At the start of every year, the task of filing federal income tax returns emerges as a particularly daunting chore across America. Collecting receipts and W-2s, choosing between tax software or using a preparer, wrestling with complicated forms and rules, and finally, reconciling with the IRS, all make for a strenuous ordeal. But is it necessary for everyone to endure this process every year?

Perhaps not.

Not all individuals are mandated to file a federal tax return annually. Whether you’re required to file depends on factors such as your income level, age, and filing status. For instance, the returns you file this year pertain to the 2023 tax year and are generally due by April 15, 2024, for most taxpayers. Interestingly, if you’re exempt from filing, you could potentially save considerable time and effort.

On the other hand, even if you don’t satisfy the basic tax filing requirements, there are certain special circumstances under which you still need to file a return. Plus, even though you might not be required to file a tax return, sometimes you’ll want to file one anyway.

If this all sounds confusing, don’t worry. We’ll walk you through the basic federal income tax filing requirements, exceptions to the general rules, and situations requiring a return no matter what—as well as some reasons why you should file a return even if you don’t have to this year.

Table of Contents

Do I Have to File Taxes Based on My Income?

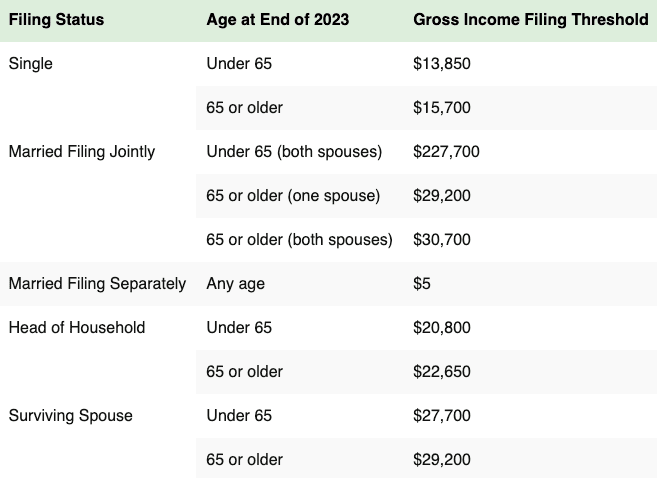

Millions of people ask this question around this time each year. For the vast majority of Americans, the answer is “yes.” However, if your 2023 gross income is below a certain amount, you generally aren’t required to file a 2023 federal income tax return this year.

Use the table in the next slide to see if your 2023 gross income is above or below the basic tax filing requirements threshold for your filing status and age. If your income is at or above the threshold amount, you’re required to file a 2023 tax return this year. If your income is below the applicable threshold, you might be off the hook. (Note: The thresholds that apply if you can be claimed as a dependent on someone else’s tax return are discussed later.)

Gross Income Thresholds Needed to File a Federal Return in 2023

Gross income means total income received in the form of money, goods, property, and services that isn’t exempt from tax. This includes taxable income from sources outside the U.S. or from the sale of your primary home.

Only taxable Social Security benefits count as gross income for purposes of the filing thresholds. Since at least some Social Security income isn’t considered taxable income, people receiving Social Security benefits must first determine the taxable portion of their benefits before using the table above. (Most retirees who rely solely on Social Security benefits for their retirement income won’t have to file a return, since none of their Social Security income will be taxable.)

In addition, for married couples filing jointly, if you didn’t live with your spouse at the end of the taxable year and your gross income was at least $5, you must file a return regardless of your age.

Relation to Standard Deduction

As it turns out, the gross income thresholds are the same as the 2023 standard deduction amounts, except for married couples filing separate returns. That’s because the income thresholds are generally tied by law to the standard deduction and personal exemption amount for each filing status (the personal exemption is $0 from 2018 to 2025 thanks to the Tax Cuts and Jobs Act of 2017).

Like WealthUp’s Content? Be sure to follow us.

Why? Because your taxable income will be reduced to zero, and you won’t owe taxes for the year anyway, if your gross income is less than the combined total of your standard deduction and personal exemption (when there is one).

Related: When Should You Hire a Tax Pro? 15 Times It Makes Sense

However, the federal tax code doesn’t apply the same rules for married couples filing separate tax returns. Instead, the filing requirement is based only on the personal exemption, which is currently $0. The IRS bumped the threshold up to $5 so that separate filers with no income can avoid the tax filing requirements, but that’s still far short of the amount it would be if the standard deduction was part of the equation.

Related: What’s Your Standard Deduction This Year?

Dependents’ Filing Requirement Thresholds

Since the standard deduction amounts are different if you can be claimed as a dependent on someone else’s tax return, the tax filing requirements are different, too.

As described below, whether a dependent must file a 2023 federal income tax return depends on his or her marital status, age, and vision. In each case, unearned income includes taxable interest, ordinary dividends, capital gain distributions, unemployment compensation, taxable Social Security benefits, pensions, annuities, and distributions of unearned income from a trust. Earned income includes salaries, wages, tips, professional fees, and taxable scholarship and fellowship grants. Gross income is the total of unearned and earned income.

