If you want to increase your net worth, investing in the stock market is an excellent way to make that dream a reality. The stock market isn’t just a get-rich-quick scheme; it can be a way to build sustainable wealth.

However, it is possible to lose (rather than gain) wealth through the stock market. It’s essential to have a strategy in place and to invest in suitable securities at the right time.

What do I need to know before investing in stocks? What investments garner the most wealth? How much should I invest? When should I sell my investments? The answers to these questions and more are below.

Table of Contents

Ways to Get Rich Investing in the Stock Market—Top Picks

|

Primary Rating:

4.7

|

Primary Rating:

4.8

|

|

$89 for 1st year; $199 renewal

|

7-day free trial. Premium: $269/yr.* Pro: $2,400/yr.

|

Can a Person Become Rich by Investing in the Stock Market?

Yes, you can become rich by investing in the stock market. Investing in the stock market is one of the most reliable ways to grow your wealth over time.

People have different definitions of how much it takes to “get rich.” Some believe you’re rich if you have financial freedom, while others think you need to be a multi-millionaire, and others won’t be happy unless they are billionaires.

According to the FRED Economic Data Series from the Federal Reserve Bank of St. Louis, 89% of all U.S. stocks are owned by just the wealthiest 10% of American households. Between January 2020 and mid-2021, the top 10% had the value of their stocks rise 43%.

Clearly, the stock market can increase your net worth, but not everybody has such stellar results.

How much money you make from the stock market will depend on what you invest in, how much money you invest, and timing. Even starting to invest small amounts of money can grow your wealth substantially if you place it in a robust and long-term investment.

No matter how much you make from the stock market, if you invest strategically, that money will likely be worth more than if you invested it elsewhere.

How Do Beginners Make Money in the Stock Market?

You don’t need a degree in finance or Warren Buffett as your uncle to make money in the stock market. Even beginners in the stock market can make sound decisions and earn money through stock exchanges.

While it’s true you “need money to make money” in the stock market, you can get started with small amounts.

Start investing early, if possible, so you can stay invested and give your wealth more time to increase. Plan on staying invested as long as possible.

The first step for someone who wants to invest is to open an account, preferably with investing apps meant for beginners or the best robo-advisors, to build a diversified portfolio automatically.

In either case, choose an established, trusted brokerage firm that has minimal or no fees. You can connect your brokerage account to a bank account to deposit money, or you can setup recurring deposits directly as you earn paychecks.

You can also consider supplementing these options by using one of the many trusted stock picking services out there that vet investments and give you a place to start. As a beginner, you should start with safer, long-term investments.

There is always the possibility of losing money when you buy and sell stocks. The good news is there are several ways to minimize your risk of losing money investing. Follow the tips below to make as much money as possible from the stock market.

Featured Financial Products

Related: Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

How to Get Rich Off Stocks

To make a lot of money off stocks, you need to have a logical investing strategy and style. It’s essential to create a diversified portfolio of index funds and stocks. In general, it’s better to hold high-quality investments long-term rather than short-term.

1. Develop an Investing Strategy

Your investment strategy is a set of rules or guidelines to help you decide when you should or shouldn’t invest. Having a set strategy will keep you from making impulsive decisions out of hope or fear.

Fundamental analysis and technical analysis are the two dominant types of investing strategies. Fundamental analysts concentrate on measuring what they believe to be a stock’s intrinsic value. This investment style assumes the current stock price doesn’t necessarily reflect the intrinsic value, and stock prices eventually correct themselves to match their true value. Therefore, if a stock is currently undervalued, it might be wise to buy it as a long-term investment.

To determine the intrinsic value, fundamental analysts look at various metrics, such as price-to-earnings ratios, price-to-sales ratios, debt-to-equity ratios, PEG ratios, free cash flow, and much more. They often use stock research and analysis apps to drill down into the data to understand the stock better. Fundamental analysis is a strategy for long-term investors.

Technical analysts try to figure out a stock’s future price by evaluating patterns and trends. They will look at past performance, simple moving averages, momentum indicators, trendlines, support and resistance levels, and more. This investing style is mainly used by day traders and swing traders who make short-term investments. The market price is more critical to technical analysis than whether the share price makes sense.

Investors who increased their wealth from GameStop used technical analysis. Technical analysts believe price movements aren’t random, and price trends have a tendency to repeat themselves.

Some investors use a combination of both strategies, and your strategy will also include other factors.

