U.S. income investors have it pretty good. The vast majority of our dividend stocks pay regular, reliable payouts—and they do so at a more frequent clip (quarterly) than dividend stocks in most other countries (typically every six months or year).

Still, if you’ve ever thought to yourself, “it’d sure be nice to collect these dividends more often,” you don’t have to look far. While they’re not terribly common, American exchanges boast dozens of monthly dividend stocks.

Today, I’m going to talk about the virtues of monthly payers. Then after that, I’ll introduce you to some of the best monthly dividend stocks you can find today.

Disclaimer: This article does not constitute individualized investment advice. These securities appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Editor’s Note: Tabular data presented in this article are up-to-date as of Nov. 21, 2024.

Featured Financial Products

Table of Contents

The Importance of Dividends

A dividend is a cash payment that a company makes to its shareholders. It’s an excellent additional source of investment return that complements price gains—and it means different things for different investors.

Dividend stocks (which commonly are value stocks, but can be growth stocks) are great ways to drive long-term performance of your portfolio. These companies pay a regular flow of their profits directly back to shareholders, meaning you receive some sort of return regardless of the ebb and flow of share prices.

Stocks that can both grow and pay dividends are the ultimate long-term stocks given just how much in additional returns they can generate over the long term.

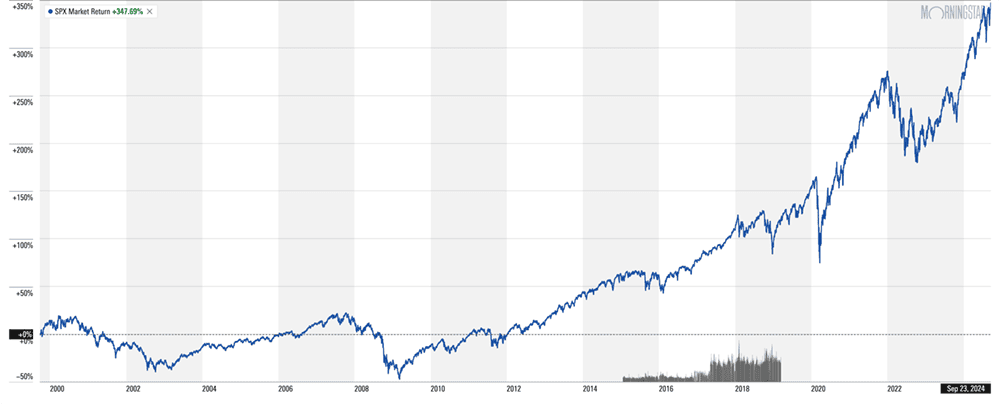

The above image is a look at the return someone could expect if they received just the price returns from an S&P 500 over the past 25 years.

But What If I Reinvested My Dividends?

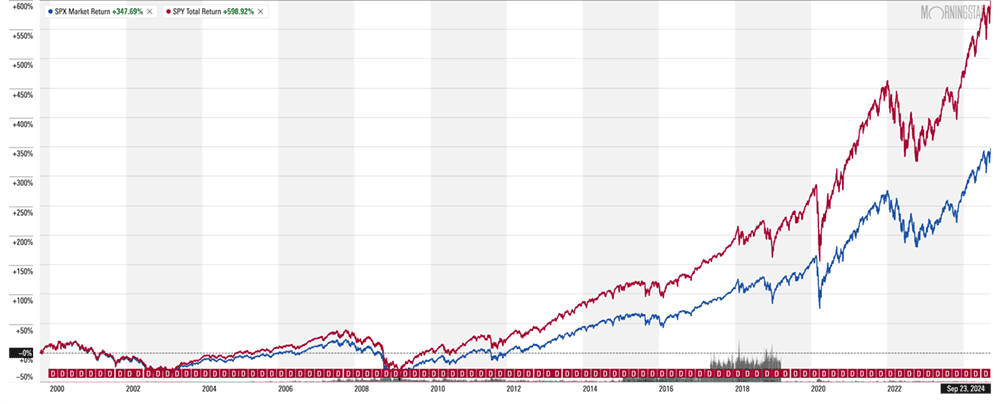

Now look at the above chart to see how much better the return is when you factor in dividends had you had reinvested those dividends back into the S&P 500 (returns illustrated by an S&P 500-tracking ETF; note that expenses are included in performance).

The price return is about 350%. The total return (price plus dividends) is almost 600%!

But dividends can mean something else entirely when you’ve reached retirement. Specifically, they can become a source of passive income.

When you retire, you no longer receive a regular paycheck from an employer. Instead, you have to rely on Social Security checks and whatever you’ve saved up for retirement. Investors typically withdraw money from their nest egg to pay the bills in retirement, but a steady stream of stock-dividend and bond-interest income can reduce how much of your investment accounts you have to draw down—keeping your nest egg better intact for longer.

Why Monthly Dividends?

Monthly dividends, from a pure payout-schedule perspective, benefit every kind of investor in some way, but they clearly have a certain appeal to retirees.

Think about what I said before: U.S.-based stocks are the most frequent dividend payers, and even then, they’re only paying dividends every quarter. Also, they’re not paying during the same quarters—different stocks have different schedules, with some paying in Jan/Apr/Jul/Oct, some in Feb/May/Aug/Nov, and some in Mar/Jun/Sep/Dec. Well, depending on how much you have invested in stocks with different schedules, you could be receiving your checks in uneven clumps, which makes them difficult to budget around.

Monthly dividend stocks? If all goes well, you’re getting the same exact payout every month (with the occasional annual payout hike, to boot). That’s outstanding news to retirees. After all, they’re not working anymore—but they still have bills to pay, and bills still come monthly.

There’s also a tangible (albeit slight) benefit to investors of any age: quicker compounding.

When a company pays a dividend, you can choose to have it go straight to your account for use as you’d like … or you can immediately reinvest those dividends, which many people do when they’re not already retired.

Let’s say you buy $10,000 worth of shares in a stock with a 5% yield and hold it for 30 years. It never gains a dime, but you collect the same level of dividends the entire time.

— If that stock paid you quarterly, you’d end up with a balance of $44,402.13.

— If that stock paid you monthly, you’d end up with a balance of $44.677.44.

It’s not world-changing, but it’s a nice sweetener. If nothing else, it’s a case for including a few of these income investments as part of a diversified portfolio.

Which Stocks Pay Monthly?

One last thing to know before I introduce my list of monthly dividend payers: They’re largely not what you’d consider “normal” stocks.

A “normal” stock is, say, an Apple (AAPL) or a General Electric (GE)—virtually always a plain-vanilla C corporation with no unusual rules or designations.

But for whatever reason, most monthly dividend stocks tend to involve companies with specialized structures, such as real estate investment trusts (REITs), master limited partnerships (MLPs), business development companies (BDCs), and royalty trusts. These businesses all have one thing in common: They’re mandated to pay out large percentages of their taxable income or cash flow back to shareholders—which come in the form of dividends (or dividend-esque “distributions”).

In general, all these special classes tend to deliver much higher yields than your average stock. That’s great for income hunters, but remember: Higher yields can often involve higher risk, or at least a bigger emphasis on income at the cost of lower price returns.

So today, I’m going to point you in the direction of monthly dividend-paying stocks that largely garner positive opinions from the Wall Street analyst set. Take a look and see which ones you’ll want to target for a closer look of your own.

Related: 13 Best Mutual Funds to Buy

1. Realty Income

— Market capitalization: $50.0 billion

— Dividend yield: 5.6%

— Industry: Commercial real estate

Any roundup of the best monthly dividend stocks should start with (or at least include) Realty Income (O), which literally bills itself as the “Monthly Dividend Company.”

No, really. They even registered the nickname.