For a single dependent who is younger than 65 years of age and not blind, a 2023 federal return must be filed if the dependent has any of the following:

— Unearned income over $1,250

— Earned income over $13,850

— Gross income more than the larger of (a) $1,250, or (b) up to $13,450 of earned income, plus $400

Related: IRS Erases $1 Billion In Back Tax Penalties

For a single dependent who is at least 65 years old or blind, a 2023 federal return must be filed if the dependent has any of the following:

— Unearned income over $3,100 ($4,950 if age 65 or older and blind)

— Earned income over $15,700 ($17,550 if age 65 or older and blind)

— Gross income more than the larger of (a) $3,100 ($4,950 if age 65 or older and blind), or (b) up to $13,450 of earned income, plus $2,250 ($4,100 if age 65 or older and blind)

Related: How to Get Your Tax Refund Fast

For a married dependent who is younger than 65 years of age and not blind, a 2023 federal return must be filed if the dependent has any of the following:

— Unearned income over $1,250

— Earned income over $13,850

— Gross income at least $5 and one spouse files a separate return and itemizes deductions

— Gross income more than the larger of (a) $1,250, or (b) up to $13,450 of earned income, plus $400

Related: 10 “Most Serious” IRS Problems Taxpayers Face

For a married dependent who is at least 65 years old or blind, a 2023 federal return must be filed if the dependent has any of the following:

— Unearned income over $2,750 ($4,250 if age 65 or older and blind)

— Earned income over $15,350 ($16,850 if age 65 or older and blind)

— Gross income at least $5 and one spouse files a separate return and itemizes deductions

— Gross income more than the larger of (a) $2,750 ($4,250 if 65 or older and blind), or (b) up to $13,450 of earned income, plus $1,900 ($3,400 if 65 or older and blind)

Related: Does My Child Have to File a Tax Return?

Exception for Children With Unearned Income

There’s an exception to the general tax return filing requirements for a dependent child with unearned income. If certain conditions are met, the child’s parents can report the income on their tax return, which means the qualifying child doesn’t have to file a return. Parents electing this option must file Form 8814 with their federal income tax return.

Related: The Best REITs to Invest In for 2024

To qualify for this election, all the following conditions must be satisfied:

— The child was under age 19 (or under age 24 if a full-time student) at the end of the tax year

— The child’s only income was from interest and dividends, including capital gain distributions

— The child’s gross income was less than $12,500 (amount for 2023 tax year)

— The child is otherwise required to file a tax return

— The child isn’t married filing jointly

— There were no estimated tax payments for the child

— There was no federal income tax withheld from the child’s income

Related: Kiddie Tax: What Is It, Who Must Pay, How Much + More

Do I Have to File Taxes for Other Reasons?

Even if your income isn’t high enough to trigger a tax return filing requirement, you still might have to file a tax return for other reasons.

Here’s a rundown of situations under which you’re required to file a federal return regardless of your income.

Related: 2 States Eliminated Taxes on Social Security Benefits [Do You Live In One of Them?]

1. “Special Taxes”

You must file a federal return if you owe any of the “special taxes” reported on Schedule 2 (Form 1040). This include the following special taxes:

— Alternative minimum tax

— Additional tax on a qualified retirement plan (including an IRA or 401(k) plan) or other tax-favored account (including 529 plans, health savings accounts, and ABLE accounts)

— Social Security or Medicare tax on tips not reported to your employer or on wages you received from an employer who didn’t withhold these taxes

— Uncollected Social Security, Medicare, or railroad retirement tax on tips reported to your employer or on group-term life insurance and additional taxes on health savings accounts

— Household employment taxes

— Recapture taxes (e.g., paying the government back for tax breaks you weren’t qualified to take or for the improper use of funds in a tax-favored account)

Related: Charitable Tax Deduction: What to Know Before Donating

2. HSA, Archer MSA, or Medicare Advantage MSA Distributions

A federal tax return must be filed if you (or your spouse if you’re married filing jointly) received distributions from a health savings account, Archer MSA, or Medicare Advantage MSA.

Related: Best Health Savings Account (HSA) Providers

3. Self-Employment Income

Self-employment income above a certain amount can trigger a filing requirement. You must file a tax return if you have net earnings from self-employment of at least $400. You also must file Schedule SE and pay any self-employment tax due.

Like WealthUp’s Content? Be sure to follow us.

4. Church Income

A federal return must be filed if you received $108.28 or more in wages from a church or qualified church-controlled organization that’s exempt from employer Social Security and Medicare taxes. If this is the case, you must also file Schedule SE and pay any self-employment tax due.

