“Will you be paying with cash or card?” It’s a well-worn financial question—one that might be slowly falling out of use amid cards’ growing dominance, but one you’re still bound to hear every now and then.

While some people are fine using either, some people are staunch proponents of one or the other. Cash lovers tout that cash can be used virtually anywhere, that you can’t spend more than you have, and that it’s relatively anonymous. Credit card advocates enjoy the convenience and monetary benefits.

But is one really better than the other?

Well, yes … sometimes. It’s all a matter of circumstance. Sometimes, cards are the clear-cut best option. But in some situations, you’re actually better off paying in cash.

Today, I’m going to review a set of spending situations that are best handled with cash, and another set of spending situations where it’s better to use a credit card. By having both payment methods handy, and knowing when to use each, you can maximize your spending power and even avoid some hassles.

When You Should Pay With Cash

Today, depending on the business, you’re given several options when you want to pay for a product or service. You could use a credit or debit card, a payment app like Venmo, a payment service like Apple Pay or Google Pay, maybe even cryptocurrency.

But despite this growing glut of options for making purchases, many people still prefer good, old-fashioned cash.

This isn’t purely out of a stubbornness to resist change. In some situations, cash is still the best payment method. So we’ll start by going over some of the occasions where it makes the most sense to pay with cash.

1. When It’s the Only Option

This seems pretty obvious: In some situations, you only have the option to pay with physical cash, so it’s wise to always keep at least a little on hand. Examples of vendors where you might need to pay cash include garage sales, farmers’ markets, old-school vending machines, and lemonade stands. And occasionally, you’ll even find a few restaurants that refuse to accept cards or other alternative payments.

Indeed, even though the smallest of vendors are starting to accept cards and other payments—and even though some vendors are starting to ban cash altogether—you might occasionally find yourself in a situation where cash is your only choice. Given that you might be nowhere near an ATM, always carry at least a little cash if you can.

Related: Do Installment Loans Build Credit?

2. Any Time a Credit Card Surcharge Will Be Applied

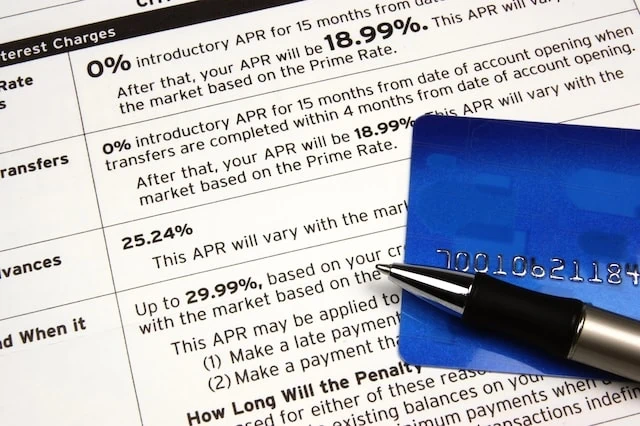

One of the ways credit card companies make money is by charging fees to merchants and retailers. This has long been the case, but ever since a class-action lawsuit against the credit card companies was settled in 2013, merchants have been able to pass along charges to consumers in the form of credit card surcharges.

Credit card surcharges range between 1% to 4% of the overall purchase cost. If a business plans to have consumers pay this junk fee, they must disclose it ahead of time—it can’t be a surprise. The business needs to post signs, and the surcharge must be shown on your receipt.

If you’re expected to pay a credit card surcharge, it’s better to pay with cash and avoid paying that extra percentage. Remember: These charges can be as high as 4% of your bill. Even if you have a rewards credit card, it’s very rare to collect rewards that high.

Also, sometimes these savings are presented in a different way—some vendors will provide a “discount” for paying in cash—but it amounts to the same idea. Pay in cash when it’s cheaper to do so.

Related: The 10 Best Fidelity Funds You Can Own

3. When You’re Worried About Overspending

It’s easy—sometimes too easy—to spend money with a credit card. By the time a credit card gets declined for being maxed out, it can have thousands or even tens of thousands of dollars charged to it. So in any situation where you have a strict spending limit that you’re worried about surpassing, it’s better to stick to cash.

For example: Don’t bring a credit card with you when you’re out for a night of drinking. According to a 2024 LendingTree survey, nearly half of drinkers (45%) say they have regretted spending too much on alcohol and/or partying, and 17% went so far as to say that purchasing too much alcohol led to debt.

Overspending can happen in a heartbeat, particularly when your judgment is impaired. So it’s better to only have as much cash on you as you’re willing to spend than it is to wake up and realize you ran up a pricey bar tab on your card.

Related: 20 Expenses to Cut From Your Budget

4. When You’re Traveling Internationally (In Some Situations)

There are several situations when, during international travel, it makes more sense to use cash.

One has to do with who you bank with. If your bank charges no or low fees for international ATM transactions, and your credit card charges higher foreign transaction fees, it makes sense to avoid those higher fees by withdrawing money while you’re in the country. (But avoid currency exchange booths, which typically charge unfavorable rates.)