Related: 10 Best Dividend Stocks to Buy [Steady Eddies]

Realty Income is a real estate investment trust focused on single-tenant commercial properties. It owns more than 15,450 properties that are under long-term net-lease agreements. The “net lease” detail is important—it means that the leases are “net” of insurance, maintenance, and taxes. Tenants including 7-Eleven, LA Fitness, CVS Health (CVS), and Walmart (WMT) are responsible for all three of those things, while Realty Income simply collects a check. This results in much stabler, more predictable income—what you want when you’re relying on a stock for income.

Realty Income also became a lot bigger in January 2024, when it closed on its $9.3 billion all-stock deal to acquire Spirit Realty Capital (SRC). Spirit Realty is another net-lease REIT whose properties are complementary to the Realty Income portfolio.

Related: The 7 Best Dividend ETFs [Get Income + Diversify]

“O has been very active, acquiring both investment- and non-investment-grade assets,” say Stifel analysts, who rate the stock at Buy. “The company has one of the sector’s strongest balance sheets, in our view, the lowest costs of capital, and pays a consistent and growing monthly dividend.”

Another reason Realty Income is a king among monthly dividend stocks? The dividends, of course. Realty Income doesn’t just offer a high yield of more than 5%—it has paid 652 consecutive monthly dividends and increased the payout for 109 consecutive quarters.

2. Agree Realty

— Market capitalization: $8.0 billion

— Dividend yield: 3.9%

— Industry: Commercial real estate

Agree Realty (ADC) is another net-lease REIT, though in this case, it’s focused even more on retail than Realty Income. Agree’s portfolio includes 2,135 properties in 49 states, leased out to the likes of Walmart, Tractor Supply (TSCO), Dollar General (DG), and Best Buy (BBY).

Related: 7 Best Fidelity ETFs for 2024 [Invest Tactically]

Retail real estate has been a minefield over the past decade, given the pain that e-commerce has caused traditional brick-and-mortar retailers. But not all retailers are built equally—many discretionary retailers operating malls might have been pelted, but many staples-goods retailers (think Walmart, warehouse clubs, grocers, and gas stations) are doing just fine and paying steadily climbing rents. And those are the types of tenants Agree has built its business around.

“We view ADC as a growth company that also provides defense, which we like in a difficult macroeconomic backdrop,” says Baird analyst Wesley Golladay, who is one of 13 Wall Street pros who have a Buy-equivalent rating on ADC shares right now. They make up the majority, too—the only other ratings on Agree Realty currently are a trio of Holds.

Related: 7 Best High-Dividend ETFs for Income-Minded Investors

Agree Realty’s dividend program isn’t new, but its payment on a monthly basis is—ADC started the practice in 2021. That said, ADC has been improving the dividend on a semiannual basis since 2016.

Related: 9 Best Real Estate Crowdfunding Sites + Platforms

Featured Financial Products

3. Whitestone REIT

— Market capitalization: $737.4 million

— Dividend yield: 3.4%

— Industry: Commercial real estate

Whitestone REIT (WSR) is a commercial real estate firm that primarily owns retail-focused properties in the Sun Belt.

Like with ADC, any attraction to Whitestone’s real estate portfolio is that, while retail in nature, it’s a less beleaguered type of retail. WSR owns open-air retail centers that are largely convenience-focused—a mix of grocers, restaurants, health, fitness, financial, entertainment, and even education providers.

Whitestone’s geographical placement is working in its favor, too, with growth across the southern U.S. allowing WSR to raise rents with little issue, especially in certain core cities. “Phoenix market rent was up ~13% in 2023 and ~7% for Austin,” Truist analyst Anthony Hau (Buy) said following the fourth-quarter earnings report. “We believe the fundamentals of these two markets will continue to bolster lease spreads as WSR marks the portfolio up.”

Another promising sign for current and would-be WSR shareholders alike? After years of keeping its monthly dividend level at 4¢ per share, Whitestone just announced a 3% increase to the payout, to 4.125¢. While modest, it’s a big step in the right direction and might speak volumes about management’s optimism for the business.

