“Aaaaaaaaaaaaaaaaaaaaaaaaaaaaaaa!”

– A bunch of investors, Monday, Aug. 5

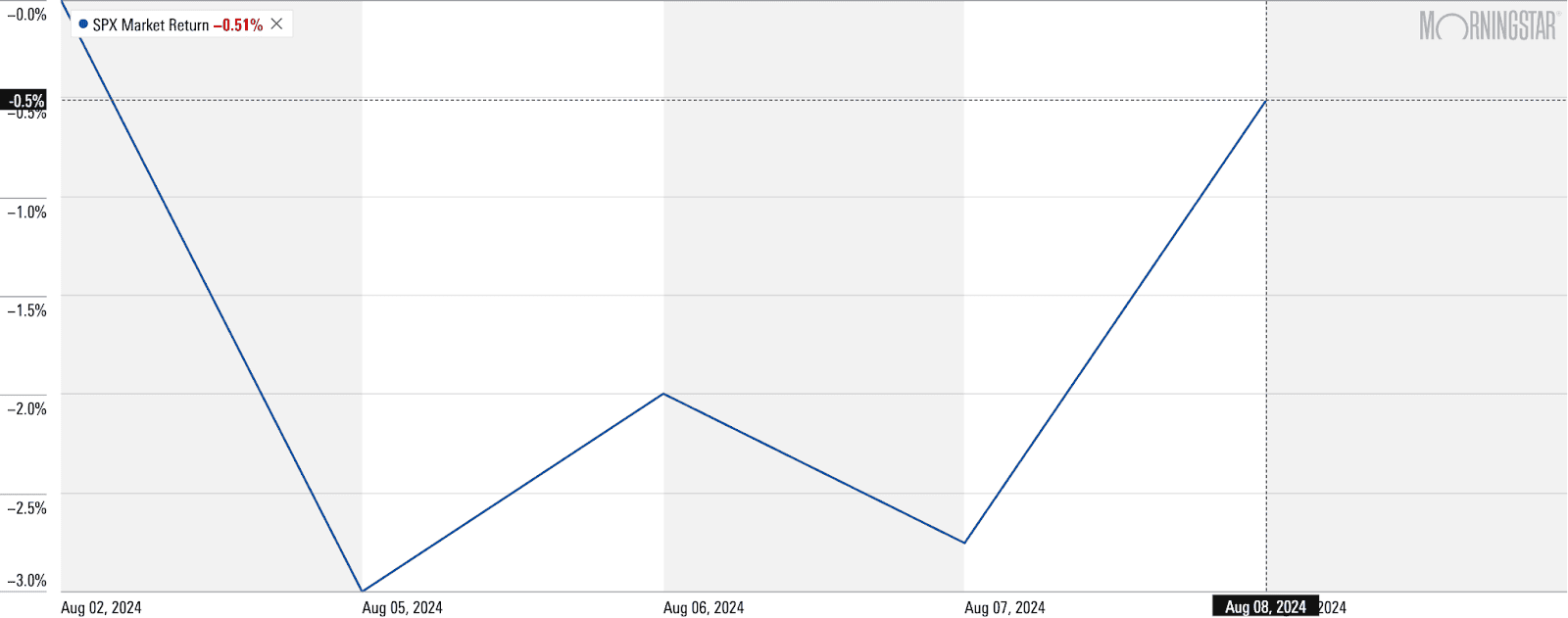

If you were paying any attention to social media or financial cable TV earlier this week, you might remember that the end times were nigh. “Great Depression” and “stock market crash” were trending on Twitter. Pundits were howling for the Federal Reserve to make an emergency rate cut. To say people were panicking would be an insult to the relative order and tranquility of a panic.

Anyways, we thought we’d check in on the end of the financial world.

Oh. How about that.

All snarkiness aside for a moment, this is no time to spike the ball. Just like Monday’s spill hasn’t (yet) led to a market flush, the recovery across the rest of the week doesn’t necessarily mean stocks are out of the woods, either. We simply do not know what’s coming next.

But that’s not the point of today’s Tea.

WealthUp Tip: Dividend income can help smooth out price volatility. Start your search with these dividend stocks.

Instead, we’re going to focus on volatility (and the stock losses frequently associated with it). Read on as we help you understand what volatility is, explain why it makes investors crazy, and provide some data that will help you mentally steel yourself against future bursts of volatility.

The Tea: Let’s start by explaining what volatility is.