Also, in some countries, cash is still a widespread payment method to the point where you might not even have the option to use a credit card in most places. Countries including Morocco, Bulgaria, Czechia, and Egypt are heavily reliant on cash.

Lastly, if you think you’ll be in a lot of tipping situations, cash remains the best payment medium.

Related: 10 “Most Serious” IRS Problems Taxpayers Face

5. At Small, Independently Owned Shops

While you’re not usually required to do so, you might want to pay in cash at your favorite “mom and pop” shops.

Small business owners often get hit with interchange fees of between 2% and 3% of the transaction cost. That means the owner of a shop where credit cards are frequently used is typically losing thousands of dollars each year to processing fees.

A few thousand dollars might be chump change for larger chains, but that can make a huge different for an independent operator.

Supporting these little shops and paying in cash isn’t a purely charitable action, either. It can be challenging for these stores to stay afloat; and if they go out of business, you’ll have no choice but to shop with major corporations instead.

Related: 13 Dividend Kings for Royally Resilient Income

When You Should Pay With a Credit Card

Credit card usage is extremely common—Capital One notes that credit cards are used to pay for nearly a third (63%) of all retail purchases, and 41% of all in-store transactions.

What’s more? In a 2022 Pew Research Center survey, 41% of American adults said they used cash in none of their purchases in a typical week. That number jumped to 59% for adults with an annual household income of at least $100,000.

In many (dare I say most) cases, using a credit card makes more sense than paying with cash, including in the following situations:

1. When You’ll Get a High Cash-Back/Rewards Percentage

Some rewards credit cards offer set cash-back (or other “-back” rewards, such as stock-back) for all purchases. Others give you a varying percentage back depending on the spending category; say, 5% back at restaurants, 3% back for gas, and 1% for all other types of purchases.

If your cash-back rewards would be greater than a posted credit card surcharge (if any), you’re basically declining free money if you pay with cash instead of your card. For instance, if a restaurant charges a 2% credit card surcharge, but your card offers you 5% cash-back on restaurant expenditures, you’re still coming out ahead. (And naturally, anywhere you’re not paying a credit card surcharge, you’ll come out ahead using your rewards credit card, regardless of the rewards rate.)

Related: Enough With Deceptive Drip Pricing: How You’re Being Tricked + How to Stop It

2. For Very Large Purchases

Cash is fine for small purchases—a few tacos at a food truck, a souvenir at the airport—you’re typically better off using a credit card for large purchases.

To start: Cash is easily stolen. And while it’s never good to have any amount of cash stolen from you, you’d really hate to be out hundreds or thousands of dollars you’ll never recover. Conversely, if someone steals your credit card, you’ll likely be covered by theft and fraud protection.

Also, proving you bought something is much easier with a credit card. Yes, you’ll receive a receipt regardless of how you pay. But receipts are easily lost. Your credit card, however, also keeps a record of your purchases, so if you lose the receipt, that record should still allow you to make a return. (Also, if you itemize your deductions come tax time, having your purchases recorded by credit card makes the process much simpler for you or your CPA.)

Furthermore, by using cash, you might be forgoing warranties or purchase protection. Credit cards sometimes provide additional coverage to the manufacturer’s warranty or allow you to extend the warranty.

Related: 10 Most Expensive Cities to Buy a House In

3. When You’re Trying to Establish Credit

Are you trying to quickly build a credit history? Well, you can’t really do that with cash, but it’s very easy with a credit card.

Credit scores are a gateway to important purchases. Your credit score not only determines whether you’ll qualify for things like renting an apartment, auto loans, mortgages, and more, but in many cases, it can also determine how much you’ll be charged in interest.

Regularly using your credit card, then paying off the balance on time every month, can help you build credit. Your FICO Score is made up of several pieces of data, but No. 1 among them is payment history, at 35%.

Conversely, paying in cash does nothing to help you establish credit. So if you’re trying to establish or build credit, using a credit card is a way to go.

Related: 9 Monthly Dividend Stocks for Frequent, Regular Income

4. When You (Or Others) Are in a Rush

Generally speaking, credit cards are more convenient than cash.

There is no counting involved; you automatically pay the exact amount. Finding your card is easier than digging for exact change in bills and coins. Your cashier might struggle to count out change. The register might not be able to break large bills.

So if you’re in a rush, using your credit card is almost always going to be your fastest option.

Related: 10 Fun Jobs That Pay Well

5. When You’re Splitting Costs With Others

Nothing can ruin relationships quite like arguing over money.

Pretend you’re on vacation with a group of friends. You take turns paying for food, drinks, and transportation. However, while some of your friends have an “it all evens out in the end” mentality, others are following strict budgets and want to ensure they don’t pay more than their fair share.

When you pay with cash, it can be challenging to remember who paid when and where. But if you forget about any expenses, it’s much easier to look over credit card charges to see if anything is missing.

Related: