Life is full of mysteries, and for many people, credit scores are among them.

But they shouldn’t be.

Your credit score is a key that unlocks most of the major financial products anyone will ever need: credit cards, car loans, mortgages, personal loans, and more. It also determines how much—or how little—you’ll pay on these products over time. In fact, it’s not an exaggeration to say that a good credit score can save you hundreds of thousands of dollars’ worth of interest payments across your lifetime.

That’s a long way of saying: A brief primer on building credit could do most people a world of good.

Featured Financial Products

How Do Credit Scores Work?

Despite its importance, and despite it following you around for quite literally your entire adult life, most of us don’t actually understand how credit scores work, including how to build up these vital scores.

But we think we do.

Young and the Invested Tip: If you’re thinking about skipping this article because you’re near retirement, well … your credit still matters once you call it a career.

An overwhelming majority of Americans say they understand what contributes to their credit score. According to a study by MyFICO—the official consumer division of FICO (the company that invented the FICO credit score)—90% of us say we at least “somewhat” understand what a credit score is.

Answers to a Capital One survey suggest otherwise.

The survey asked about a number of misconceptions—like, for instance, that a hard credit check by a business can’t affect your score (it can!)—for each of five misconceptions, anywhere between 26% and 70% of respondents believed it!

Hey, a little humility is a good thing! It reminds us that no one knows everything, and we can all learn at least a little something!

Today, we hope the lesson you’ll learn is how to get (and keep!) a good credit score.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

How to Get a Good Credit Score

Helping us out this week is J.R. George, Senior Vice President at Trustco Bank, who will offer up some wisdom on building up your credit score.

We’ll start with the scoring system itself.

When people talk about their credit score, they’re typically referring to their FICO score. FICO uses information from a person’s credit reports—built by the three major credit bureaus, Equifax, Experian, and TransUnion—to calculate this score. The score ranges from 300 to 850; the higher the score, the more your creditworthiness.

A quick note for overachievers: Don’t expect perfection—you’ll only be disappointed. For both FICO and competitor VantageScore, 850 is the highest credit score you can achieve, but George says he’s never worked with someone with an 850 score. It’s very difficult to even get a score over 820, and while other factors will go into this, you’re very likely to be approved for whatever you want with any score above 800, which is FICO’s baseline for “Exceptional.”

The exact credit score you need for approval depends on what you’re applying for, and who you’re applying with. But in general, 670—which is considered “Good,” according to MyFICO—should be enough to at least get you an approval.

To get more ideal terms, you’ll want a score of at least 740, the baseline for “Very Good.”

So, how do you achieve these scores?

“There’s a big misconception that just because people make a lot of money, they’ll have good credit. That isn’t 100% true,” George says. “A credit score is a numerical representation of a person’s ability to pay, but it’s also their willingness to pay.”

In fact, while how much money you make is often gauged and considered when a lender decides whether to approve you, it actually plays zero role in FICO’s credit-scoring system.

Here’s what does:

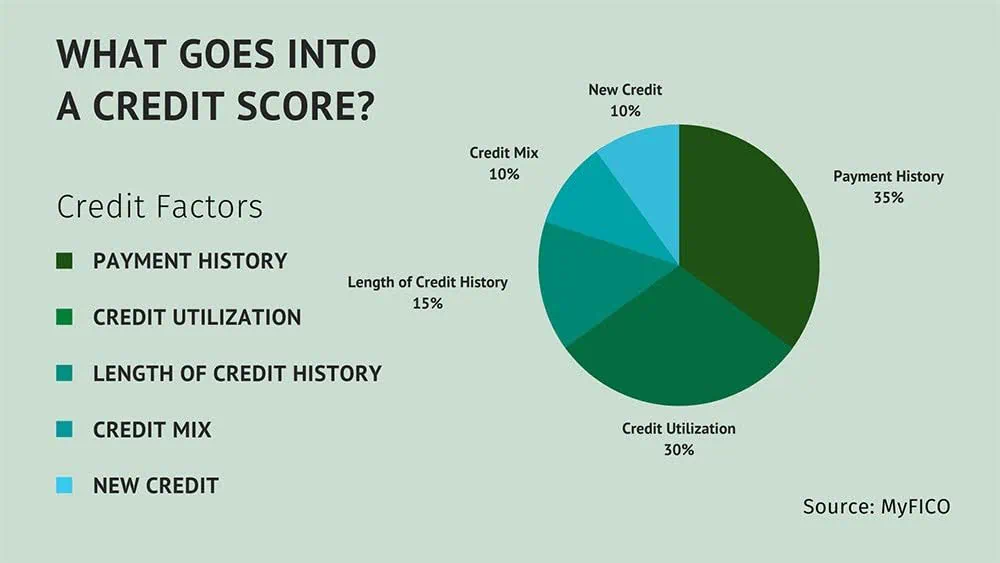

- Payment history (35%): Your record of paying past credit accounts (and importantly, paying them on time).

- Amounts owed / Credit utilization (30%): How much you owe compared to your available credit. In general, the more you owe, the more it weighs on this criteria.

- Length of credit history (15%): Predominantly how long your credit accounts have been open, but also how long it has been since you’ve used certain accounts.

- New credit (10%): New credit means new risk, so if you’ve opened several new accounts recently, that will weigh on this factor.

- Credit mix (10%): The types of credit accounts you hold—credit cards, installment loans, mortgages, etc. You don’t necessarily have to have one of every type of credit to satisfy this factor

So, with all that knowledge in hand, here are some tips on how to build (and keep) a great credit score:

Pay your bills on time.

When you were in school, teachers made a pretty big deal about turning in work on time. That’s in part because they were preparing you for the real world, where you need to be punctual about work … and your bills.

Young and the Invested Tip: Some landlords will let you pay your rent with a credit card. Whether you should is another issue.

When you’re trying to establish and improve your credit, paying your bills by the due date is critical. For what it’s worth, some bills might not affect your credit—some organizations don’t report information to the credit bureaus. But as a general best practice, it’s best to operate as if they do and pay everything on time.

George says he frequently encounters a misconception among younger people, like college students, who think their actions when they’re young won’t affect their credit score. But they can, and they do! Let’s say you get cable service for your apartment, but you decide to switch to streaming and ignore the last bill you got from the cable company. If you don’t pay for a few months, that bill could get sent to collections, and that would have an adverse effect on your credit score.

And if you don’t check your credit report regularly, you might not realize the negative impact until much later (like, say, when you apply for a credit card or loan)—something George says he sees all the time.

Speaking of …

Featured Financial Products

Check your credit report.

Your credit report is thick with important information about your credit history and scores—including anything dragging on your credit.

And drags on your credit aren’t always self-inflicted.

For one, reporting companies can and do make mistakes. George says he’s found errors before on his credit report; a long time ago, he checked his report in anticipation of having his credit pulled when he applied to rent an apartment in New York City.

Young and the Invested Tip: If you always use cash or always use a credit card, you’re not always making the right decision.

Thing is, “J.R. George” is short for “John Ryan George.” His father’s name? “John Richard George.” The bank merely slipped up because their names were similar. (And you can imagine J.R.’s surprise when his father’s mortgage showed up on his credit report!)

That was an innocent mistake. But sometimes fraudulent actions can slip into your credit report as well.

No matter what the nature, you want to jump on any mistakes as soon as possible. Negative items on your credit report can affect your score for seven years (and Chapter 7 bankruptcy can last for 10). So it’s better to learn about and fix errors on your credit report right away, rather than waiting to find out when you’ve been denied a mortgage or auto loan.

And the way to root out these mistakes is to regularly check your credit report.

The government is on your side here. Federal law allows for every person to receive a free credit report, every 12 months, from each of the three national credit bureaus (Equifax, Experian, and TransUnion). And you can do that at annualcreditreport.com.

Plenty of other sites can provide you access to your credit reports, but per the Federal Trade Commission:

“Only one website—AnnualCreditReport.com—is authorized to fill orders for the free annual credit reports you are entitled to by law.”

And yes, checking your credit once a year is generally regarded as frequent enough.

Other ways to achieve/maintain a high score.

- Pay off your credit card in full: It’s not so much that paying off your credit card each month necessarily improves your credit score, but carrying a balance doesn’t help it. The lower your utilization ratio, the better—thus, paying off your credit card each month naturally keeps your utilization low.

- But don’t let a card go inactive: “If a low utilization ratio is good, then I should just open a credit card and never use it, right?” Wrong. If you don’t use your credit card for long enough, your card will be automatically shut down. That will lower your available credit, which—if you’re using any of your available debt anywhere else—will raise your credit utilization ratio. If you’re opening a card, you should plan on using it (and paying it off). That doesn’t mean to never close a credit card, just know it can negatively impact your score temporarily.

- Mind the reporting date: If you have to keep a balance on your card, you can at least be strategic about when you pay it off. Credit card statements will typically reveal the date at which they report your credit to the bureaus, though you can also talk to your card issuer to find out that information. With that information in hand, you can try to manage your card in such a way that you’re making payoffs and lowering your balance right before your company reports your score.

- Ask for a higher credit limit: As we always like to say around the office, “Asking is free.” Even if you don’t actually need additional head space, you can always ask your credit card company to raise your credit limit—preferably without making a hard credit check. If they agree, that higher credit limit will naturally lower your credit utilization ratio.

- Use a secured card: If you have new or low credit, you might not be able to get a typical credit card, which is unsecured. But you might be able to get a secured card. With an unsecured card, if you’re approved, you’re simply given credit. But with a secured card, you put down a security deposit, which acts as your credit limit. You’re billed just like you would be with a regular credit card—though if you miss a payment, the provider might use your deposit to pay any unresolved debts—and it can be used anywhere your card’s brand is accepted.

- Be an authorized user: If you’re really in the credit pits and can’t get your own card, you can still be an “authorized user” on someone else’s card. If you have a friend or family member you trust (and that trusts you), you can ask them to ask their issuer to add you to the card as an authorized user. While you can request your own copy of that credit card, you don’t necessarily have to. For instance, a parent of a college student might add their child as an authorized user but never actually give their kid a card, and just let their credit build as the parent makes timely payments. But be careful! Being an authorized user can also hurt your score if the account you’re added to is managed poorly. The best advice is to get added to an account with a high credit limit that the owner reliably pays off in full every month.

Importantly: You can’t cheat your way to getting a high credit score. If you have low or unestablished credit, it simply will take time to build it. Be proactive, but be patient.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.