Technical definitions of volatility tend to be pretty drab and mathematical. Here’s Wikipedia with an appropriately dry example:

“In finance, volatility (usually denoted by “σ”) is the degree of variation of a trading price series over time, usually measured by the standard deviation of logarithmic returns.”

For those of us who don’t spend our Friday nights thumbing through academic whitepapers, here’s a more relatable definition from the Financial Industry Regulatory Authority (FINRA) that should bring it home:

“Anyone who follows the stock market knows that some days market indexes and stock prices move up and other days they move down. This is called volatility. The more dramatic the swings, the higher the level of volatility—and potential risk.”

Here’s the funny thing. Volatility isn’t inherently positive or negative for stocks. You can have a volatile downturn in the market, but you can also have a volatile rally. But go back and read the FINRA definition. They don’t mention that the more dramatic the swings, the higher the level of potential reward … they only mention potential risk.

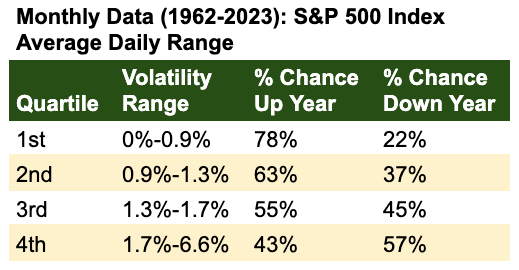

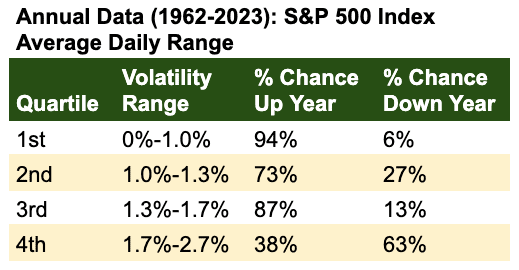

FINRA isn’t alone. Just about anything you’ll read about volatility will lean toward the negative. And that’s because, regardless of the fact that upturns can occur during periods of high volatility, they’re much less likely to. Consider this data from Crestmont Research:

Source: Crestmont Research

Editor’s Note: Crestmont’s annual data for % chances of up years and down years in the fourth quartile add up to 101%. This appears to be a rounding issue.

Importantly, the data doesn’t say that high volatility causes lower returns—merely that the existence of higher volatility corresponds to a higher probability of declines (and vice versa).

“We do not assert a causal relationship; rather, the coexistence of the relationship implies that many measures of risk actually compound in declining markets,” Crestmont says. “By contrast, the reward-to-risk relationship improves significantly in strong markets.”

You can see, then, why investors get the jitters when markets become more volatile: Not only is there higher risk, which investors largely don’t enjoy in the first place. But also, if you’re playing the historical odds, where there is volatility, there are losses, too.

But to become a better investor, you need to overcome those jitters.

