You’re trying to map out your financial future, and you realize there are certain parts that are just too complicated to tackle on your own. You know you need help, and you know where to look. But just as you’re about to reach out to a professional, a nagging doubt bubbles up:

“Do I have enough money to work with a financial advisor?”

That scenario is a lot more common than you’d realize. A 2022 survey conducted by The Harris Poll, on behalf of Intelliflo, showed that there’s a high number of Americans (59% overall, 71% of Gen Z and 72% of Millennials) who want financial advice but don’t know where to get it … but just less than a third of Americans actually use a registered financial advisor.

Why the disparity? Well, the top reason given in the same study is “the belief that they don’t think they have enough money to hire one.”

So, how much money should you have before hiring a financial advisor? The good news is, the minimum dollar amount of financial assets you need to work with a professional is likely much lower than you realize. The less-good-but-not-bad news is, there’s no set threshold for all advisors—the amount you’ll need will vary from one pro to the next.

Read on as we help you determine how much you’ll need to save up before bringing on a financial advisor, understand which assets you should use in that calculation, how you actually pay financial advisors, and more.

What Services Do Financial Advisors Provide?

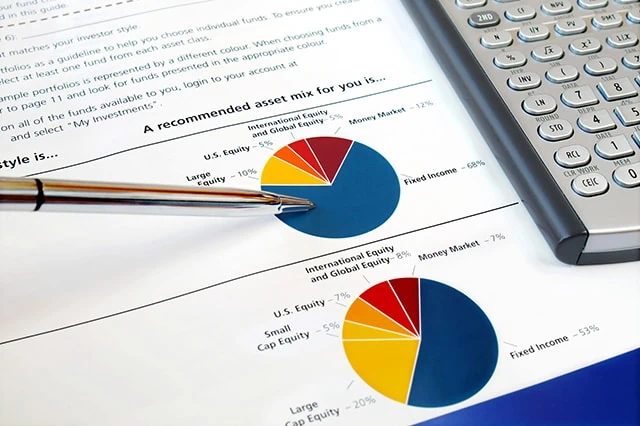

The 2023 Herbers & Company Service Market Growth Study found the most demanded services from financial advisors among people with over $250,000 in household assets were as follows:

— Tax planning (90%)

— Retirement planning (74%)

— Investment planning (55%)

— Cash flow planning (41%)

— Insurance planning (30%)

— Estate planning (28%)

Some of the lesser-demanded services included education planning, tax preparation, employee benefits, business planning, and health care planning.

Financial advisors who provide a more complete suite of these and other services might require you to have a much larger amount of assets than financial advisors who only offer one or a limited set of these solutions. So, for instance, an advisor who only provides investment management might have a lower asset minimum than an advisor who helps you manage your investments, budget your retirement savings, plan out your taxes, and maps out how your estate will be divided after you pass.

Customization will be another factor. A financial advisor that works with an individual to develop a fully personalized financial plan, with your specific needs and financial goals in mind, might require a larger amount of assets to start than a financial investor who matches a client with one of several “off the shelf” plans that best fits their situation.

Certification and credentials could influence assets and cost, too. For instance, a Certified Financial Planner™, who is rigorously trained and certified in a wide variety of financial disciplines, might require more assets, and charge higher fees, than an uncredentialed financial coach.

Related: Is Your Retirement on Track? Here Are the Average 401(k) Balances By Age

How Does Someone Know If They’re Eligible? Savings? Salary?

Think your relatively low salary disqualifies you from consideration? Think again.

Person A earns $250,000 per year. However, they’re a big spender in the first place, plus a big chunk of their paycheck goes toward paying off old debt. That person owns a home, but they only have $10,000 in their bank account and own no other financial assets.

Person B earns just $75,000 per year. However, they’re much more frugal. They’re debt-free. They don’t own a home. But in addition to also having $10,000 in their bank account, they also have managed to accumulate a tidy investment portfolio of stocks and bonds worth $50,000.

Most financial advisors will be more interested in working with Person B. That’s because wealth managers care about the total value of your liquid financial assets—that is, assets that are either cash, or can be easily and quickly converted to cash (such as stocks and bonds). While your salary affects your ability to accumulate those assets, it’s not as big of a factor as actually accumulating those assets.

Financial planners can help your money grow. But you need to have enough of a financial seed to get started.

Related: 7 High-Quality, High-Yield Dividend Stocks

What Is the Minimum Asset Threshold?

