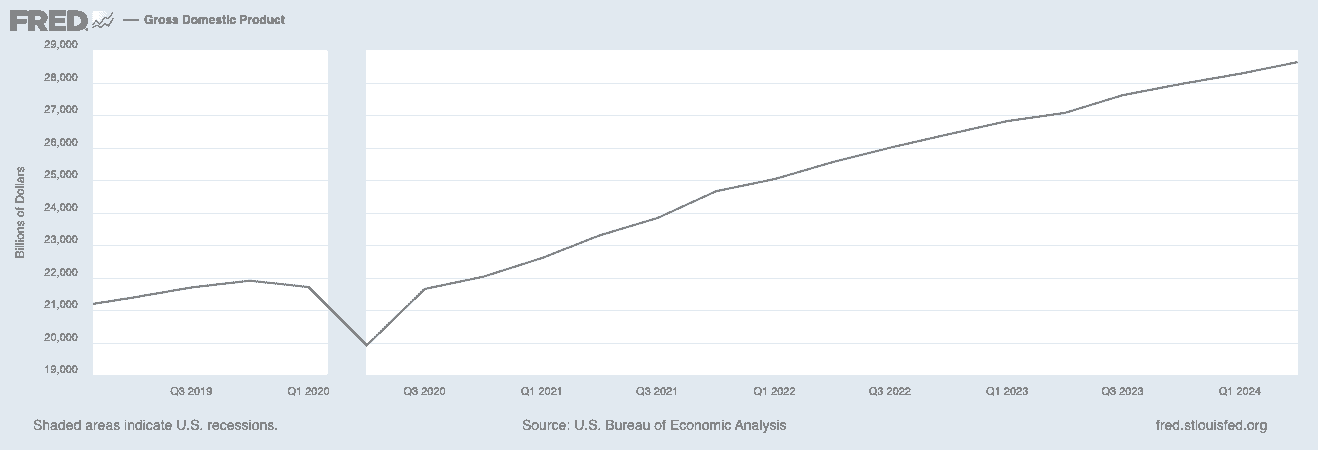

America’s economic growth roared ahead more quickly than anticipated in the second quarter of 2024, as Commerce Department data out Thursday showed that U.S. gross domestic product (GDP) accelerated past Q1’s rate and eclipsed economists’ expectations.

The Commerce Department’s Bureau of Economic Analysis (BEA) said that GDP, factoring in both seasonality and inflation, expanded at a seasonally adjusted 2.8% annualized pace across the second three months of 2024. That came in ahead of Bloomberg-surveyed economists’ expectations of 1.9%, and was much faster than the first quarter’s 1.4% rate.

The “core” Personal Consumption Expenditures (PCE) index, which backs out food and energy, also improved at a robust clip (2.9%) that, while slower than Q1’s 3.7% gain, topped expectations for 2.7% growth.

The Best Dividend Stocks: 10 Pro-Grade Income Picks

Leading the charge in consumer spending growth were motor vehicles and parts, recreational goods and vehicles, and furnishings and durable household equipment, among other goods; as well as health care, housing and utilities, and recreation services, among other services.

“The acceleration in growth was backed by remarkably broad-based contributions from sub-components, but was driven mostly by healthy consumer spending, investments in equipment and a build-up in inventories,” says Mike Reynolds, Vice President of Investment Strategy at Glenmede.

Specifically, investments in equipment raced ahead by 11.6% in Q2 2024, which was its fastest rate of expansion since the first quarter of 2022.

“The story all along has been corporate investment. The consumer is healthy, but investment grew almost double digits over the last quarter,” says Scott Helfstein, Head of Investment Strategy at Global X ETFs. “Companies are investing in automation and digitalization. That will drive margins higher and valuations will continue to follow.”

One noteworthy black mark on the GDP report was imports, which jumped 6.9% while a strong dollar and weak international economies only buoyed exports by 2%.

The 10 Best Fidelity Funds You Can Own

“Even though higher tariffs are getting a lot of chatter as a potential ramification of the 2024 election, they may be having an impact ahead of time,” Reynolds says. “Anecdotally, there have been reports of Chinese exporters accelerating their delivery schedules to get ahead of tariffs announced in May, as well as more aggressive levies proposed on the campaign trail. Higher imports are a headwind to growth figures since they’re a subtraction in the GDP calculations. Investors would do well to see through such distortions in the data.”

Nonetheless, Thursday’s report continued to raise hopes that the Federal Reserve is indeed pulling off a so-called soft landing. While it has no exact definition, a soft landing is generally considered to be a successful dampening of inflation without sending the economy into recession.

“While this number can be subject to revisions, it does lend support to the soft-landing narrative, which is our base case,” says Matt Peron, Global Head of Solutions at Janus Henderson Investors. “Today’s report should provide some relief to stressed markets by showing that the second quarter was generally solid.”

It’s encouraging news for now, but Reynolds warns that the economy is showing all the hallmarks of a late-stage expansion, with economic output continuing to produce more than its expected potential.

“An economy operating above potential is at greater risk for building up excesses that can tip the economy into a downturn,” he says. “This calls for cautious optimism and a vigilant approach to emerging risks.”