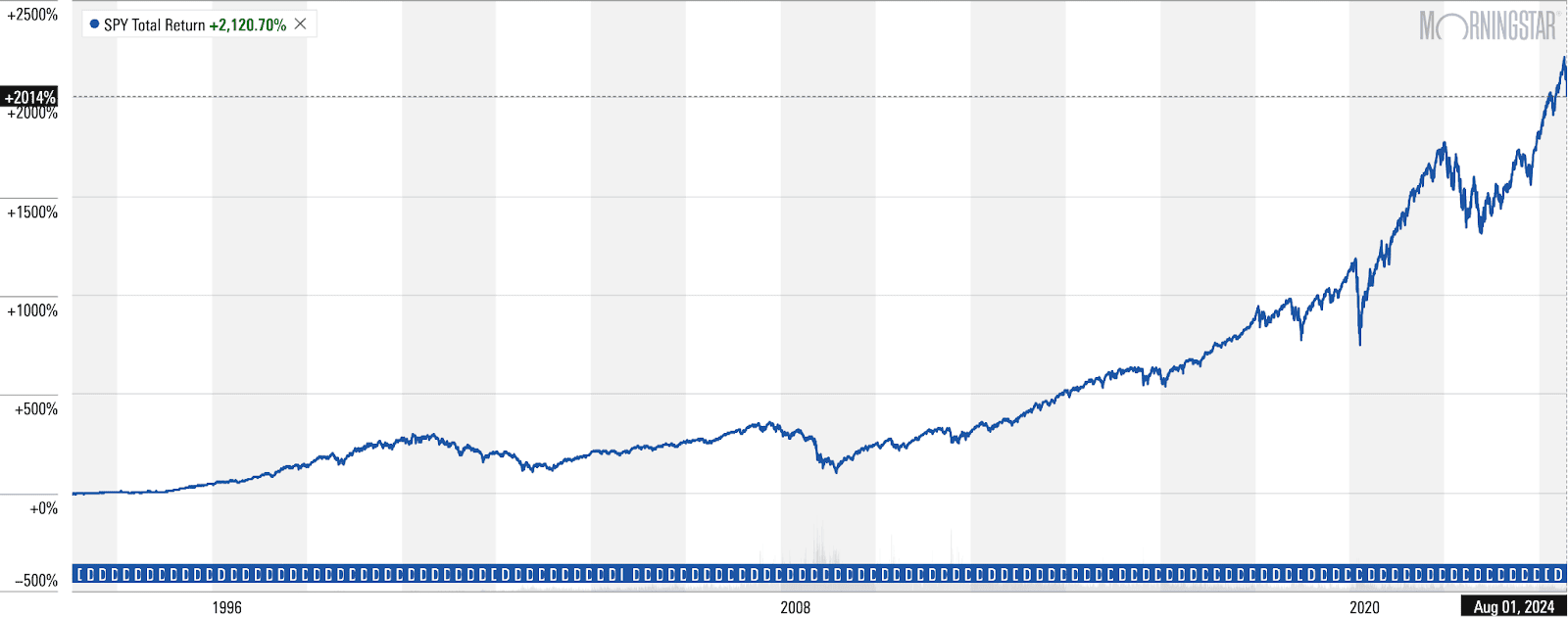

The Take: Volatility causes fear, and investment decisions made out of fear (or any emotion!) are more likely to blow up in your face. In particular, volatile selloffs often compel investors to exit their investments—and they often don’t return until the markets calm down and they feel more comfortable again. Unfortunately, by the time that happens, they’ve missed out on a lot of the recovery, and ultimately are worse-off performance-wise than they would have been had they just held on.

So if you’re mostly or entirely invested in stocks, you have to find a way to deal with your fear of volatility.

And at least in our eyes, there are really only three ways of doing that:

- Stop investing in markets entirely. You could always make money by investing in products such as certificates of deposit (CDs) or money market accounts (MMAs). You would eliminate virtually all investing risk this way. However, your potential returns would be severely limited, making it difficult to reach many investing goals, and nearly impossible to accumulate enough money for retirement.

- Stay in the markets, invest more conservatively. You could also pull back your risk by investing in less-risky stocks and even bonds. You would reduce your portfolio risk, and you would have a higher potential return than you would if you invested in CDs and MMAs … but you would still have a lower potential return than if you invested mostly or entirely in stocks.

- Stay in the markets, don’t change a thing, and learn to look at volatility differently. Just about every investment study shows that stocks have better historical returns than just about every other major asset. So if you can find a way to grit your teeth through periods of volatility, you’ll give yourself a much better chance of hitting all your goals.

Sure, No. 3 is easier said than done. But that’s where a little perspective and data can go a long way.

First off, just look at the long-term chart of any high-performing stock, fund, or index, and you’ll find that no matter how good the returns have been, they haven’t come in a straight line.

Volatility isn’t just something that happens every now and then—it’s par for the course. I’m not talking about the occasional bad day. I’m talking about corrections (10%+ drop from a peak) and even bear markets (20%+ drop from a peak).

Consider this: Between July 16 and the close on Monday, Aug. 5, the S&P 500 had dropped roughly 8.5%, which is actually short of a correction.

WealthUp Tip: These mutual funds are among some of the market’s best ready-built portfolios of stocks, bonds, and more.