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

4. Gladstone Land

— Market capitalization: $429.4 million

— Dividend yield: 4.7%

— Industry: Farmland real estate

Gladstone Land (LAND) is a fairly unique REIT that operates in farmland under a “sale leaseback” model—in other words, Gladstone Land acquires farms and leases them back.

Related: REITs vs Private Placements: An Investment Guide

In some cases, farmers will sell their land for capital to upgrade their farming operations, and Gladstone Land will lease the land back to them; in other cases, farmers come to Gladstone Land looking only to lease certain farmland; and in other cases, people will sell to Gladstone any farmland they’re simply not using.

Gladstone is currently navigating its way through a difficult stretch; in its last quarterly report, GLAD noted that 15 of the farms in its portfolio were vacant, and five were on non-accrual (typically, this means a tenant hasn’t paid for 90 days or more).

“We are forecasting no portfolio growth in 2023 and 2024 as management is more selective due to current market conditions,” say Oppenheimer analysts. But they nonetheless rate GLAD at Outperform (Buy) because they “believe continued portfolio growth and diversification should continue to support lease revenue growth and drive [adjusted funds from operations, an important metric of REIT operational success].”

Related: The Best REITs to Invest In for 2025

Indeed, despite the company’s troubles, the pros still view LAND as one of the better monthly dividend stocks out there, with four calling the stock a Buy, and two staying pat at Hold. That’s in part because of a stellar decade’s worth of dividend history—Gladstone Land has paid 139 straight monthly cash dividends since its initial public offering (IPO) in January 2013, and it has raised its distributions 33 times in the past 36 quarters.

One last interesting note: LAND is just one of several specialty businesses under the Gladstone banner. The others include Gladstone Capital (GLAD), a BDC focused on financing solutions for lower middle market companies; Gladstone Investment (GAIN), a BDC focused on acquiring lower middle market companies; and Gladstone Commercial (GOOD), an industrial-and-office REIT.

Related: 5 Best Vanguard Retirement Funds [Start Saving in 2025]

5. Apple Hospitality REIT

— Market capitalization: $3.8 billion

— Dividend yield: 6.3%

— Industry: Hotel real estate

The COVID-19 pandemic was hard on a lot of industries, but few lines of business were beaten up worse than hotels and hotel REITs. Those hard times were followed by a boom once the end of travel bans released all that pent-up demand. And now we’re sitting in a period of normalization where performance isn’t being driven solely by trends—but by who the best operators are.

Related: The 7 Best Growth Stocks to Buy for 2025

Apple Hospitality REIT (APLE) is one such candidate. This hotel REIT focuses on upscale, rooms-focused hotels, with a portfolio of 225 hotels across 88 markets in 38 states. (In the simplest terms, rooms-focused means more like a traditional hotel and less like a resort.) The portfolio is largely centered around 120 Hilton (HLT) brand hotels and 100 Marriott (MAR) brand hotels, though it also has five hotels under the Hyatt (H) brand.

Apple Hospitality has deeply experienced management, with an average executive tenure of 16 years. The REIT has homed in on Hilton, Marriott, and Hyatt because of their strong loyalty programs, reservation systems, and consumer appeal. And in general, APLE prioritizes a conservative capital structure over aggressive financing, which might cap growth in boom cycles but ensures more stability across all types of economic environments.

Related: 7 Best Fidelity ETFs for 2025 [Invest Tactically]

“[Apple Hospitality] deserves a premium multiple, in our view, given its strong balance sheet and recent acquisitions,” says Oppenheimer’s management team, which rates the stock a Buy. “The portfolio mix also provides downside protection in the event of a lodging downturn.”

It’s worth noting that, like most other hotel REITs, Apple Hospitality’s dividend was rocked by COVID, with the company suspending its 10-cent monthly dividend in 2020. But the payout is recovering. APLE restarted with a nominal penny-per-share quarterly payout across 2021. It returned to monthly payments in 2022, starting with 5 cents, then increasing it to 7 cents, then raising it once more to 8 cents, where it sits today. APLE also paid a 5-cent special dividend at the end of 2023.

Young and the Invested Tip: If you ever do decide to buy shares of Apple Hospitality, be very careful with your data entry. It’s very easy to type in “Apple” instead of “APLE” and get the wrong stock. It’s a more common mistake than you’d like to think.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

6. Ellington Financial

— Market capitalization: $1.1 billion

— Dividend yield: 12.7%

— REIT industry: Mortgage

Ellington Financial (EFC) is a mortgage real estate investment trust (mortgage REIT or mREIT, for short). It invests in residential and commercial mortgage loans, residential and commercial mortgage-backed securities (MBSes), consumer loans, asset-backed securities backed by consumer loans, and a number of other mortgage- and loan-related investments.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

Whereas your typical equity REIT owns and possibly operates physical real estate, an mREIT deals in “paper” real estate like the instruments I just mentioned. An mREIT will take out debt to purchase mortgages and related products, and their profit is the spread between what they’re paying on debt and what they’re earning in interest income from their mortgages—known as net interest margin.

It’s a difficult business—one that can be rocked by any number of things, including high and/or rising interest rates. So success for an mREIT usually boils down to the quality of its management team.

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

“We continue to view EFC as a top-tier mREIT that is well-positioned to take advantage of the next cycle via multiple drivers coupled with a hedging strategy that protects book value,” says B. Riley analyst Matt Howlett (Buy). “We expect management’s time-tested investment capabilities to remain a key driver of earnings through the investment horizon.”

Of note: Ellington Financial recently completed a merger with another mREIT, Arlington Asset Investment Corp., though it’s still called Ellington Financial and it still trades as EFC. Importantly, the merger hasn’t impacted the monthly dividend—EFC recently reaffirmed the monthly payout at 15 cents per share. That level has been stagnant for the past few years, but it still translates to the largest yield among the best monthly dividend stocks covered here today.

Like Young and the Invested’s content? Be sure to follow us.

7. Global Water Resources

— Market capitalization: $313.7 million

— Dividend yield: 2.3%

— Industry: Water utility

Global Water Resources (GWRS) is one of the rare “regular stocks” to pay monthly dividends. It bills itself as a “water resource management company,” better known to investors as a water utility. It provides water, wastewater, and recycled water services to areas around metropolitan Phoenix and Tucson, Arizona.

Related: 5 Best Vanguard Retirement Funds [Start Saving in 2025]

Regulated utility companies are often considered a tradeoff—they act as de facto monopolies given that they typically lack any real competition, so they tend to boast stable revenues and profits. However, given that they’re regulated, they’re usually allowed to raise rates only so much, only so often, which guarantees a low level of growth, but not much more than that.

In Global Water’s case, revenues have improved pretty consistently every year, by about 8% annually over the past half-decade, while net income has climbed ahead by about 21% annually. Interestingly, GWRS—which started to pay dividends monthly as soon as it initiated its program in 2016—has raised its payout at least once annually since then, at a clip of more than 3%. That’s not exactly explosive, but you’re rarely looking for explosiveness out of a utility … you’re looking for stability.

Related: Best Fidelity Retirement Funds for a 401(k) Plan

8. Main Street Capital

— Market capitalization: $4.6 billion

— Dividend yield: 7.8%

— Industry: Business development company

Business development companies are a fairly niche industry that shares several fundamental traits with real estate investment trusts. REITs and BDCs were both created by Congress to spur more public investment, and in exchange for favorable tax treatment, they’re both required to pay out at least 90% of their taxable income to shareholders as dividends.

REITs came about in 1960, when Congress created the business structure as a way of allowing more people to enjoy in the gains of real estate investing. BDCs were brought to life two decades later to enhance investment in American small businesses. Why? Well, many small businesses have a hard time accessing capital—in many cases, larger banks simply don’t want to take on the risk of lending to relatively new and/or unestablished companies, and when they do, they can charge usurious rates.

That’s where BDCs like Main Street Capital (MAIN) come in. Main Street Capital offers both private debt and private equity capital to lower middle market (LMM) companies, and private debt to middle market companies. The former typically involves investments of between $5 million to $75 million in companies with $10 million to $150 million in revenue and $3 million to $20 million in EBITDA (earnings before interest, taxes, depreciation, and amortization). The latter is a little more open-ended, but typically involves larger investments in larger companies than the LMM strategy.

I’ll be clear: The current macroeconomic environment doesn’t favor BDCs in general. A drop in short-term rates doesn’t favor these companies, and the potential for a slowing economy could be especially painful for the small businesses they invest in. And Main Street Capital, at current prices, is too rich for that outlook, trading at 1.55 times its net asset value (NAV). That’s one of the most inflated prices in the BDC space.

However, Main Street Capital is worth watching for an opportunity to buy at better valuations. It’s one of the industry’s best stewards, and it has an extremely conservative dividend program that offers both safety and high yield. That is, MAIN has a regular monthly dividend that yields more than 6% at current prices and has been growing for the past few years. But rather than stretching for an even higher regular payout, Main Street also issues special dividends as profits allow.

Related: The 7 Best Closed-End Funds (CEFs)

Featured Financial Products

9. Gladstone Investment

— Market capitalization: $495.4 million

— Dividend yield: 7.1%

— Industry: Hotel real estate

Why yes—at least one other Gladstone business is an interesting monthly dividend payer.

Gladstone Investment (GAIN) is another BDC, this one focused on mature, lower middle market U.S. companies (EBITDA of roughly $4 million to $15 million).

It typically wants to invest in businesses that have leading market positions, positive cash flow generation, and strong management teams. GLAD keeps a tight portfolio (currently 26 companies), but it’s a pretty diversified group that’s spread across 19 states, coast-to-coast, and includes 15 industries.

Related: IRA Contribution Limits for 2024 + 2025 [Save More Money]

While the majority of its investments are debt—56% of the portfolio is secured first-lien debt, while another 11% is secured second-lien debt—a meaningful chunk, currently about a third of the portfolio, is preferred and common equity. And that equity component is a noteworthy one.

“GAIN’s equity participation in most of its portfolio companies allows it to participate in the upside if a company performs above expectations,” say Oppenheimer analysts, who rate the stock at Outperform and says this quality has contributed to Gladstone Investment’s relatively high return on equity.

Like many BDCs, Gladstone Investment delivers a high dividend yield. The headline yield based on its monthly payment is around 7.1%, but the company also loves to deliver special dividends as profits allow … and those extra payouts can be massive. The past 12 months’ worth of specials comes out to an additional 8.4% in yield, translating to a combined 15.8% yield. (Just remember: Special dividends like GAIN’s can come and go; for instance, GAIN hasn’t yet paid a special dividend in 2024. Specials are nice, but you should typically only plan around regular dividends.)

Related: Best Target Date Funds: Vanguard vs. Schwab vs. Fidelity

What is Dividend Yield?

Dividend yield is a simple financial ratio that tells you the percentage of a company’s share price that is paid out across a year’s worth of dividend distributions. Expressed as a mathematical equation, it’s simply:

Dividend yield = annual dividend / price x 100

Yield helps dividend investors normalize dividend payments regardless of stock price, different quarterly payments, even different payment frequencies (like monthly or annually). For instance, each of the following fictional stocks all have a dividend yield of 2.5%:

— Alpha Corp. currently trades for $40 a share. It pays a 25-cent quarterly dividend, for $1.00 per year in full. ($1 / $40 x 100 = 2.5%)

— Beta Inc. pays $1 in the first quarter, $2 in Q2, $3 in Q3 and $4 in Q4. That’s $10 in dividends for the full year. It trades for $400 a share. ($10 / $400 x 100 = 2.5%)

— Gamma Ltd. pays $2.50 just once per year. It trades for $100 a share. ($2.50 / $100 x 100 = 2.5%)

The idea is to focus on the percent of your initial investment you get back, and help you compare apples to apples.

Taking this math a step further, you learn that a company can suddenly feature a very high dividend yield through one of two very different ways: the share price falling very quickly, or the dividend growing very rapidly.

Alpha Corp., which trades for $40 per share, pays a 25-cent quarterly dividend that yields 2.5%. In a month, it yields 5.0%. Here are two ways that could have happened.

— Alpha Corp. doubled its dividend to 50 cents per share, for a full $2 per share across the year. The share price stays the same. ($2 / $40 x 100 = 5.0%)

— Alpha Corp. kept its dividend the same, but its share price plunged in half to $20 per share. ($1 / $20 x 100 = 5.0%)

Clearly, that 5% yield appears to be much safer and reliable in one scenario than the other.

Like Young and the Invested’s content? Be sure to follow us.

What is a Payout Ratio?

As with dividend yield, it’s important to normalize the dividend payout ratio for a stock. This is simply the percentage of a company’s earnings per share that is being distributed via dividends. It’s calculated as:

Payout ratio = dividends per share / earnings per share x 100

As an example, a stock that makes $100 million in profits and has 10 million shares of public stock has $10 in earnings per share. And if that company pays $5 annually in dividends, it has a payout ratio of 50% ($5 / $10 x 100 = 50%).

There’s a lot of “gray” when it comes to payout ratios. In general, though, the lower the payout ratio, the more sustainable the dividend, and the more room for future hikes.

Note: Payout ratio is calculated using different metrics depending on the type of business you’re looking at. For typical companies, you look at earnings. But, for example, when working with REITs, you typically calculate payout ratio using funds from operations (FFO), which is an important measure of REIT profitability.

What is ‘Yield on Cost’?

When you look up a stock’s information, the dividend yield listed is based on the most recent dividend and the current stock price.

That yield is often actually different than the one current shareholders enjoy. That yield is called “yield on cost,” which is the payout based on what you paid, at the moment you invested.

Let’s say you buy a stock at $100, and it pays $1 per share. It yields 1.0% when you buy it ($1 / $100 x 100 = 1.0%).

In a year, that stock has doubled to $200 per share, and it also doubled its dividend to $2 per share. If you look up its information, its dividend is still 1.0% ($2 / $200 x 100 = 1.0%).

That’s not your yield on cost, however. You’re still receiving that higher dividend of $2 per share. But your cost basis is still the original $100 you bought the share at. So now, your yield on cost has doubled, to 2.0% ($2 / $100 * 100 = 2.0%)!

Related: 12 Best Investment Opportunities for Accredited Investors

Featured Financial Products

Related: 6 Best Stock Recommendation Services [Stock Picking + Tips]

Stock recommendation services are popular shortcuts that help millions of investors make educated decisions without having to spend hours of time doing research. But just like, say, a driving shortcut, the quality of stock recommendations can vary widely—and who you’re willing to listen to largely boils down to track record and trust.

The natural question, then, is “Which services are worth a shot?” We explore some of the best (and best-known) stock recommendation services.

Related: 12 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if your’e looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Related: Best Target-Date Funds: Vanguard vs. Schwab vs. Fidelity

Looking to simplify your retirement investing? Target-date funds are a great way to pick one fund that aligns with when you plan to retire and then contribute to it for life. These are some of the best funds to own for retirement if you don’t want to make any investment decisions on a regular basis.

We provide an overview of how these funds work, who they’re best for, and then compare the offerings of three leading fund providers: Vanguard, Schwab, and Fidelity.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to The Weekend Tea, our weekly newsletter to read more about investing, spending, taxes, and more, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!