Vanguard didn’t just create the humble index fund—it made these simple, rules-based products one of the cornerstones of its business. Nearly 50 years after launching its S&P 500 tracker, its index fund lineup has grown to some 200 funds.

And while Vanguard’s index funds can serve a number of purposes, perhaps the best use of these straightforward products is as the building blocks of a portfolio’s core.

While everyone’s portfolios will look a little different from one another, most people are generally advised to have exposure to certain broad categories of stocks and bonds. Vanguard provides that exposure to those areas of the market via straightforward and well-tested indexes, and it does so while charging less than most if not all of its competitors.

That makes these funds useful if you’re just putting together a portfolio for the very first time … but also if you’re trying to make improvements to your current roster of holdings.

Let’s look at Vanguard’s best core index funds. Each portfolio building block addresses a common investment investment strategy, so readers should be able to identify at least one fund (if not several) that speaks to their particular needs.

Disclaimer: This article does not constitute individualized investment advice. These funds appear for your consideration and not as investment recommendations. Act at your own discretion.

Editor’s Note: Tabular information presented in this article is up-to-date as of Oct. 6, 2025.

Featured Financial Products

Table of Contents

Why Invest in Vanguard Funds?

Vanguard Group is a leader in index funds. Vanguard founder Jack Bogle launched the first Vanguard index fund for U.S. retail investors—the Vanguard First Index Investment Trust, which is now the Vanguard 500 Index Fund Admiral Shares (VFIAX)—in 1976. And in the four-and-a-half decades that have followed, Vanguard Funds have grown to become the dominant force in index investing.

Today, this former upstart mutual fund company’s products boast about $11 trillion in assets under management with an average expense ratio of just 0.07%, or a mere 70¢ for every $1,000 invested. And that average is dropping. In early 2025, Vanguard announced its largest fee cut in history—a drop in price on 168 share classes across 87 funds that the firm predicts will save its investors $350 million in the first year alone.

There are currently more than 400 Vanguard funds, including mutual funds and ETFs. Vanguard index funds, which account for roughly half that number, cover every conceivable pocket of the investable universe, including individual sector funds and emerging markets.

Vanguard grew into the powerhouse mutual fund company it is today by taking care of its clients and genuinely looking after their interests. Vanguard funds really started and continue to accelerate the trend of fee compression. We all collectively pay less in fees and expenses and enjoy better returns because of the index revolution started and led by Vanguard’s founder Jack Bogle.

Today, we’re going to take a look at the very best Vanguard index funds for beginners. They run the gamut in terms of styles and strategies, but all of the best Vanguard funds share one thing in common: They all have rock-bottom fees.

The 7 Top Beginner-Friendly Index Funds From Vanguard

It’s not particularly easy to narrow down the universe of Vanguard funds to just seven of the very best Vanguard index funds. And this list shouldn’t be considered a comprehensive portfolio.

But you can absolutely use these to build a starter portfolio. For the beginning investor, this particular mix of Vanguard funds covers the major bases, giving you exposure to U.S. stocks, stocks in developed and emerging markets, and government and corporate bonds.

This list is also heavy in what are called “Admiral Shares,” which is a popular Vanguard share class. Admiral Shares generally have a slightly higher investment minimum but a lower expense ratio. However, if the investment minimums are difficult for you to meet, good news: You can probably buy it as an ETF, which you can buy for as little as one share, and we’ll let you know when that’s the case.

With that said, let’s jump into it.

Best Large-Cap Fund: Vanguard 500 Index Fund Admiral Shares

— Type: Mutual fund (ETF available)

— Style: U.S. large-cap stock

— Assets under management: $1.4 trillion*

— Dividend yield: 1.1%

— Expense ratio: 0.04%, or 40¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

The vast majority of fund managers who run large-cap funds (funds that invest in larger companies) struggle to consistently beat the S&P 500 index, particularly after fees.