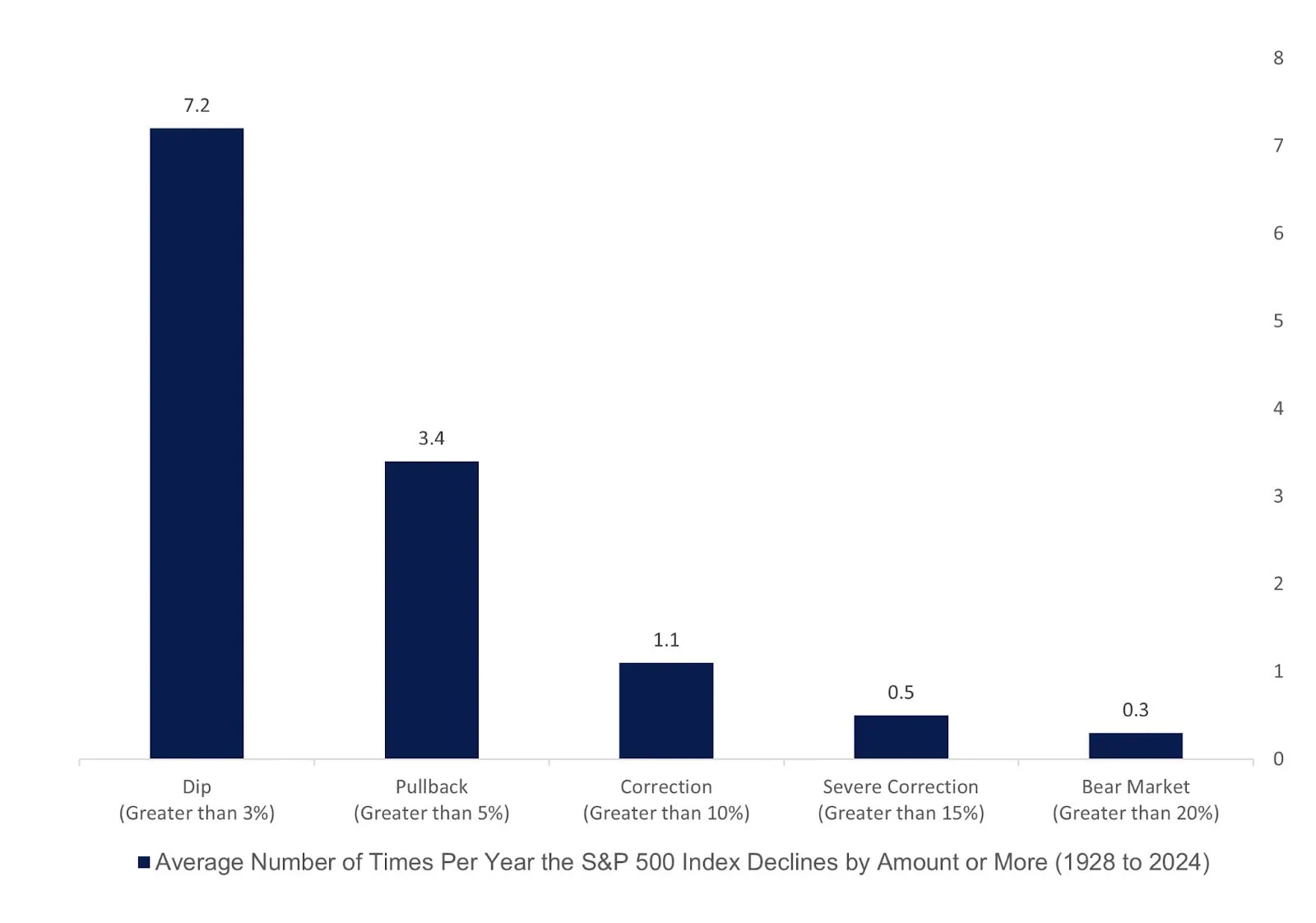

“While such sharp declines in equity prices are concerning, looking back at historic data on the S&P 500 index reminds us that dips, pullbacks and corrections of 10% or more are a normal and healthy part of any bull market,” says George Smith, Portfolio Strategist for LPL Financial. “On average, stocks experience a pullback of over 5% over three times per year and a correction of 10% or more around once per year—even in positive years.”

Source: LPL Financial, Ned Davis Research

In fact, part of the reason investors might be freaking out more than they otherwise would be is that we’ve been pretty spoiled.

“The S&P 500 fell 3% on Monday; but prior to this, 2024 and 2023 had been abnormally calm years with regards to large daily moves. Before the last week in 2024, there had been one other down day of more than 2%, in late July, and one up day of over 2% (in February).”

