The Federal Reserve made a splash last month by cutting back its benchmark interest rate—officially snapping a streak of 11 rate hikes from March 2022 and July 2023, and marking the first rate reduction since March 2020.

If you read this newsletter on the regular (or, let’s be real, read or watch any financial media whatsoever), you already know that.

However, only people who read this newsletter on the regular would know that, after discussing what lower rates mean for your wallet, we promised you a second look at the Federal Reserve’s new rate-cutting cycle—this time focusing on your portfolio.

So, let’s get to it!

The Tea: We’ll start by getting everyone up to speed with a quick review from last week.

The Federal Reserve is responsible for (among other things) determining the federal funds rate—the interest rate at which banks lend money to (and borrow money from) one another.

WealthUp Tip: Lower interest rates mean lower rates on savings accounts. Here are some alternative ways to make money off your money.

That rate directly affects consumers in several ways, but most notably:

- It determines the rates on lending products such as mortgages, car loans, and student loans.

- It impacts the return on fixed-income investments such as bonds and annuities, as well as the rates you receive on savings products like high-yield savings accounts and certificates of deposit (CD).

Broadly speaking, the Fed also can (and does) use this benchmark rate to keep our economy humming at an ideal pace, changing the rate to correct course should things veer too hard in one direction or the other. It can raise rates (much like it did in 2022 and 2023) to cool an overheated economy and tamp down inflation, but it will lower rates (like it did in September) to combat a slowing or even recessionary economy and fend off high unemployment.

Understandably, these machinations can impact the stock market, too—again, in a number of ways:

- Most obviously, speeding up or slowing down the economy will have differing impacts in the various corners of corporate America. But generally speaking, a rising economic tide lifts most boats, and a weaker economy will weigh on most industries.

- Changes in interest rates have a much more direct effect on certain industries (such as banking) whose primary business models revolve around these rates.

- Changes in interest rates also have a less direct, but still very tangible effect on various other industries. For instance, lower rates mean lower refinancing costs for real estate investment trusts (REITs). It also means a lower corporate borrowing rate, which helps not only REITs, but many other sectors—for instance, technology firms are well-known for taking out debt to fund their growth initiatives.

That brings us to the Federal Reserve’s most recent rate cut.

In September, the Fed lowered its federal funds rate by 50 basis points (a basis point is one one-hundredth of a percentage point), from a range of 5.25%-5.50% to a range of 4.75%-5.0%.

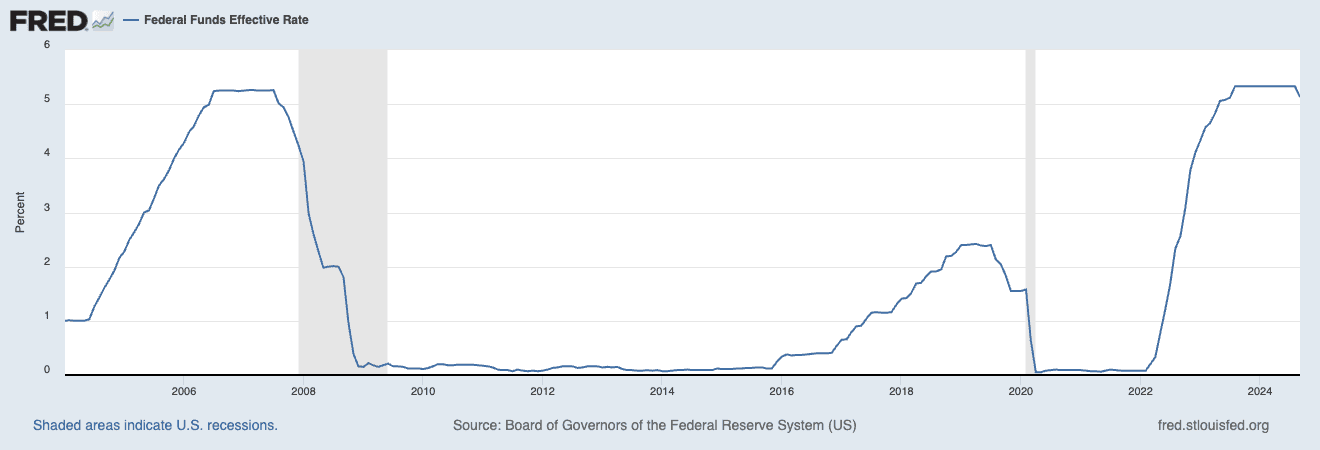

Source: Federal Reserve Bank of St. Louis

That brought the interest rate off of multidecade highs, and many strategists believe it was only the first move in what could be a longer rate-cutting cycle.