For example, you might have a breakdown of what percentage of your investments you want to be individual stocks versus ETFs, etc. You might choose only U.S. investments or always have a certain amount of foreign exposure. Make a list of all the valuation metrics you need to check when considering an investment. Decide ahead of time what metric numbers mean a stock or other investment has passed your tests.

2. Choose an Investing Style

In addition to choosing whether you want to be more of a fundamental and/or a technical analyst, you’ll have to decide if you want to invest more actively or passively.

Professional money managers run actively managed funds. These professionals actively rebalance funds’ holdings. Having actively managed funds means you can pass on some of your investing responsibility, but these funds can come at a high cost. Passive funds cost much less and still often have high returns.

You’ll also need to decide how aggressive you want your investments to be. Calculate how much you can afford to invest.

Write down your goals, such as how much money you’ll need for retirement. This will affect how aggressive your portfolio is, and it will also affect how long you plan to stay invested. You should have a more aggressive portfolio if you start investing at a young age because the market will have time to correct itself from any downturns. As you approach retirement, you can transition your portfolio to a more conservative asset allocation.

In general, I recommend a long-term approach to stock investing over a short-term plan to increase your wealth. It’s possible to get rich from either strategy, but long-term investing has shown itself as the last true edge in investing and thus more reliable.

With long-term investing, you gain the power of compounding to build wealth. When you reinvest your dividends, your amount of shares grow in number while simultaneously growing in value.

3. Use Index Fund Investing

Index funds follow a benchmark index, such as the S&P 500. Index funds are considered low risk because they are highly diversified. You can usually get an S&P 500 index fund or another index for a low price and minimal fees. The expense ratio is low because the funds are passively managed.

You’re also saving money because index funds are tax-efficient. Since index funds have a low turnover ratio, they are more tax-efficient than actively managed funds. The low turnover also means there aren’t often capital gains taxes for shareholders to pay.

Perhaps most importantly, index funds typically have high returns that beat most actively managed mutual funds. When choosing an index fund to invest in, make sure to compare expense ratios.

A powerful way to leverage index fund investing comes from using low-cost, or even no equity commission investing apps, such as the below:

4. Buy and Sell Individual Stocks

Buying and selling individual stock shares gives you the opportunity for much higher returns than buying funds with many stocks. With today’s competitive brokerages, you can buy stocks with no trading commissions. Plus, it’s a highly liquid investment, and it also gives you more control to make your portfolio look exactly how you want.

You have the power to buy and sell at any time (as long as the market is open or your brokerage allows after-hours trading). Today, many platforms will even allow you to buy fractional shares, meaning you can always have your money fully invested.

Since you control capital gains timing when you buy and sell, stocks are more tax-efficient than mutual funds. You can make vast amounts of money, but only if you choose the right stocks. You might start with companies you’ve heard about already.

While it’s essential to conduct your stock research, you need a starting point to know which stocks to analyze. Consider getting advice from expert stock picking services, such as Motley Fool’s Stock Advisor or Seeking Alpha Premium, on which stocks you should check out. From there, you can crunch additional numbers.

Only subscribe to investment newsletters and other services with proven track records. With the most trusted services, you can more than make your money back.

5. Buy and Hold Quality Stocks and ETFs

Buy both stocks and ETFs to help keep your portfolio diversified. Once you’ve found stocks and ETFs that fit your purchasing criteria, hold onto them.

You can try to time the market in terms of stock prices, but it’s usually wiser to hold long-term investments than to be constantly buying and selling. There might be downturns, but the market generally rises, and quality, long-term investments tend to beat the market. Holding will stop you from making emotional trading decisions.

The amount you pay in taxes for capital gains varies by income level. For most people, long-term investments are taxed at a lower rate than short-term investments, and short-term capital gains are taxed as a person’s ordinary income. As far as taxes are concerned, long-term investment counts as anything you hold longer than a year. But to earn as much wealth as possible, you will want to hold longer than that.

Some stock picking services recommend you hold for a minimum of five years. When possible, you should try to keep investments you’ve researched and believe in for even longer.

If you hold dividend-paying stocks and ETFs, you can set it to reinvest your earnings automatically. By reinvesting your earnings, you end up owning more of the stock than you originally bought. However, if you need some of your earnings sooner, you can get your dividends deposited into your account and use it as a passive income right away.

6. Contribute Money Consistently

Whether the market is up or down, you should continuously add money to your investment account and purchase more shares—whether fractional shares or whole ones.

The strategy of periodically investing more money, regardless of how the current market performs, is called dollar-cost averaging. Dollar-cost averaging aims to limit the impact of volatility on your overall portfolio. Plus, it can save you time and take some of the guesswork out of investing. You won’t have to stress about whether you’re timing the market well or not.

Many folks have automatic payments sent to their brokerage account each month or couple of weeks, either directly from paychecks or a checking account. Once the money lands in your account, you can buy more shares of your current holdings or add new investments to your portfolio.

An additional benefit from doing this comes from making investing part of your regular budget, rather than something you toss “extra” money into when you have it. The more capital you invest—and the sooner you invest it—the richer you can become.

Use Market Data to Guide Your Decisions

Market data refers to the price, bid/ask quotes, dividend per share (if applicable), market volume, and other market information. There is historical data as well as real-time data.

Whether you are more of a fundamental or analytical investor, this data is valuable. Data-driven decisions prevent impulsive and emotional purchases. You can find some of these data points within your stock trading platform or on stock and investment websites.

Additionally, commonly-available information to you in most online brokerage accounts will show you the current share price, the 52-week range, market capitalization, volume, and more.

Sell Stocks that Generate Losses, Let Your Profits Run On

One of the most successful investors in history, David Ricardo, used math to calculate differences between an investment’s market price and its intrinsic value. Doing so identified mispriced securities worth buying for his portfolio.

Through doing this, he developed simple golden rules he found well worth following:

- Cut short your losses

- Let your profits run on

He means to say here, by cutting short your losses, that you should sell a stock immediately should its price fall or show signs of wavering. Doing so limits your downside.

He also recommends letting your profits run on, meaning continuing to hold for long periods, so long as the investment continues to perform well.

Services like the Motley Fool take these investing rules to mind when recommending stocks. Specifically, the service’s co-founder, David Gardner, believes in “[letting] your winners run [high]” while avoiding the idea of “locking in gains.”

They only recommend the best companies to make you rich in the stock market with a minimum investment period of five years. David Ricardo would have approved of their service based on performance alone.

Get Help Picking the Right Stocks

The best stock picking services consider all of the variables discussed above when making their selections to subscribers. Have a look at Motley Fool’s Stock Advisor newsletter, subscribed to by millions of investors.

The subscription makes for a great short-listing system to find good stocks worth investigating yourself—and possibly even buying for your portfolio for the long-term. The service recommends buying and holding for no less than five years, departing with some of the other swing trade alerts services people use to find short-term profit potential in the stock market.

You can also get Stock Advisor, and other Motley Fool services, as part of Motley Fool’s Epic.

Motley Fool Stock Advisor (Best for Consistent Market Outperformance)

- Available: Sign up here

- Best Stock Picking Service For: Buy-and-hold growth investors

- Price: Discounted price for first year

Motley Fool’s signature product, Stock Advisor, aims to provide investors with one thing: top picks for market-beating stocks from the site’s co-founders. Over a decade ago, they advised subscribers to buy companies such as Netflix and Disney, which have been hugely successful.

As a subscriber, you’re granted access to Stock Advisor’s history of recommendations and can see for yourself how it has done over the years.

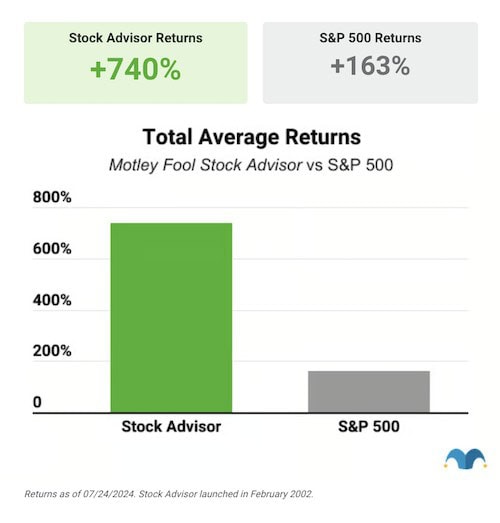

The Motley Fool Stock Advisor stock subscription service has returned 740% through July 24, 2024, since its inception in February 2002. This number is calculated by averaging the return of all stock recommendations it has made over the past 22 years. Comparatively, the S&P 500 Index has returned 163% over that same time frame.

What to Expect from Motley Fool’s Stock Advisor

The Motley Fool Stock Advisor service provides a lot of worthwhile resources to members:

- “Foundational Stocks”: 10 stocks that can serve as the foundation of your portfolio, whether you’re a new investor or experienced

- Two new stock picks each month

- Monthly analyst rankings of the service’s top 10 stocks based on their potential to beat the market over a five-year span

- A list of all the service’s active picks, “hold” recommendations, and closed positions

- Recommendations for stock and fixed-income exchange-traded funds (ETFs) you can use to build a diversified portfolio core

- Access to the GamePlan financial planning hub

- Access to Fool IQ, which provides essential financial data and news summaries about all U.S.-listed publicly traded stocks

- Access to a community of investors engaged in outperforming the market and talking shop

The service charges a discounted rate for the first year and has a 30-day membership-fee-back period. Consider signing up for Stock Advisor today.

Read more in our Motley Fool Stock Advisor review.

- Motley Fool Stock Advisor is a stock service that provides recommendations for both "steady Eddie" and high-flying stocks, as well as a few ETFs for investors who want diversified holdings, too.

- Just getting started? Stock Advisor provides 10 "Foundational Stocks" you can use to anchor your portfolio.

- You're not alone! Stock Advisor membership also gives you access to a community of investors who also want to outperform the market and love talking shop.

- Enjoy access to GamePlan: Motley Fool's financial planning hub, which includes advice on personal finances, taxes, retirement, and more, as well as calculators and other financial tools.

- Limited-Time Offer: Get your first year with Stock Advisor for $99 (vs. $199 usual value)—a 50% discount for new members!

- Discounted introductory price

- Strong outperformance compared to the S&P 500

- High overall average return for stock picks

- High renewal price

- Not every stock is a winner

Motley Fool Epic (Best Multi-Strategy Stock Picking Service)

- Available: Sign up here

- Price: $299/yr.*

Motley Fool Epic isn’t itself a stock-picking service—instead, it’s a bundled selection of four popular Motley Fool stock recommendation products, three of which you can only enjoy by becoming an Epic member:

- Stock Advisor: Buy-and-hold stock picks designed to deliver consistent performance with less volatility. Stock Advisor is the only one of these services you can subscribe to individually. (See our Stock Advisor review.)

- Rule Breakers: Stocks that have massive growth potential, whether they’re at the forefront of emerging industries or disrupting the status quo in long-established businesses. (See our Rule Breakers review.)

- Hidden Gems: Stocks of medium-to-large businesses, selected by Fool CEO and co-founder Tom Gardner for their “all-in, visionary leadership teams.” More so than the other services, Hidden Gems is mindful of macroeconomic and market environments—and how they might dictate how aggressively you should invest.

- Dividend Investor: This recommendation service revolves around producing equity income. Fool analysts target companies that deliver above-average yields and dividend growth, with the hope of producing both competitive total returns and an income stream that should carry you through retirement.

Epic members will get five new picks per month across the various services, can access all active recommendations, and also view Cautious, Moderate, and Aggressive strategies including specific stock allocations.

But Epic makes this list because it’s more than just a pile of recommendation services. Epic membership also unlocks access to a number of stock research and analysis tools, as well as other informational products, including:

- Fool IQ+: Fool IQ, which comes with Stock Advisor, provides essential financial data and news summaries about all U.S.-listed publicly traded stocks. With Epic, you get Fool IQ+, which includes all the features in Fool IQ, as well as a much wider variety of financial analysis data (earnings coverage, insider trading data, analyst opinions, and more) and advanced charting options.

- GamePlan+: GamePlan is a hub for retirement and financial planning. It includes exchange-traded fund (ETF) rankings; portfolio strategies (including stock, ETF, and mutual fund picks) with allocation recommendations; content about a variety of financial topics such as taxes, estate planning, and everyday finances; and a variety of tools, such as credit card interest and mortgage calculators. GamePlan is available when you sign up with Stock Advisor. However, GamePlan+, which you get through Epic, delivers a wider array of articles and tools, as well as more in-depth coverage.

- Epic Opportunities: A members-only podcast from Motley Fool.

You can learn more by reading our Epic review, or sign up today at Motley Fool.

Related:

![4 Best Ways to Save Money for Kids [Children's Savings Plans] 23 Best Ways to Save Money for Kids](https://wealthup.com/wp-content/uploads/Best-Ways-Save-Money-for-Kids-600x403.webp)

![Best Credit Cards for Kids [Build Credit & Money Habits Early] 24 credit cards for kids](https://wealthup.com/wp-content/uploads/credit-cards-for-kids.webp)