Related: Student Loan Interest Deduction: How Much, Eligibility + More

5. Premium Tax Credit Advance Payments

If you, your spouse, or a dependent bought health insurance coverage through a state or federal marketplace and received advance payments of the premium tax credit, then you must file a tax return. The amount of advance payments received for health coverage is shown in Part III (Column C) of Form 1095-A, which the marketplace will send you.

Related: 2023 Child Tax Credit FAQs [What Every Parent Needs to Know]

6. Foreign Income

Under Section 965 of the U.S. tax code, American shareholders must pay taxes on previously untaxed foreign earnings of certain foreign corporations. You must file a tax return if you’re required to pay taxes under Section 965. You must also file a return if you pay taxes owed under Section 965 in installments or elected to defer those taxes.

Related: 30 Tax Statistics and Facts That Might Surprise You

Should I File Taxes Even If I Don’t Have To?

So, you don’t have to file a tax return. That’s great! But what if the IRS owes you a tax refund? Would that make filing a tax return worth the time, money, and effort?

Related: When is Tax Day in 2024 [When Are Taxes Due]?

If you qualify for one or more refundable tax credits, the IRS could be sending you a sizable tax refund if you file a tax return this year. The same could be true if you had income tax withheld from your paycheck (or other income) during the year, or paid estimated taxes for the 2023 tax year.

Here’s more information about the reasons why you ought to file taxes even though you’re not required to file a return.

Related: Child Tax Credit FAQs [What Every Parent Needs to Know]

1. You Can Claim Refundable Tax Credits

Refundable tax credits are the best tax break you can get. There are two types of credits: non-refundable and refundable credits. All tax credits reduce your overall tax bill on a dollar-for-dollar basis. However, non-refundable credits can only reduce the tax you owe to $0, while refundable credits can actually reduce your tax bill below $0. If that happens, you’ll get a tax refund from the IRS.

So, make sure you file a return if you can claim tax credits from the following list:

— Credit for federal taxes on fuels

— Premium tax credit

— American Opportunity tax credit

— Credits for sick and family leave

Related: Avoid a Terrible Tax Preparer: Insider Tips to Find a Great Pro

2. Taxes Were Withheld From Your Paycheck or Other Payments

If income taxes were withheld from your paycheck or other payments to you, they’re treated like a refundable tax credit. In other words, they can trigger a tax refund if you file a tax return to reclaim them. For 2023 tax returns, you can claim income taxes withheld on Line 25 of your Form 1040.

Related: 8 Free Tax Filing Options for 2024

The amount withheld during the year will be reported on various forms that you’ll receive in the mail. For instance, federal taxes taken out of your paycheck can be found in Box 2 of the Form W-2 you receive from your employer. Taxes withheld on dividends, interest income, unemployment compensation, retirement plan distributions, and certain other types of income are shown in Box 4 of the related Form 1099. Withholding from Social Security benefits are recorded in Box 6 of Form SSA-1099. Other types of withholding will be shown on other forms.

Related: Tired of Paying to File Taxes? You Might Need Have To

3. You Paid Estimated Taxes

If you paid estimated taxes for 2023, then you should file a tax return in order to get that money back. Like withheld income taxes, the year’s estimated tax payments can also trigger a refund when reported on Line 26 of your Form 1040.

The IRS won’t send you anything showing how much you paid in estimated taxes for the year. You’ll have to refer back to the 1040-ES forms you filed or the receipt received for electronic payments to get that information.

Related: What Is IRS Direct File [And How Does It Work?]

Does the IRS Offer Any Help?

Yes, the IRS has an online tool that helps you determine whether you need to file a tax return. IRS Publication 501 also provides additional information about filing obligations for U.S. citizens living abroad, residents of Puerto Rico, people with income from U.S. possessions, deceased people, and more.

Like WealthUp’s Content? Be sure to follow us.

Related: What Tax Bracket Are You In?

Perhaps the best way to lower your federal income tax bill is push yourself down into a lower tax bracket to reduce your tax rate. On the flip side, you certainly want to avoid getting kicked into a higher bracket and increasing your tax rate.

But, of course, under either scenario you need to have a good feel for where you are right now. For that purpose, check out the federal tax brackets and rates that will apply for your next federal tax return.

Related: What’s Your Standard Deduction?

For most people, their largest and most important tax deduction is the standard deduction. However, the standard deduction amounts change every year to account for inflation. Plus, the standard deduction isn’t the same for everyone.

So, before start your tax return or jumping into tax planning mode, you’ll need to know how much your standard will be for the tax year.

Related: Capital Gains Tax: What You Need to Know

Millions of Americans sell stocks, bonds, cryptocurrency, real estate, precious metals, and other types of investment property every year. However, if you sell investments during the year, you might owe capital gains tax on any profits.

The good news is that you’ll pay a lower tax rate on capital gains when compared to income taxes on wages, tips, and other “ordinary” income. On the other hand, there are a few landmines to avoid when you sell investment property. Get all the details with our guide to the capital gains tax.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!