Indeed, consider the CME FedWatch Tool, which uses trading in federal-funds futures to determine Wall Street’s expectations for future Federal Reserve actions.

On Thursday, Oct. 3, FedWatch showed the market was pricing in a 63.8% chance of a 25-basis-point cut during the next Federal Open Market Committee (FOMC) meeting in November, and a 36.8% chance of a 50-point cut.

That changed on Friday, Oct. 4, following the release of a September nonfarm payrolls report that showed a much-better-than-expected 254,000 jobs were created last month—implying that the Fed might not need to cut rates as drastically to keep the economy healthy. The odds of a 50-point cut in November dropped to zero. The odds of a 25-point cut shot up to 99.1%, and the market even priced in a small, sub-1% chance that the Fed would leave rates unchanged next month.

Nonetheless, the market is pricing in the likelihood of multiple future rate cuts, including:

- A 76% chance that rates will be 4.25%-4.50% after the December meeting

- A 62% chance we’ll be at 3.75%-4.00% by March 2025

- And a 33.1% chance (the best odds of any one rate range) that we’ll be at 3.25%-3.50% by this time next year

So with all that in mind, let’s turn to what the possibility of what the start of rate cuts, and a rate-cutting cycle, could mean for your investments.

The Take: As we always try to remind investors, the most truthful answer anyone can give to “How’s the market going to do?” is “I don’t know.”

None of us have crystal balls.

None of us read palms.

And while The Hierophant can set you on an established path, tarot cards are notoriously useless when it comes to picking stocks.

WealthUp Tip: Don’t want to pick stocks on your own? These recommendation services will do the work for you.

Fortunately, we’re not the only ones trying to be refreshingly honest (emphasis ours):

“I think the most common question a guy like me has been fielding for the past month or two is, ‘Which ETFs should I buy for the Fed rate cuts?’ Jeff Weniger, Head of Equity Strategy at fund sponsor and asset manager WisdomTree, told us in a recent interview. “And the answer is, ‘I can show you what worked in prior rate cycles. But I haven’t the foggiest idea if any of this will parlay into this rate-cut cycle.’“

So that’s where our discussion will lead today: The past, and what might make this time different, or the same.

Broad Market Performance

Just to give us a baseline, we’ll start with a summary of historical broader-market (read: S&P 500) performance following the Federal Reserve’s first rate cut in a cycle. From there, we’ll take a deeper look into growth/value and sectors.

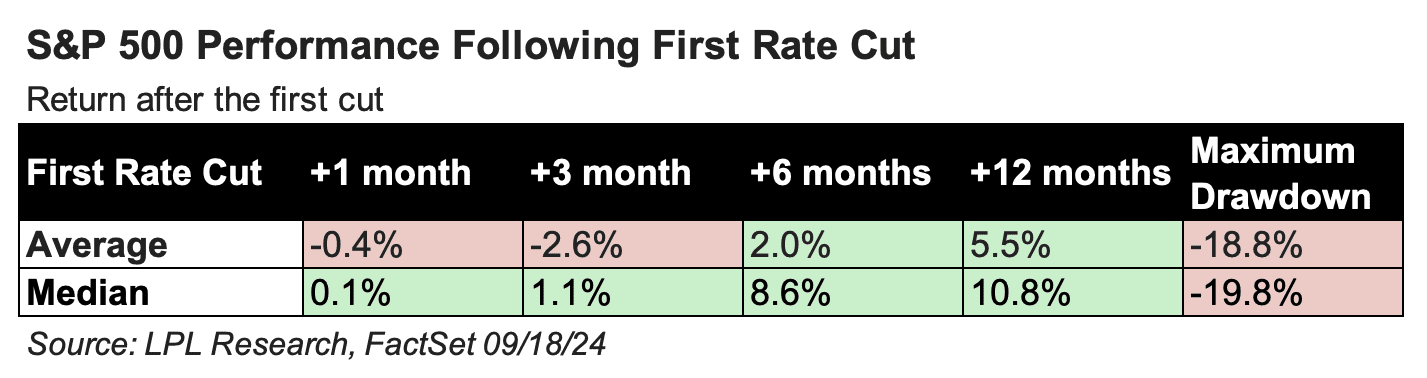

Here’s how the S&P 500 has fared based on the last nine major rate-hiking cycles since the 1970s, according to data from LPL Financial, the nation’s largest independent broker-dealer:

“Of course, how the economy holds up and if we enter or avoid a recession will ultimately dictate how stocks perform over the longer term,” LPL says.

Growth vs. Value

Now, let’s move on to one of the most basic stock-market divisions: growth stocks vs. value stocks.

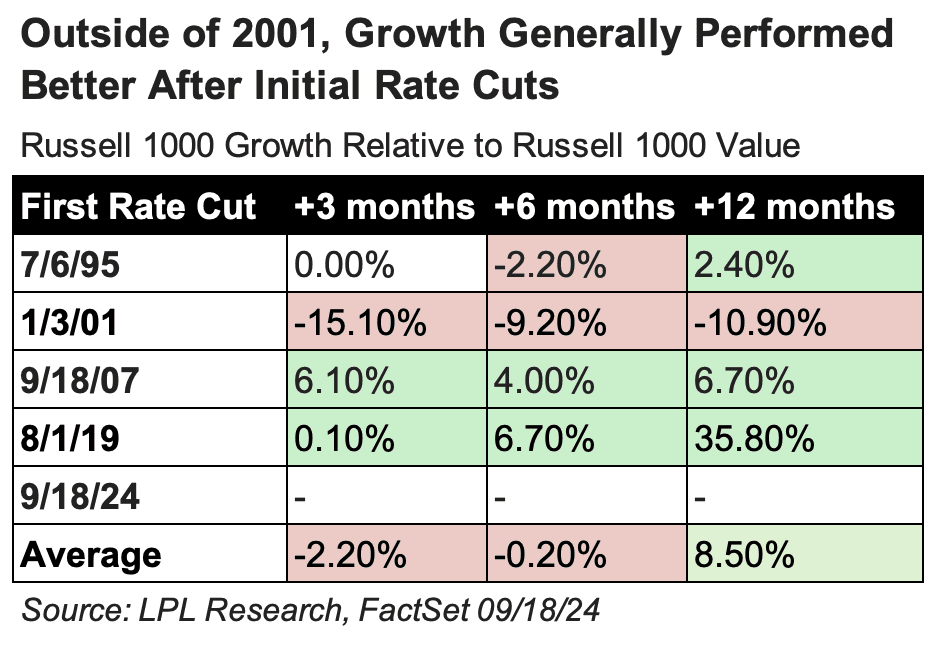

“On average, value stocks slightly outperformed their growth counterparts three and six months after the initial cut, but growth outperformed 12 months later,” says Jeff Buchbinder, Chief Equity Strategist for LPL Financial.

But, of course, each rate-cut cycle had its own specific circumstances.

“Growth was the center of the market collapse in 2001 and 2002, while value was at the epicenter of the 2008 Global Financial Crisis, making those periods less comparable,” Buchbinder says. “The 1995 cycle seems most analogous to where we are currently. During the 12 months after that cut, growth was slightly better, but value had an edge over the first six months.

“Some of the factors at play in 1995 included greater funding availability, which supported growth stocks; steady economic growth, which supported cyclical (economically sensitive) value stocks; and the early stages of the internet buildout, which helped the growth style.”

WealthUp Tip: How do you determine what stocks are values? These fundamental analysis tools can show you the way.

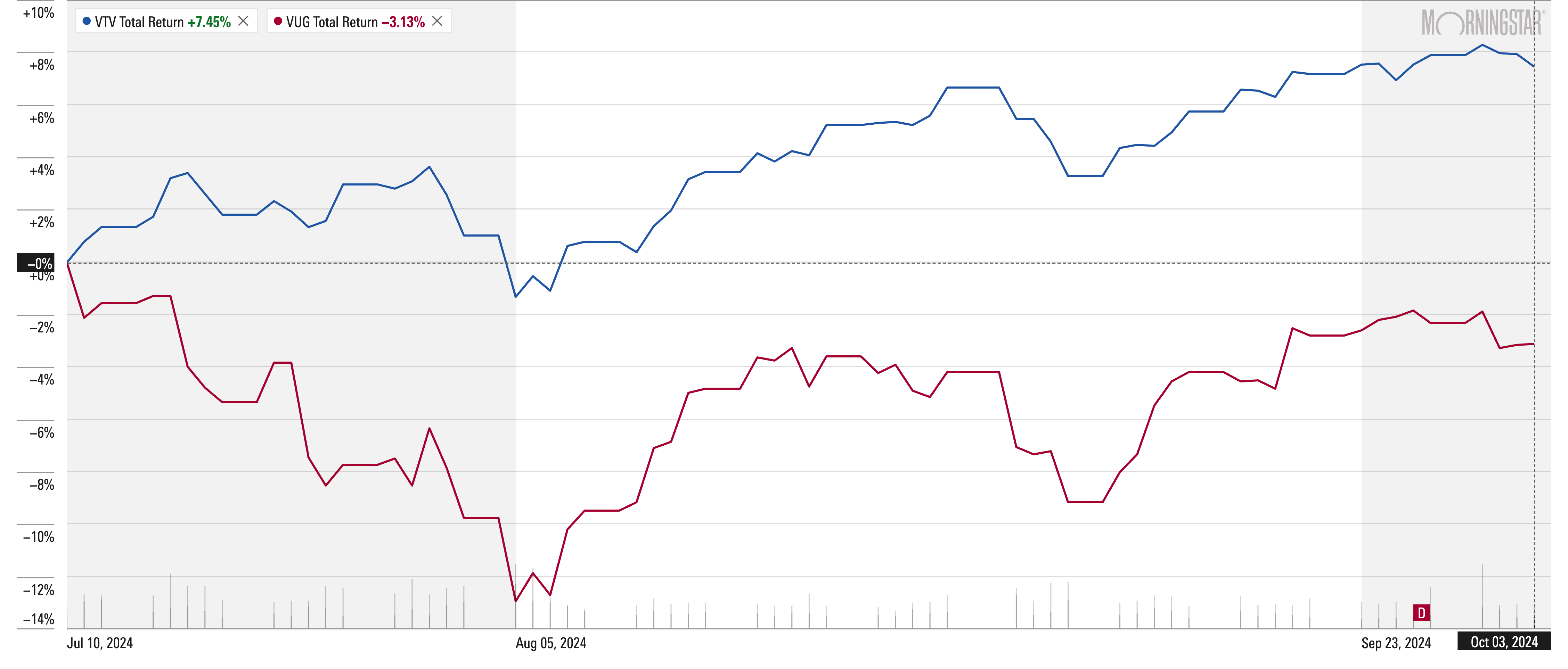

Indeed, this time around, value had already been “working” … for months before the actual rate cut.

“Up until about a year or a year and a half ago, if you told me what interest rates were doing, I could tell you what growth and value were doing. But the relationship flipped on a dime,” Weniger says. “There’s a specific date where everything changed the collective view to a view that inflation had been tamed: The July 11 June CPI report.

“And value started working again.”

Consider these two charts, which use Vanguard ETFs—Vanguard Growth ETF (VUG) and Vanguard Value ETF (VTV)—to illustrate the relationship between value and growth in 2024 up until the June CPI report, and then afterward:

Buchbinder adds that 2019 is a “reasonable comparison,” at least for the first few months … until the initial breakout of COVID-19 in the spring of 2020, which was clearly far outside the norm. But during that period, growth held a slight advantage.

Stock Market Sectors

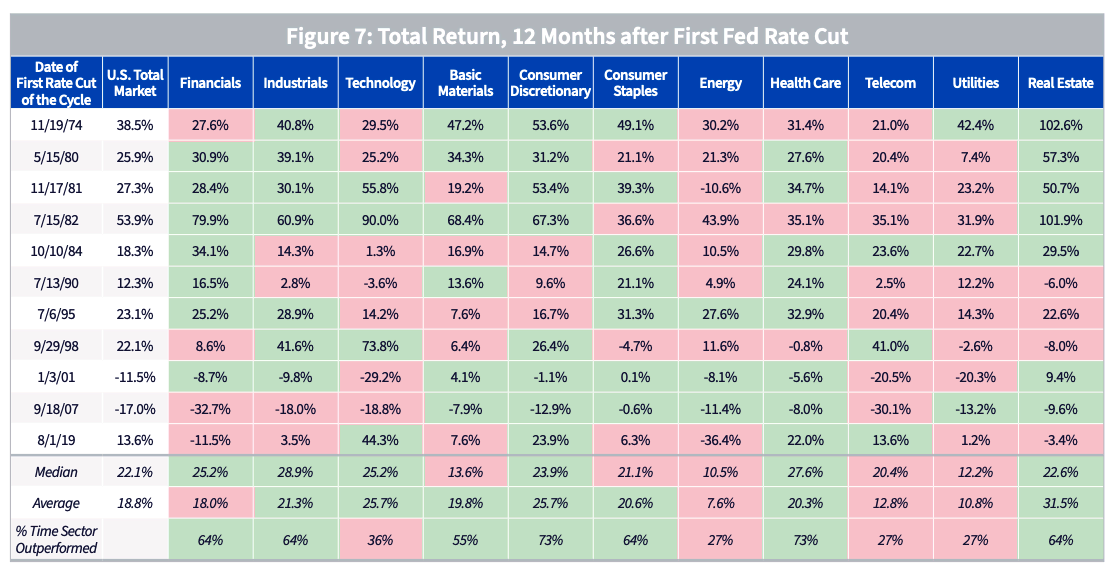

Going back even further in time, you can pick up on a few broader trends that emerge during the 12 months following past rate cuts. From WisdomTree’s analysis:

- Cyclical sectors, such as consumer discretionary stocks and industrials, tend to outperform.

- Defensive sectors, such as utilities and telecommunications (before the creation of the communication services sector in 2018), tended to underperform.

- There are several exceptions. Energy is generally a laggard. Health care has predominantly beat the market. Technology has underperformed more often than it has topped the market, but it’s capable of massive post-cut surges.

Take a look at the chart below, which shows the total returns (price plus dividends) of the different market sectors in the 12-month period following the first rate cut of the cycle. Note that green/red shading doesn’t signify positive/negative performance, but instead whether the sector outperformed (green) or underperformed (red) the market in that period.

Source: Refinitiv, via WisdomTree, using Datastream total return aggregates, 12/31/1973-8/30/2024

Some of these trends seem very obvious in hindsight.

“All you have to do with respect to REITs generally is say to someone, ‘Tell me which group in this market is absolutely itching for a lender to say yes to them,'” Weniger says.

Sure enough, REITs have been successful 64% of the time, even doubling on two occasions during the first 12 months after a Fed rate reduction. We’ll see what happens this time around, but since July 11, REITs have clobbered the market and are the second-best sector performer.

However, the top-performing sector since July 11 has been utilities, which often rise in the face of interest-rate cuts … but still underperform the broader market.

“We forget that the Fed usually saves the day. The Fed has three cut cycles in a row with a big asterisk, but if the Fed is saving the day—like 1980s- or ’90s-era Fed, why do I want to be in utilities? I want to be in cyclicals,” Weniger says.

WealthUp Tip: If you’re looking to play defense, look toward high-quality dividends.

“But that’s the thing about the historical record. Utilities are loving the 2024 rate cuts.”

Why the difference? Jeff notes in a recent report that “many investors are treating utilities as a backdoor play on artificial intelligence due to the gobbling of electricity by data centers,” so this could be a special situation.

And going back to that potentially comparable 1995 cycle? Among LPL’s observations, which involve the first six months after initial rate cuts:

- “The technology sector underperformed the S&P 500 after the 1995 rate cut, even though the internet buildout was in its early phases,” Buchbinder says. Why is that last detail important? “The technology sector, which as we know, is in a major buildout phase now with artificial intelligence, may not get a performance bump from a more accommodating Fed.”

- Financials fared well.

- Defensive sectors, which typically thrive in the six months after an initial rate cut, did particularly well in 1995, which “included a soft landing and technology buildout,” Buchbinder says. Healthcare and telecom were top performers; consumer staples and utilities outperformed, too.

- Consumer discretionary has a good track record within the first year, but it takes a while to get going, typically lagging during the first six months. In 1995, it was one of three sectors to sit in the red six months after the first rate cut.

Why Would This Time Be Any Different?

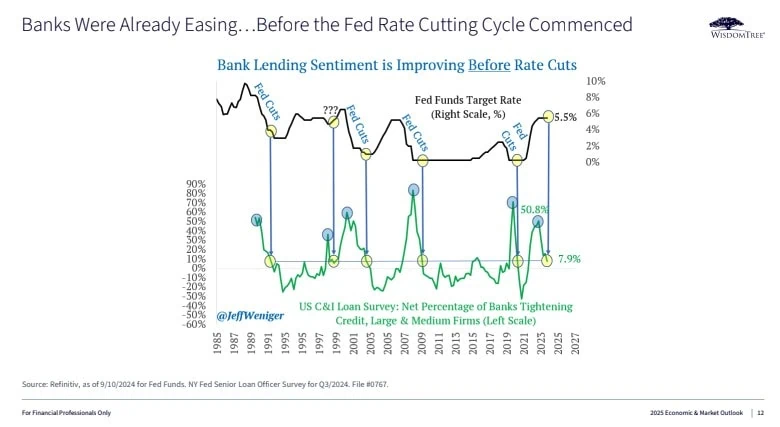

One of the biggest differences, Weniger says, can be found by looking at the typical chain of events before and after a rate hike.

“Look at the chain of events,” he says. “Something hits the fan. The Fed says, ‘Oh man, we underestimated something, now we need to start cutting.’ The Fed proceeds to cut for months or years. Then after a delay, the banks say, ‘OK, now we’re going to open up the purse and ease our lending standards now that we’ve had four or five quarters to think about what we’ve missed.'”

Look at the super-tight readings (blue dots) in the chart below—the thick of the Gulf War, Long-Term Capital Management collapse, the heart of the recession, September 2008, and so on. You can see that the Fed begins cutting, but lending standards don’t really start easing until the end of the Fed cycle.

Source: WisdomTree

“But [in 2024], the banks have been easing standards for five straight quarters, throughout the second half of 2023 and throughout all of 2024,” Weniger says. “And now Wall Street is saying that the Fed thinks a year from now, rates will have a number starting with 3.

“So I think that’s one of the things that makes this time different than before.”

WealthUp Tip: If you want to own more than just two or three dividend stocks, consider ETFs that hold dozens or even hundreds.

Weniger also points out that in September, China “took out the monetary bazooka,” referring to a laundry list of aggressive stimulus measures the country’s central bank took to buoy the economy. That included interest-rate cuts on existing mortgages, a lower required minimum downpayment (to 15%), reduced reserve requirement ratios for commercial banks, and more.

“There’s a strong argument that I and others make that the thing that finally got us out of the Global Financial Crisis wasn’t just our central bank, but that China’s central bank also had the wherewithal to step in [to provide stimulus],” he says about the world’s second-largest economy. “Today, we’ve been talking about the Fed, in concert with Christine Lagarde [president of the European Central Bank] and the Bank of England … but now we have someone [China] joining the party out of necessity. It’s helpful. It’s a bullish setup.”

“Most other major global central banks are also either cutting rates or contemplating doing so,” adds Scott Wren, Senior Global Market Strategist at the Wells Fargo Investment Institute. “That should help S&P 500 earnings, as approximately 35% of revenues at the index level come from outside the country.”

—

Have a great rest of the weekend, everybody—and if your team is still alive, enjoy October baseball!

Riley & Kyle

WealthUp & Young and the Invested

Like what you’re reading but not yet a subscriber? Get our weekly financial insights and updates delivered to your inbox every Saturday morning by signing up for The Weekend Tea today! You can also follow WealthUp on Flipboard for more great advice and insights.

Other WealthUp Stories Appearing on Nasdaq: