if you have $500 or more in your account.

- The Strategies team will regularly rebalance to ensure your portfolio is aligned with your goals. Want to make a change? Just update your investor profile.

- Robinhood Strategies allows you to have one of each type of managed account: traditional brokerage, traditional IRA, and Roth IRA.

- Low investment minimum for an account

- Low fees on portfolio funds

- Not available for joint accounts or 529s

- No access to human financial advisors

- Managed accounts don't enjoy Robinhood's IRA match

5. Public.com: Best on Cost for Medium-to-Large Portfolios

- Available: Sign up here

- Price: Per-recurring-purchase fees for stocks and ETFs, 1.25% of order amount for cryptocurrencies

- Account minimum: $20

- Platforms: Web, mobile app (Apple iOS, Android)

Public.com is a zero-commission investing app, geared toward Millennials and Gen-Zers, that as of late has built up the types of assets available to its users and the products investors can use to invest in public markets. On Public, users can invest in not just stocks and ETFs, but also more than 25 different cryptocurrencies, options, individual bonds, Treasuries, and alternative assets. They’ve also introduced a way for you to invest in several of these asset classes automatically through their own take on the robo-advisor: Investment Plans.

Public.com’s Investment Plan feature offers the ability to build a collection of assets that you can automatically contribute to on a recurring basis. Investors can choose from their pre-built catalog of Investment Plans covering a wide range of investing styles and risk tolerances, or you can create your own Investment Plan from scratch. These can hold up to 20 stocks, ETFs, and/or crypto. This strategy allows you to dollar-cost average, allowing you to lessen the risk of market volatility over time. (Editor’s Note: This doesn’t eliminate the risk of market volatility, as your portfolio will move with the market.)

Public.com routes orders directly to exchanges and does not receive any payment for order flow revenue, so they’re not earning money from your trades as many zero-commission brokers do in today’s industry. Though, because placing stock market trades isn’t without cost, Public.com covers their Investment Plan offering’s cost by charging a per transaction fee based on the number of assets held in your Investment Plan. Those fees are as follows:

- 1-3 symbols: $0.49 per recurring purchase

- 4-10 symbols: $0.99 per recurring purchase

- 11-20 symbols: $1.99 per recurring purchase

- Cryptocurrencies (any amount): 1.25% of order amount

(Please note: Public Premium members are exempt from paying these fees.)

With a diversified portfolio of 10 ETFs, you’d pay ~$12/year. For a $5,000 portfolio, you’d pay less using Public.com’s automated investing Investment Plan product than you would with most other robo-advisors on the market. If you choose to use a simple three-ETF portfolio, you’d be better off using Public.com at the $2,500 portfolio size or higher.

If you’d like to learn more about Public.com and their Investment Plans product, consider visiting their website and opening an account.

- Public.com offers zero-commission trading on thousands of stocks and ETFs, available as fractional shares. The app also allows you to invest in cryptocurrency, options, and bonds as well, and it's one of the rare brokerages that allows its users to buy alternative assets.

- Lock in a 5.3% yield with Public.com's Bond Account, which allows you to invest in a diversified portfolio of investment-grade and high-yield bonds.

- Use a social feed where members can share why they believe in certain companies (or don't) and can post comments on others' trades.

- Invest in curated lists of stocks and ETFs for people to aggregate investments by interest area or values.

- Subscribe to Public Premium for features such as advanced company-level data, Morningstar insights, and exclusive audio content from Public.com's expert analysts.

- Special offer: Receive an uncapped 1% match on transfers into a Public IRA.

- Fractional shares

- Good selection of investible assets

- Allows you to trade alternative assets

- No payment for order flow (PFOF)

- Creative social investing features

- Doesn't support mutual funds

- Limited investment research and other tools

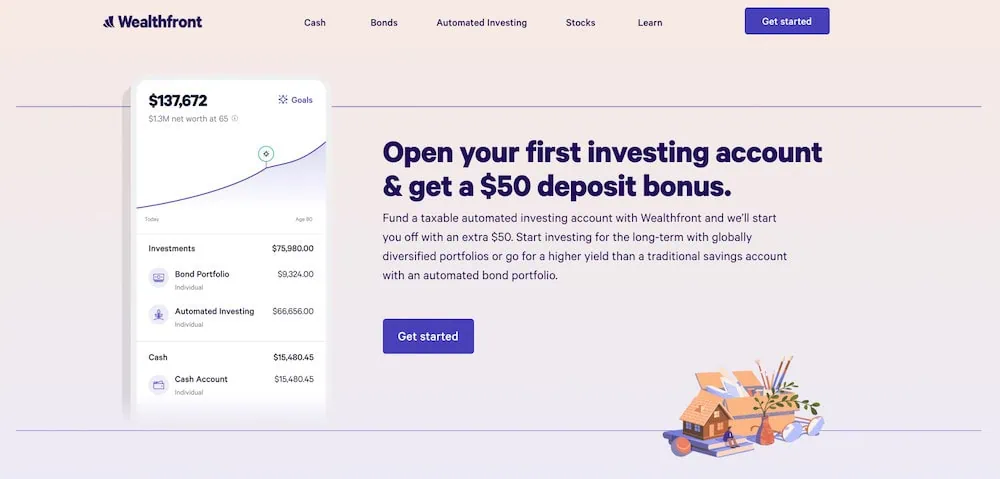

6. Wealthfront (Best Robo-Advisor for Small Balances)

- Available: Sign up here

- Price: 0.25% annual management fee; no opening or closing fees

- Account minimum: $500

- Platforms: Desktop web app, Apple iOS and Google Android.

Wealthfront is a popular robo-advisor that offers numerous account types, including individual, joint, and trust taxable brokerage accounts, Traditional, Roth, SEP, and Rollover IRAs and 529 plans.

While some of its robo-advisor competitors have a relatively high minimum balance requirement of a few thousand dollars or much more, Wealthfront requires a fairly small initial deposit of $500 to open an account. (Again, that’s high for an investment account, but low for a robo-advisory product.) So if you don’t have a huge sum invested already to move into the account or to rollover from an existing account like a 401(k) or other IRA, this account might be a good choice.

Wealthfront offers some valuable perks with its accounts, including automatic tax-loss harvesting, automatic rebalancing, automatic trading, and the option to customize your expert-built portfolio. This top robo-advisor also offers access to a 529 plan (or the ability to link an external one to your account) to help with saving for educational expenses. This is an uncommon feature for most standalone robo-advisors outside of a traditional brokerage, so it’s well worth noting.

If you’re considering putting this on your shortlist, just note that Wealthfront does charge a 0.25% annual management fee across the board. That’s more affordable than some robo-advisors, but it’s also not free. Learn more on Wealthfront’s website.

- Wealthfront provides the power of robo-investing for investors with a small starting deposit ($500 minimum).

- Answer just a few questions, and Wealthfront will build you a portfolio of low-cost index ETFs from up to 17 different asset classes, then manage rebalancing and trading as long as you have the account.

- Wealthfront allows you to link an outside 529 educational savings plan or open one through Wealthfront (plan is sponsored by the state of Nevada).

- Bonus: Get a $50 deposit bonus when you fund your first taxable investment account

- Low minimum investment for a *robo-investing product*

- Tax-loss harvesting

- Offers 529 plan management, investment account

- Few investment choices

- High minimum investment for an *investment account*

- No access to human financial advisors (CFPs)

7. Acorns: Best Robo-Advisor for Beginners

- Available: Sign up here

- Price: Acorns Personal: $3/mo. Acorns Personal Plus: $6/mo. Acorns Premium: $12/mo.

- Account minimum: $0

- Platforms: Apple iOS and Google Android

Acorns is a micro-investing app geared toward minors, young adults and millennials by offering “Round-Ups”: The app rounds up purchases made on linked debit and credit cards to the nearest dollar, investing the difference on your behalf.

For example, if you purchase a coffee for $2.60 on a linked credit card, Acorns automatically rounds this charge up to $3.00 and puts the 40-cent difference aside. Once those Round-Ups reach at least $5, they can be transferred to your Acorns account to be invested.

The Acorns investment offering itself is a simple, automated platform that uses pre-built portfolios of ETFs to keep investors exposed to stocks and bonds, which is similar to how traditional robo-advisor services work. While Acorns doesn’t have much to offer intermediate investors who want variety in their portfolios, Acorns’ basic approach makes it one of the best investment apps for beginners.

It also features a powerful way to accelerate your savings: Later Match. While most people are aware that employers will sometimes match funds you contribute to your 401(k), “matches” are virtually unheard of in retirement accounts like IRAs, where there’s no employer to kick in extra cash. However, Acorns itself will match 1% or 3% on new contributions to IRAs for Personal Plus and Premium subscribers, respectively.

Here’s more about what you can expect from Acorns’ varying subscription options:

- Acorns Bronze ($3 per month): Includes an Acorns Invest investment account, as well as Acorns Later for tax-advantaged investment options such as Roth IRAs. Also includes Acorns Checking, a bank account that has no account fees, lets you withdraw fee-free from more than 55,000 ATMs nationwide, and Smart Deposit, which allows you to automatically invest a bit of each paycheck into your Acorns accounts.

- Acorns Silver ($6 per month): Everything in Acorns Bronze (Acorns Invest, Later, and Checking), plus Premium Education, which are live onboarding sessions covering account setup, Round-Ups, setting up recurring investments, and more; Emergency Fund; and a 25% bonus on Acorns Earn rewards (up to $200 per month).

- Acorns Gold ($12 per month): Everything in Silver, plus Acorns Early, which allows you to open a custodial investment account for your child so you can begin investing for them while they’re a minor; custom portfolios that allow you to hold individual stocks; live Q&As with financial experts; a 50% match on Acorns Earn rewards (up to $200 per month); $10,000 in life insurance; even the ability to set up a will for free.

- Acorns allows you to sign up for investment, retirement, and checking accounts for you and your family, learn how to earn more money, and grow your investing knowledge.

- Famous for investing spare change automatically through Round-Ups, this all-in-one financial app helps younger generations start investing earlier.

- Invest in expert-built portfolios made up of diversified ETFs.

- Silver tier includes perks such as a 25% match on Acorns Earn rewards (up to $200/mo.), generous APYs on Checking and Emergency Fund, and live Q&As with investing experts.

- Gold tier includes perks such as a 50% match on Acorns Earn rewards (up to $200/mo.), $10,000 in life insurance, picking individual stocks for your portfolio, a free Acorns Early account, and Acorns Early Invest custodial accounts for children with 1% contribution matches.

- Earn even more with Later Match: Acorns will match up to 1% (Silver) or 3% (Gold) of all new IRA contributions in your first year.*

- Special offer: Get a free $20 bonus investment when you sign up with our link and start making recurring investments.**

- Robo-advisor with affordable fees (on larger portfolios)

- Fixed fee model

- Round-ups

- FDIC/SIPC insurance

- IRA match (Personal Plus and Premium)

- High fixed fees for small balances

- Limited investment selections

- Must subscribe to Premium for any self-directed investing options

The Best Robo-Advisors

Robo-advisors offer a low-cost way to diversify your portfolio, rebalance it regularly and keep on track toward financial goals. Previously, accessing the stock market with tailored investment advice often came to you if you were prepared to shell out money for a professional or had the time and know-how to do it yourself. Further, you couldn’t start investing with little money like you can with most robo-advisors—you needed a decent sum to justify the management fee or maintain a minimum account balance.

Thanks to financial technology (fintech) advancements, this is no more. These automated investing services act as a free or low-cost investment advisor in your pocket. Even more, most of these services allow you the same ease of access as standard online brokers but add doses of automatic rebalancing of your portfolio and valuable financial planning help.

Above, we cover the best robo-advisors for your needs below. Our ratings considered available portfolio customization, costs, account minimums, access to other services like a cash account or banking products, educational resources, sign-up bonuses, customer support, unique features and included tools. All of the robo-advisor options found on the above list offer diversification, automatic rebalancing at a regular cadence and assist in planning your investment goals.

You can rest assured that these robo-advisors will help you build wealth for free or at a reasonable management fee compared to a traditional human advisor.

Features to Consider When Selecting the Best Robo-Advisors

Have a look at the features below to understand what you should consider when looking for a robo-advisor to manage your investments.

Fee Model

Robo-advisor offerings come with two primary methods for assessing management fees and account fees:

- Fixed monthly account fees. The service charges a fixed monthly fee regardless of your portfolio size

- Fixed fund management fees. Using an assets under management (AUM) approach, you might find small balances pay very little relative to fixed monthly account fees. In contrast, more significant balances pay far more. A standard fee ranges from a 0.20% management fee to a 0.25% management fee or even a 0.35% management fee. The level of service and features offered often drive this management fee.

Portfolio Options

Many start your assessment with a questionnaire to understand essential items like your age, income, investment goals, marital status and more. Based on these answers, you will have several portfolio options recommended to you. This can include diversified portfolios of index funds with low expense ratios offered through proven portfolio allocations.

It can also offer the ability for you to customize your portfolio and automatically rebalance it as you go.

Access to Human Financial Planners

Some robo-advisor options allow you to pay additional fees or management expenses to access a human financial planner. Likewise, you may need to make a minimum investment on the platform to unlock this access automatically.

Having a human financial advisor can help you with non-investment-related questions a traditional financial advisor might provide.

Ability to Trade Individual Stocks

Not all robo-advisor options allow you the ability to trade individual stocks. Some require you to purchase index funds only.

If individual stock buying serves as a requirement for your investing needs, make sure you choose services like M1 Finance, Stash or Charles Schwab.

Account Minimum Requirements

The central sticking point for many people looking to start investing for the first time is the available money they have to put into the market. In the past, working with a traditional broker might require some hefty minimums, but this hurdle has largely gone the way of the dodo: extinct.

Many of the robo-advisor choices shown on this list require no account minimum to begin investing. For those that do, the threshold amounts to a few thousand dollars.

Tax-Loss Harvesting

Tax-loss harvesting gives you the chance to lower your tax bill but not necessarily your investment returns. This feature, when used in a taxable brokerage account, can lead to significant cost savings.

Banking Services

Some options in the market offer other services to complement your investing needs. This can mean offering you access to a savings account, credit card or debit card, personal loans, student loan refinancing and more.

Retirement Accounts

Many of these services offer multiple types of investment accounts, such as individual and joint taxable brokerage accounts, individual retirement accounts in multiple flavors (e.g., Traditional, Roth, SEP, SIMPLE).

Automatic Rebalancing

These automated investment services should work to keep your portfolio balanced over time, meaning you answer questions at the start and maintain ongoing contributions to build your balance over time. Betterment, Marcus Invest, and more all offer such features.

Low-Cost Exchange Traded Funds

Make sure the index funds in your portfolio charge the lowest expense ratios possible if they have the same investment objective: to mimic the performance of a stock or bond index. If they all deliver the same intended result, why pay more for an index fund than you must?

Target the lowest expense ratios you can, typically from providers like Vanguard, Schwab, Goldman Sachs and Fidelity.

Robo-Advisor FAQs

How does a robo-advisor work?

Robo-advisors work by first gathering necessary information from you related to your investment goals, age, risk tolerance and investment suitability, among other valuable questions. Based on your responses, it will create a portfolio tailored to your answers and provide two significant functions investing by yourself might not: diversification and making programmatic, emotionless decisions.

One of the best ways to outperform the stock market is not making mistakes when everyone else does. Often, emotion drives these mistakes (such as selling when the market bottoms and missing the upside when it resumes its ascent higher). Robo-advisors don’t fall prey to emotions, instead relying on programmatic investment selections and asset allocations.

How are the best robo-advisors different from human financial advisors?

The best robo-advisors can deliver better monitoring and performance than a human advisor, such as a traditional financial advisor. However, where the value differs between even the best robo-advisors and human financial planners comes with personalized advice extending beyond your investment portfolio.

Human financial planners can assist with portfolio management just like the best robo-advisors, but they cannot offer advice on other financial questions you might have. This can include insurance, savings rates, educational expense planning, helping with building an emergency fund and much more. Certified financial planners can offer value-added investment advice alongside a personalized retirement plan and financial plan.

Robo-advisors invest your money following your questionnaire responses and some have even sought to offer free financial planning (or for a one-time fee) to match the service offerings of a human financial advisor.

When would it make sense to consider consulting human advisors for your financial planning needs?

You may want to consider consulting a human advisor when you want more individualized recommendations and hand-holding. Robo-advisor options use artificial intelligence and rules to place your money in optimized portfolios for the masses. You might want something different than this generic advice.

Further, human advisors might offer you more value-added services beyond investment management like wealth management strategies from other financial products like life insurance, annuities and more.

Consulting with human financial planners might be more advisable if you seek a more comprehensive financial management arrangement. If you just need investment advice, a robo-advisor can handle most of your needs in all likelihood.

What is tax-loss harvesting?

Generally, you engage in tax-loss harvesting when selling some of your investments at a taxable loss and using this loss to offset capital gains earned elsewhere in your investment portfolio. Because of the wash sale rule from the IRS, you can’t sell a stock or other security for a loss and then immediately add it back to your portfolio.

Instead, you can employ a tax-loss harvesting strategy by yourself by selling the security at a loss and waiting at least 30 days to repurchase the same security or a substantially similar one. You can use the capital loss to offset other capital gains or up to $3,000 of your taxable income in a year. Any unused losses roll forward indefinitely to offset future capital gains or taxable income. You can have this work by selling your investment for a loss and then having the plan to repurchase it at least 30 days later or outside of the IRS’ 30-day wash sale rule window.

Many top robo-advisors offer this feature for you in taxable brokerage accounts, lowering the cost of client assets. This can offset the costs of advisory fees or the robo-advisor’s management fee on your robo-advisor account.

Which robo-advisor has the best returns?

Overall, the investment performance varies based on the responses you make to your initial questionnaire. The underlying assets largely overlap between robo-advisors, meaning the ability to compare performance doesn’t necessarily make sense when stacking robo-advisor against robo-advisor.

Index funds attempt to mimic an underlying index. Therefore, the best robo-advisors offer tax-loss harvesting, low fees, and other features like Smart Beta investing, and Marcus Invest offers such an investing option.

Do robo-advisors beat the market?

Generally, no. They seek to replicate the market’s performance through purchasing low-cost index funds. Some offer the ability to invest in individual stocks alongside index funds or even use Smart Beta portfolios through a robo-advisor like Marcus Invest. Still, they by and large attempt to meet the market performance.

Is a robo-advisor good for beginners?

Because robo-advisors represent a way for beginning investors to add money to a diversified portfolio without much knowledge of the stock market or exposure to particular stocks, robo-advisors are suitable for beginners. Based on your responses to a questionnaire at account opening, your investment funds work for you on these online brokers without knowing how they work or manage your money.

If you answered the questions accurately and honestly, the robo-advisors would purchase a combination of exchange-traded funds or mutual funds in your brokerage account aligned with your risk tolerance.

Why are robo-advisors bad?

The answer to this depends on your investing style. If you prefer active stock picking to passive index fund investing, they present a challenge. For the vast majority of investors looking to add recurring contributions to a diversified portfolio over long periods, they make fantastic services.

Are robo-advisors a good investment?

Yes. If you’d like an automated investing service and investment advisor to manage your money on your behalf, robo-advisors present a remarkably good investment. They manage your money without emotion, and some even offer added financial planning tools to enable your secure financial future. Many come with valuable educational resources to teach you about investing and personal finance decisions you might encounter.

If you need extra help, some also offer access to human financial advisors for a fee. Combined, this can deliver you financial peace of mind, representing a good investment. You can even invest following your consumer preferences with some robo-advisors. Some offer access to socially responsible investing, meaning you invest in companies with environmental consciousness, strong corporate governance and socially-progressive positions.

Do robo-advisors make money?

Robo-advisors generally invest your money in index funds matching your risk tolerance and investment goals. While past performance doesn’t guarantee future results, when remaining invested in a widely-diversified portfolio matched to your risk tolerance over long periods, robo-advisors’ actions can make money for your bottom line.

These advisors overlook market downturns or market swells to maintain a diversified portfolio and transact without emotions. Remaining disciplined during critical moments can lead to the best returns when compared to other investors.

How much does a robo-advisor cost?

Most robo-advisors use either an assets under management fee model (e.g., 0.25% of AUM) or a fixed monthly fee approach. Depending on the intended size of your portfolio, one or the other may make sense. For example, if you plan to build an extensive portfolio quickly, choosing a low-fixed fee might save you more over time.

Likewise, if you won’t have serious money to invest for a while, a percentage of assets under management might have you come out ahead. Some robo-advisors also offer value-added services beyond simply picking suitable investments. This includes making a holistic financial plan complete with insurance, drafting a will, deciding how best to save for life goals like buying a house, sending your children to college, or even tax planning. These usually cost extra or amount to a higher fixed or variable (AUM) fee to include them.

While automating your investing approach can pay off handsomely, sometimes speaking directly with human advisors who can guide you toward making better financial decisions is a great idea. Typically, for traditional personalized investment accounts, robo-advisors compare favorably. Though, as with all things, it depends on your situation and the advisor you think makes the best fit for your needs.

Many financial advisors rely on a simple AUM model, whereby they charge anywhere from 0.50%-1.5% (or more) to manage your investments, create financial plans, and generally guide you toward making sound financial decisions. Likewise, many fee-only fiduciary advisors have come to serve customers by charging a fixed fee for performing multiple services or even a la carte pricing from a specific menu of services.

Depending on the services you choose, you will need to compare their cost to those of robo-advisors.