The minimum asset threshold is a dollar amount of liquid assets that a financial advisor requires you to have to qualify for their services.

As a general rule, the higher the value of your liquid assets, the more financial advisors who will be willing to work with you. But the bottom-line number can vary substantially. Depending on the advisor, what services you require, and the level of customization involved, the minimum asset threshold could be anywhere from $25,000 to $1 million in liquid assets—even more in select circumstances.

Realistically, if you have, say, less than $50,000 in assets, you’ll have to do some legwork to find a human financial advisor willing to provide their services. But that doesn’t mean every door will close to you. Some advisors might invite you to free sessions where they provide general financial advice to help people build their wealth (so they can eventually reach said advisor’s threshold). You likely could also employ a robo-advisor, which is an automated advisory service that takes data from you, such as your earnings, assets, and financial goals, and puts together a basic investment portfolio.

In other words: If you don’t meet most advisors’ minimum asset thresholds yet, don’t sweat it. Keep saving, investing, and improving your financial literacy, and you’ll get there.

If you have more than $50,000, and especially if you have $100,000 or more, chances are you have enough liquid assets to attract a trustworthy advisor.

Related: 7 Best High-Dividend ETFs for Income-Minded Investors

How Much Do Financial Planners Cost?

People who don’t use a financial advisor often overestimate how much they cost—and they might not even realize how they get paid.

Many professionals are considered “fee-only advisors,” meaning that clients pay them fees via one of several different structures. The most common?

— Percentage of assets under management (AUM): The advisor takes a % of every dollar they manage every year. For instance, if you have $100,000 in assets, the advisor will take $1,000 annually as a fee.

— Hourly: The advisor charges you based on the number of hours worked based on a set hourly rate.

— Flat, recurring retainer: The advisor charges you a regular fee (usually monthly, quarterly, or annually) regardless of hours worked.

— One-time financial planning fee: A one-time, up-front fee typically only charged by financial planners who draw up a plan but do not help you implement that plan.

Different fee structures benefit different types of clients. For instance, percentage of AUM is great for low-dollar clients because fees are taken directly out of assets, rather than paid out of pocket, while hourly rates make sense for people who only want to pay for work performed.

And many people believe financial advisors charge more than they do. Around half of all respondents to a 2021 MagnifyMoney survey believed financial advisors collected between 5% to 15% (or more) of assets. In reality, 1% is normal for a financial advisor, though you can expect exact fees to vary from one advisor to the next.’

Lastly, note that there are also commission-based advisors. Commission-based advisors likely will be free to you, but they’re still getting paid. Specifically, they earn money based on the sales and product referrals they make. The problem? The investment advice you receive might be skewed toward the products that earn the financial advisor the most money. It’s not a guarantee, but it’s a much larger risk with a commission-based advisor than a fee-only advisor.

Related: 10 Best Dividend Stocks to Buy [Steady Eddies]

When Is a Good Time to Talk to a Financial Advisor?

Assuming you have enough money to get started and are open to help with your finances, the sooner you have a consultation with a financial advisor, the better. A good wealth manager can quickly get you on the right path to making your money grow as much as possible.

Another consideration is whether you’re currently going through a significant life event or are likely to soon. Major life events are an excellent time to consult with an advisor.

A few life changes that could warrant advice include:

— Receiving a large inheritance

— Marriage

— Divorce

— Expanding one’s family

— Starting your own business

— Approaching retirement

Of course, it’s preferable to talk to a financial advisor before these events, rather than during, so you’re better prepared to financially handle them.

Related: Do I Need a Financial Advisor? 7 Questions to Ask Yourself

Related: 11 Ways To Avoid Paying Taxes on Your Social Security

If you’re looking to minimize the tax bite taken out of your Social Security benefits in retirement, you’ve got several available actions to reduce how much you pay each year. We outline several ways to avoid paying taxes on your Social Security benefits.

Related: How Are Social Security Benefits Taxed?

In many cases, Social Security benefits are subject to federal taxation. To learn how your Social Security benefits are taxed, we’ve got an entire guide to walk you through the calculation.

Related: 10 States That Tax Social Security Benefits

While most states don’t subject Social Security benefits to taxation, at least 10 states do tax Social Security. To see if you live in one of them, or you’re considering a relocation for retirement and taxation of your Social Security is a sticking point, we’ve got you covered with all of the details.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!