The majority of fund managers who run large-cap funds (funds that invest in larger companies) struggle to consistently beat the S&P 500 Index, particularly after fees. According to S&P Dow Jones Indices, in 2024, “65% of all active large-cap U.S. equity funds underperformed the S&P 500, worse than the 60% rate observed in 2023 and slightly above the 64% average annual rate reported over the 24-year history of our SPIVA Scorecards.” That continued roughly a decade of active managers underperforming the index. And managers are on pace for another disappointing year in 2025.

I say if you can’t beat it, join it … which you can do by purchasing Jack Bogle’s original fund.

The Vanguard 500 Index Fund Admiral Shares (VFIAX) boasts more than $625 billion in assets under management, and that’s just in the VFIAX share class. Across all share classes, this fund manages roughly $1.4 trillion! Meanwhile, VFIAX offers an expense ratio of just 0.04%—that’s not free, but it’s awfully close.

Related: 10 Best Vanguard Funds to Buy

The S&P 500 is a collection of the largest and most dominant American companies. To be selected for this stock market index, a company must have a market capitalization of at least $22.7 billion, its shares must be highly liquid (shares are frequently bought and sold), and at least 50% of its outstanding shares must be available for public trading, it must have positive earnings in the most recent quarter, and the sum of its previous four quarters must be positive. Once a company is in the index, it doesn’t necessarily get kicked out if it fails to meet all of the criteria at some point in the future, but the selection committee would take that under consideration.

Turnover (how much the fund tends to buy and sell holdings) tends to be low, as only a handful of stocks enter or leave the index in any given year. Why does that matter? If mutual funds rack up net capital gains from trading throughout the year, they must make capital gains distributions to shareholders, which are taxable. VFIAX’s low turnover means it’s extremely tax-efficient, which is especially useful for people who invest in taxable brokerage accounts.

If the $3,000 minimum is a problem, the exact same strategy is available via the Vanguard S&P 500 ETF (VOO), which charges an even cheaper 0.03% in annual expenses. At time of writing, a single share can be purchased for around $615. (However, if your brokerage platform offers fractional shares, you can buy a slice of VOO for as little as $1.)

This may be Vanguard’s oldest index strategy, but it remains one of the very best Vanguard index funds.

* Many Vanguard funds have multiple share classes, including ETFs. Listed net assets for Vanguard funds in this story refer to assets under management across all of a given fund’s share classes.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

Featured Financial Products

Best Dividend Fund: Vanguard High Dividend Yield Index Fund Admiral Shares

— Type: Mutual fund (ETF available)

— Style: U.S. high-dividend stock

— Assets under management: $79.5 billion

— Dividend yield: 2.5%

— Expense ratio: 0.08%, or 80¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

As bear markets occasionally remind us, we cannot always depend on stock price returns to materialize when we want or need them. But dividends allow you to realize a steady stream of returns without having to sell your shares at potentially inopportune times.

Furthermore, dividend stocks tend to be more stable, mature, and shareholder-focused than their non-dividend-paying peers.

One of the best Vanguard index funds for beginning investors (and one of the best dividend mutual funds period) is the Vanguard High Dividend Yield Index Fund Admiral Shares (VHYAX): an index fund that tracks the FTSE High Dividend Yield Index. The companies in the index have a history of paying above-average dividends, and the fund yields a competitive 2.5% that’s more than twice the S&P 500.

Related: 5 Best Money Market Funds [Protect Your Savings]

As you might expect from a dividend-focused mutual fund, the Vanguard High Dividend Yield Index Fund has a high allocation to steady “blue chips” (stocks representing large, established companies). Its biggest holdings are Broadcom (AVGO), JPMorgan Chase (JPM), and Exxon Mobil (XOM). Its largest industry allocation is to the financial sector (22%), though four other sectors enjoy low-double-digit weightings.

“Vanguard High Dividend Yield strikes a balance between higher yield and managing the associated risk,” Morningstar analyst Bryan Armour says. “Market-cap-weighting steers the portfolio toward more stable large-cap stocks and away from those whose dividends may be distressed.”

However, understand that if you invest in Vanguard High Dividend Yield Index, you won’t be invested in the real estate sector. That’s because VHYAX’s underlying index explicitly excludes real estate investment trusts (REITs). It seems like an odd exclusion, if only because REITs tend to be one of the market’s highest-yielding sectors. One possible explanation? Most common stocks, like those held in this Vanguard fund, pay qualified dividends, which enjoy favorable tax treatment at the long-term capital gains tax rate. Most REIT dividends, however, are non-qualified, which are taxed as ordinary income at federal income tax rates. By excluding REITs, VHYAX can pay out 100% qualified dividend income, helping shareholders avoid a potential tax headache.

In short: VHYAX is a solid option for beginning investors who want to own high-yield dividend stocks while minimizing the risk that any single stock could have an outsized negative impact on their portfolio.

If the $3,000 minimum is a challenge for a beginning investor, the same strategy is offered as an ETF via the Vanguard High Dividend Yield ETF (VYM), which charges 0.06% in annual expenses. At time of writing, a single share can be purchased for around $140.

Related: 10 Best Fidelity Funds to Buy

Best Dividend Growth Fund: Vanguard Dividend Appreciation Index Fund Admiral Shares

— Type: Mutual fund (ETF available)

— Style: U.S. dividend-growth stock

— Assets under management: $112.6 billion

— Dividend yield: 1.7%

— Expense ratio: 0.07%, or 70¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

There’s more to dividend investing than simply seeking out the highest yield. In fact, the yield itself is only one small part of the story.

The payment of dividends serves as a quality filter. Earnings can be manipulated by clever accountants, but dividends have to be paid in cold, hard cash. There’s no room for fudging there.

Furthermore, there is no better sign of company health than a long history of rising dividends. As the old Wall Street maxim goes: The safest dividend is the one that was just raised. And on the other side, slashing a dividend is a major embarrassment for management and tends to infuriate shareholders. So you can bet that company boards only raise the dividend when they are confident they will have the cash to back it up.

Related: The 10 Best Index Funds You Can Buy

For this reason, the Vanguard Dividend Appreciation Index Fund Admiral Shares (VDADX) is one of the very best Vanguard index funds for those looking to invest for the long haul.

The Vanguard Dividend Appreciation Index Fund tracks the performance of the S&P U.S. Dividend Growers Index, which is composed of hundreds of U.S. companies that have followed a policy of consistently increasing dividends every year for at least 10 consecutive years. As an additional filter, the index excludes the top 25% highest-yielding eligible companies from the index, as exceptionally high-yielding stocks are often at risk for dividend cuts. It also excludes REITs.

Despite its name, income is not VDADX’s main allure. This Vanguard dividend fund yields a modest 1.7%, which isn’t much higher than that of the S&P 500. But it most assuredly is a collection of some of the strongest and most shareholder-friendly dividend-growth stocks in America, such as Johnson & Johnson (JNJ) and Walmart (WMT).

If the $3,000 minimum is a stretch on your budget, the same strategy is available via the Vanguard Dividend Appreciation ETF (VIG), which charges 0.05% in annual expenses and trades for around $215 per share.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

Best ESG Fund: Vanguard ESG U.S. Stock ETF

— Type: ETF

— Style: U.S. large-cap ESG stock

— Assets under management: $10.9 billion

— Dividend yield: 1.0%

— Expense ratio: 0.09%, or 90¢ per year for every $1,000 invested

— Minimum initial investment: N/A*

As a general rule, it’s probably better to keep your political views separate from your investment decisions. Politics tends to be emotional, and it’s generally best to strip out your emotions when investing and stick with the numbers.

That said, many investors feel strongly that investing should be ethical, and they have serious moral qualms about investing in certain industries or in companies with questionable labor practices or corporate governance. Furthermore, studies have found that companies with strong corporate governance structures in place tend to outperform, and companies with good labor relations tend to do a better job of avoiding costly strikes or work stoppages.

Related: 10 Best ETFs to Beat Back a Bear Market

For investors wanting to feel good about their investments, the Vanguard ESG U.S. Stock ETF (ESGV) is a solid option.

This Vanguard ETF seeks to track the performance of the FTSE US All Cap Choice Index, a market-cap-weighted index screened for environmental, social, and corporate governance (ESG) criteria. The index excludes stocks of companies related to adult entertainment, alcohol, tobacco, cannabis, gambling, chemical and biological weapons, cluster munitions, anti-personnel landmines, nuclear weapons, conventional military weapons, civilian firearms, nuclear power, and coal, oil, or gas. It also excludes stocks of companies that do not meet certain labor, human rights, environmental, and anti-corruption standards as defined by the UN Global Compact Principles and companies that do not meet certain diversity criteria.

The resulting portfolio is more than 1,300 qualifying stocks, which you can get for a low 0.09% in annual fees.

* As an ETF, ESGV has no minimum initial investment. You can buy as little as one share (or a fraction of a share if your brokerage supports fractional shares).

Related: Best Vanguard Retirement Funds for an IRA

Best International Developed Markets Fund: Vanguard Developed Markets Index Fund Admiral Shares

— Type: Mutual fund (ETF available)

— Style: Developed-market stock

— Assets under management: $242.1 billion

— Dividend yield: 2.8%

— Expense ratio: 0.05%, or 50¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

The U.S. economy ranks as the world’s largest. America is home to many of the world’s most innovative and profitable companies. And American investors have expenses denominated in U.S. dollars.

So, it only makes sense to keep the bulk of your investments in U.S. assets.

That said, opportunities abound in developed (established, slower-growing) and emerging (less stable but faster-growing) markets as well, and there can be multi-year stretches in which non-U.S. stocks massively outperform their American peers. This was certainly the case from 2000-08, the last major bull market in overseas shares. And more than halfway into 2025, international stocks have so far outpaced their U.S. peers.

Related: 7 Low- and Minimum- Volatility ETFs for Peace of Mind

For index exposure to the world’s major developed foreign markets, consider the Vanguard Developed Markets Index Fund Admiral Shares (VTMGX). The fund tracks the performance of the FTSE Developed All Cap ex US Index, a market-cap-weighted index that is made up of nearly 3,900 common shares of large- mid-, and small-cap stocks located in Europe, Canada, and the Pacific region. Currently, 55% of assets are invested in European shares. Asia and the Pacific Rim enjoy a collective 35% weight, North America (basically just Canada) earns a 10% weight, and the remaining sliver represents the Middle East’s exposure.

VTMGX also pays an attractive dividend yield of nearly 3%. That’s much better than you’d get from a similar collection of American blue chips but par for the course for large-cap developed-market stock funds. Meanwhile, you pay a skinflint expense ratio of just 0.05%.

If the $3,000 investment minimum is a little on the high side for you, consider the Vanguard FTSE Developed Markets ETF (VEA). It tracks the same index, charges just 0.03%, and a single share can be bought for a little more than $60 as of this writing.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

Best International Emerging Markets Fund: Vanguard Emerging Markets Stock Index Fund Admiral Shares

— Type: Mutual fund (ETF available)

— Style: Emerging-market stock

— Assets under management: $130.5 billion

— Dividend yield: 2.8%

— Expense ratio: 0.13%, or $1.30 per year for every $1,000 invested

— Minimum initial investment: $3,000

The United States is still the world’s idea factory, but it is also already a developed country with high living standards. The same is true of Canada, Japan, and much of Europe. In a developed country, if you produce economic growth of 3% to 4%, government officials are doing cartwheels and slapping five.

But it’s a much different story in emerging markets. Because they are starting at lower levels of development, it’s possible for them to grow significantly faster than their developed-world peers. Economic growth in excess of 8% or even 10% is not uncommon during booms.

Related: The 7 Best Mutual Funds for Beginners

For broad index exposure to emerging markets, consider the Vanguard Emerging Markets Stock Index Fund Admiral Shares (VEMAX). The Vanguard fund tracks the performance of the FTSE Emerging Markets All Cap China A Inclusion Index, a market-cap-weighted index of 6,000 stocks representing companies located in emerging markets around the world. China, by the way, is the largest country by weight (by a lot) at nearly a third of assets. VEMAX also has heavy exposure to India (20%) and Taiwan (20%), as well as more modest holdings in Brazil, Saudi Arabia and a host of other developing countries.

Emerging markets have really struggled over the past decade, and the COVID pandemic didn’t help. And tightening monetary policy from the Federal Reserve and other major central banks also tends to hit emerging markets particularly hard. So, you might want to start small when investing in emerging markets, then gradually build your position over time. But if you believe in the long-term growth prospects of the developing world, it certainly makes sense to have exposure here.

As with most Vanguard Admiral shares, the Vanguard emerging market fund has a $3,000 minimum investment. If this is too steep for you, consider the Vanguard FTSE Emerging Markets ETF (VWO). It runs the same portfolio, has an even cheaper 0.07% expense ratio, and shares trade for around $55.

Like Young and the Invested’s Content? Be sure to follow us.

Featured Financial Products

Best Bond Fund: Vanguard Short-Term Bond Index Fund Admiral Shares

— Type: Mutual fund (ETF available)

— Style: Short-term bond

— Assets under management: $64.9 billion

— SEC yield: 3.8%*

— Expense ratio: 0.06%, or 60¢ per year for every $1,000 invested

— Minimum initial investment: $3,000

2022 and 2023 were volatile years in the stock market, but they were also turbulent for long-term bonds. Bonds that mature in 20 to 30 years actually saw greater price declines than the S&P 500!

So if you are looking to earn a competitive yield while keeping your portfolio safe from wild price swings, consider the Vanguard Short-Term Bond Index Fund Admiral Shares (VBIRX), a diversified bond index fund including both government and corporate bonds.

Related: 8 Best-in-Class Bond Funds to Buy

This bond fund attempts to track the performance of the Bloomberg U.S. 1-5 Year Government/Credit Float Adjusted Index. Now, this fund doesn’t hold all of the bonds in the benchmark—instead, it uses “sampling” to hold fewer bonds while still closely matching index characteristics such as sector weight, maturity, coupon, and credit quality. Even then, this is a very diversified portfolio of roughly 2,900 bonds (versus the benchmark’s 3,900 or so).

This Vanguard index fund currently invests about 70% of assets in bonds issued either by the U.S. Treasury or other federal agencies; most of the rest is spent on corporate bonds. Given the relatively short duration of the bonds in the portfolio, the fund’s risk to rising interest rates is low. (Duration is a measure of bond risk. VBIRX’s duration of 2.6 years implies that a 1-percentage-point rise in interest rates would mean a short-term capital loss of about 2.6% for the fund. And vice versa: A 1-point rise should result in a 2.6% gain for VBIRX.)

Like the other Vanguard funds on the list, VBIRX has a $3,000 minimum initial investment. If this is an issue, the same strategy can be followed via the Vanguard Short-Term Bond ETF (BSV), which charges 0.03% annually and trades for around $80 per share.

* An SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Related: 11 Best Non-Stock Investments [Alternatives to the Stock Market]

What Is an Index Fund?

Most investors own index funds, whether they realize it or not. They are the dominant investment vehicle in most retirement plans these days, and with good reason: Low-cost index funds generally perform as well or better than most actively managed funds.

And naturally, Vanguard Group—which launched the very first index fund for U.S. retail investors more than 40 years ago—is a leader in index funds. If your workplace offers a 401(k) plan, it likely offers some of the best Vanguard index funds; if you have a brokerage account, you certainly have access to these products.

But if you’re new to investing, you need to understand what index funds do. So first, let’s look under the hood to see what makes the best index funds tick.

The best way to explain index funds is to compare them to their cousins: actively managed funds.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

What Are Actively Managed Funds?

Actively managed funds are run by one or more fund managers, who collect money from investors, then allocate that money to stocks, bonds, or other assets. With active funds, the managers are often tasked with beating some sort of benchmark index, but they’ll generally have a lot of discretion as to what they can buy and sell to accomplish that.

Related: Best Tech Stocks for 2025

How Do Actively Managed Funds Compare to Index Funds?

Index funds, in contrast, are passive. The fund manager isn’t actively looking to “beat the market” or “beat an index.” They’re simply looking to mimic a stock market index—like, say, the S&P 500—enjoying that underlying investment exposure. (Indeed, one of the best Vanguard index funds for beginners is its core S&P 500 offering.)

Let’s use the S&P 500 as an example. The S&P 500 holds the stocks of 500 companies, but it doesn’t hold equal amounts of each—it “weights” each stock by size. The larger the market capitalization (stock price times number of shares outstanding), the larger the percentage of the index is allocated to that stock. As I write this, the S&P 500 gives tech stocks Microsoft (MSFT) and Nvidia (NVDA) roughly 7% weights apiece. So an index fund mimicking the S&P 500 should invest about 7% of its assets in MSFT, and roughly 7% in NVDA.

Is There an Advantage to Using Actively Managed Funds?

The primary advantage of actively managed funds is that a talented manager can potentially outperform over time and might be adept at navigating a difficult period such as a bear market. But you pay for that possibility in the form of higher fees and often worse tax efficiency.

With index investing, you generally get much lower costs in terms of management fees and trading expenses, better tax efficiency, and performance that often ends up being better than that of many active managers.

If you believe the stock market will generally rise over time, an index fund is the easiest and most direct way to get exposure.

Related: The 7 Best Closed-End Funds (CEFs)

What Are Vanguard Target Retirement Funds?

If you are new to investing and looking for a simple, hands-off way to get started, a Vanguard Target Retirement Fund could be a good option.

Investing in mutual funds isn’t difficult, but it does require your attention. You should regularly check your allocation to make sure that the risk you’re taking is appropriate for your age and stage of life. You generally don’t want to be too heavy in stocks later in life, as you won’t have time to recover any potential losses. And you generally don’t want to be too heavy in bonds early in your career because you’re unlikely to keep pace with inflation. Ideally, you follow a glidepath from a more aggressive to a more conservative portfolio over the course of your investing life.

Related: Beginner’s Guide to Schwab Target-Date Funds

Well, Vanguard Target Retirement Funds do that for you, making them particularly good options for beginners.

Target-date funds start out by compiling their holdings with a specific retirement date in mind, then they adjust the asset allocation as we get closer to that date. A target-date fund with decades until the retirement date will generally be heavy in stocks, whereas a target-date fund very close to its retirement year will generally be a moderate balance of stocks and bonds.

Let’s say you’re 25 years old and looking to retire around the age of 70. You’d hit that age in the year 2070, which would make the Vanguard Target Retirement 2070 Fund (VSVNX) an appropriate option. But let’s say you’re 45. You’ll likely be retiring around the year 2050, so rather than buy VSVNX, you might instead opt for its sister fund, the Vanguard Target Retirement 2050 Fund (VFIFX).

You don’t have to get the year exactly right here, as we don’t necessarily know decades ahead of time the precise day and time we intend to retire. Being within a three- to five-year window will generally get you close enough. The key is simply to find a target-date fund that aligns fairly closely to your expected retirement date and allow the glidepath to do the work for you. My suggestion: Check out our review of Vanguard’s full line of target-date funds to make sure you get both the right date and the right fund type for you.

Like Young and the Invested’s Content? Be sure to follow us.

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

Related: The 7 Best Index Funds for Beginners

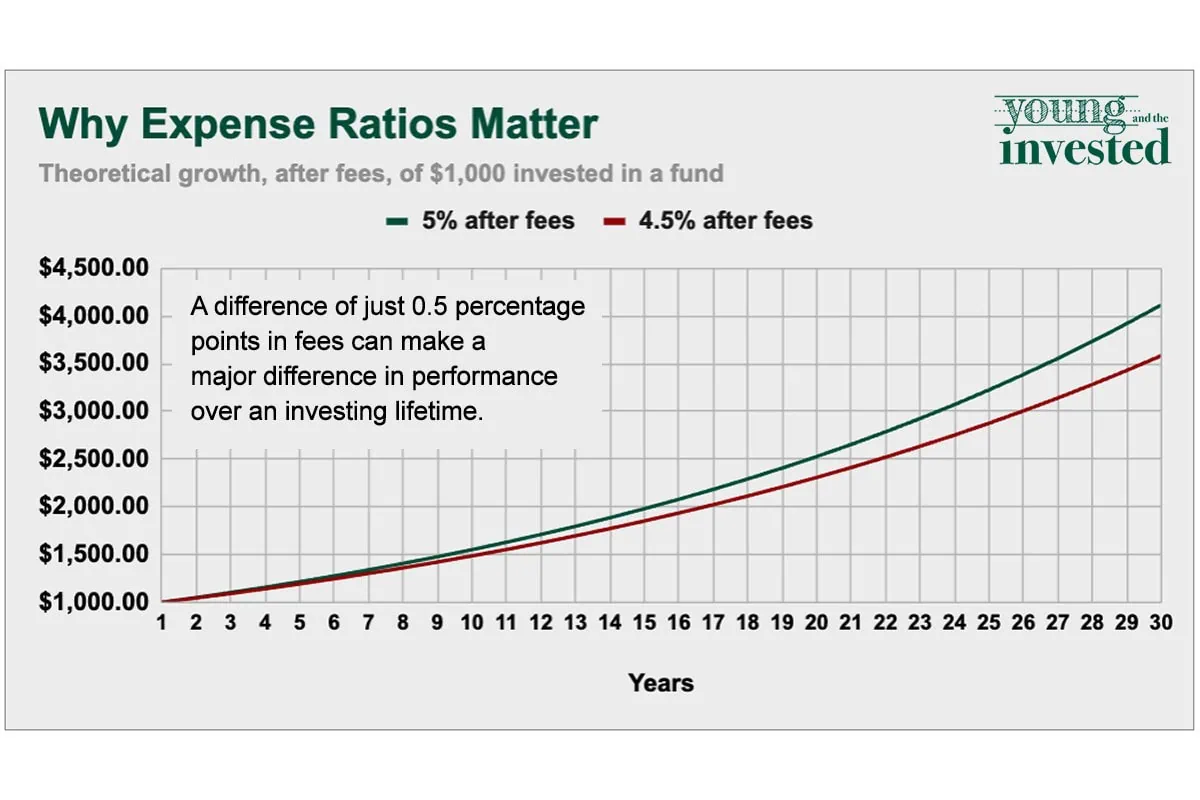

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

What Is the Minimum Investment Amount on a Vanguard Fund?

Vanguard funds are known for being shareholder-friendly. The Vanguard mutual fund company blazed new trails with the index fund, and Vanguard has done more than any other investment firm to keep costs to a minimum for investors.

But there is one hitch. Many of Vanguard’s cheapest funds in terms of fees have initial investment minimums of around $3,000.

If that is a problem for you, don’t sweat it. Most popular Vanguard index funds are also available as ETFs. Most brokers will allow you to buy as little as one share, and some even allow for fractional shares. And if you use a commission-free brokerage, you can buy those ETFs without incurring additional fees.

ETF prices vary, of course, but many cost less than $100, and they rarely exceed $400 per share.

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Featured Financial Products

Related: 10 Best Monthly Dividend Stocks for Frequent, Regular Income

The vast majority of American dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Related: 9 Best Fidelity ETFs You Can Buy [Invest Tactically]

Investors often look to exchange-traded funds (ETFs) for cheap, passive exposure to basic broader market indexes like the S&P 500.

But Fidelity’s ETF suite really shines because in addition to some of those plain-vanilla offerings, Fidelity also provides more tactical ways of tapping into specific corners of Wall Street. See what we mean by checking out our list of the best Fidelity ETFs.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!