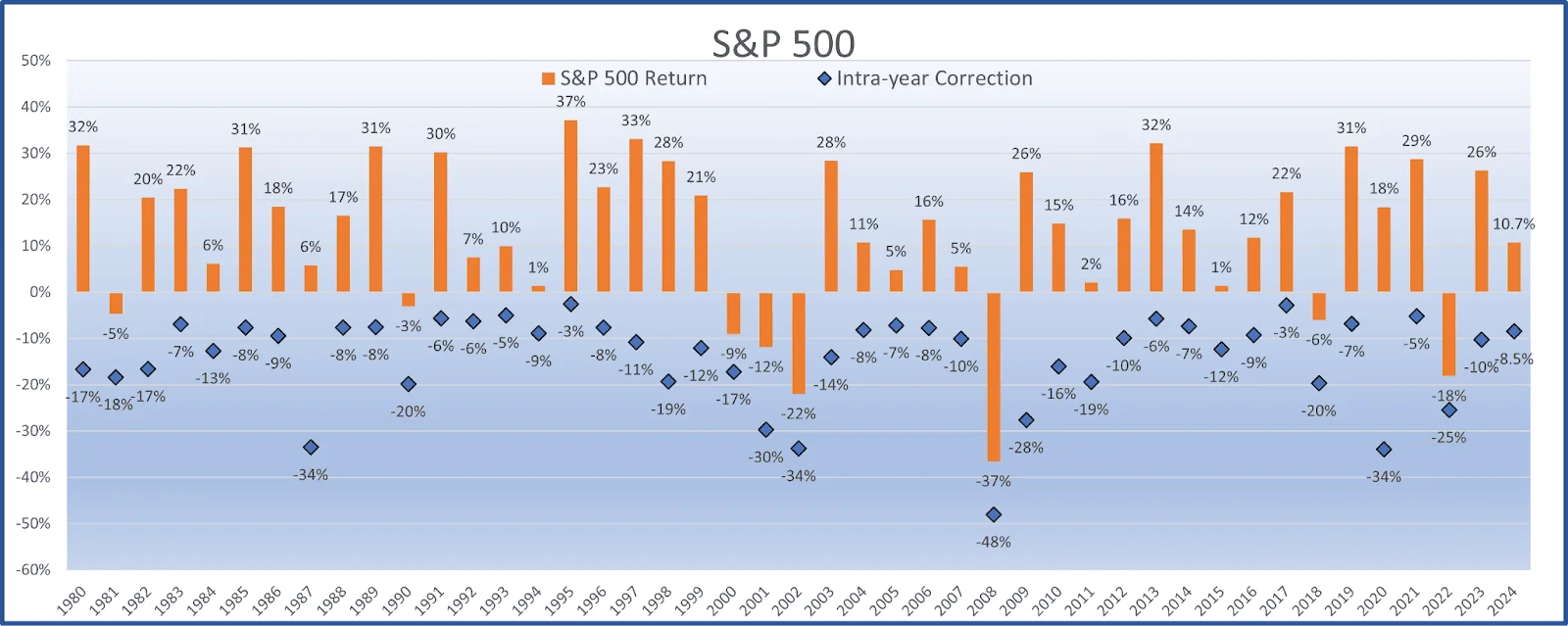

Also, not only are pullbacks common, but—returning to the point above about markets not traveling in a straight line—they happen in even the most productive of up years.

Source: LPL Financial

One last thing: A lot of the chatter around Monday’s spike in volatility and sharp downturn in stocks had to do with worries about a potential American recession. The possibility of an economic slump was already planted in some minds amid cooling data, including a big miss in the July jobs report.

BNP Paribas’ equity team believes the velocity (the peak-to-trough percentage spot drawdown divided by the number of days it took to get there) of the latest downturn points away from that possibility:

“Recessions tend to produce long bear markets. The median peak-to-trough move in a recession takes 543 days (a year and a half),” BNP Paribas says. “Positioning-driven crashes such as Volmageddon [a one-day spike in volatility in February 2018] and Black Monday [the Oct. 19, 1987, stock market crash] tend to be very high-velocity.

“The ‘Summer Sell-off 2024’ ranks fifth on our list of crashes in terms of the velocity of the move. … We would characterize this correction, at least so far, as more similar to Volmageddon or Black Monday than a recession.”

The takeaway: Stock market volatility and downturns are just a fact of life. One down day doesn’t mean a down month is coming. A down month doesn’t mean a down year is coming. And even a down year doesn’t mean you’ll be sitting on losses forever. The best thing you can do is stick to your plan … and maybe log off social media for a few days.

—

Editor’s Note: In the previous Weekend Tea, we said this week’s related topic would be “How to deal with financial stress.” That topic was pushed back a week so we could discuss the recent market volatility. The topic is slated to run Saturday, Aug. 17.

Riley & Kyle

WealthUp and Young and the Invested

Like what you’re reading but not yet a subscriber? Get our weekly financial insights and updates delivered to your inbox every Saturday morning by signing up for The Weekend Tea today! You can also follow WealthUp on Flipboard for more great advice and insights.

Other WealthUp Stories Appearing on Nasdaq: