Best Banking Apps + Debit Cards for Teens—Our Top Picks

|

Primary Rating:

4.3

|

Primary Rating:

4.8

|

|

No monthly fees.

|

Core: $4.99/mo. Max: $9.98/mo. Infinity: $14.98/mo. (Each account supports up to 5 children.)

|

Best Banking Apps + Debit Cards for Teens

| App | Apple App Store Rating + Best For | Fees | Promotions |

|---|---|---|---|

Fidelity Youth™ Account | ☆ 4.7 / 5 Investing in stocks | Free, no trading commissions | $50 bonus for teens, $100 bonus for parents1 |

Greenlight Greenlight | ☆ 4.8 / 5 Customer rating and parental controls | 1 month free. Core: $4.99/mo. Max: $9.98/mo. Infinity: $14.98/mo. (Each plan supports up to 5 children.) | 1-month free trial |

Step Banking Step Banking | ☆ 4.7 / 5 Building credit history | Free (no monthly fees) | None |

Revolut <18 Revolut <18 | ☆ 4.7 / 5 Parent-paid bonuses | No monthly fees | None |

Copper Banking Copper Banking | ☆ 4.8 / 5 Teen financial independence | Copper $4.95/mo., Copper + Invest: $7.95/mo. | 1-month free trial |

GoHenry GoHenry | ☆ 4.4 / 5 Accessible customer service support | 1 month free. Individual: $4.99/mo. Family (supports up to 4 children): $9.98/mo. | 1-month free trial |

Chase High School Checking Chase High School Checking | ☆ 4.8 / 5 Free checking account with a strong mobile app from a major bank | No monthly fees | Get $125 when you sign up¹ |

| * Apple App Store Rating as of July 28, 2025. | |||

1. Greenlight (Best Prepaid Debit Card for Teens)

- Available: Sign up here

- Price: Free 1-month trial. Core: $4.99/mo. Max: $9.98/mo. Infinity: $14.98/mo. (All plans include cards for up to 5 children)

The Greenlight debit card allows teens to begin spending, but provides parents with peace of mind by giving them control over where their kids can spend money. Parents also can choose to receive alerts that tell them when, and how much, money is spent on the Greenlight debit card.

Greenlight works like as a prepaid debit card, allowing you to transfer money onto the card for your teen to pay for expenses at approved locations. You can choose how much in funds you want to load onto the card, and your child will be cleared to make approved purchases so long as a money balance backs up the card.

If your teen asks for extra money to be added to the card, you can require them to take a photo of the purchase they want to make and receive your approval before that money will land in the account. This gives you control and allows you to have discussions with your child about why a purchase might be a good or bad idea.

And if your teen has a job, they can add their own funds to the card as well.

Each monthly Greenlight subscription includes debit cards for up to five kids. Replacement cards cost $3.50 each but are free the first time. If you need to replace your card quickly, you can get express delivery for $24.99. The company also offers a personalized card, with your own photo or design, for $9.98 per year.

Greenlight boasts numerous other features, too. For instance, parents can open an investment account to get their teens investing in stocks and exchange-traded funds (ETFs) for the first time.

Greenlight also offers monthly savings rewards based on your tier: 1% per annum for Core members, 2% per annum for Max, and 5% per annum for Infinity. You may set up “Parent-Paid Interest” between you and your child. This allows you to foot the bill and pay interest on accounts for up to five kids.

The Greenlight debit card is a good choice for parents looking to teach their teens the importance of saving money and making prudent financial decisions. This financial product can be an effective learning tool for helping teens to understand why saving should be a priority and how to simplify paying an allowance or tracking chores.

Greenlight has no minimum age requirements but recommends starting at age 6 or older.

Read more in our Greenlight Card review.

- Greenlight offers flexible parental controls for each child and real-time notifications of each transaction.

- Greenlight is the only debit card letting you choose the exact stores where kids can spend on the card.

- Parents can use this app to teach them how to invest with a brokerage account through Greenlight Max and Greenlight Infinity plans.

- Unlike many apps that simply provide features and controls, Greenlight is also designed to spark discussions with children about spending, investing, and more, fostering more education.

- Best-in-class parental controls (can prohibit specific stores)

- Can add brokerage account to invest in stocks

- Intuitive Parent + Kid apps

- Competitive cash back & interest rates

- Parent-Paid Interest

- High price points

- No cash reload options

- No parent / child lending

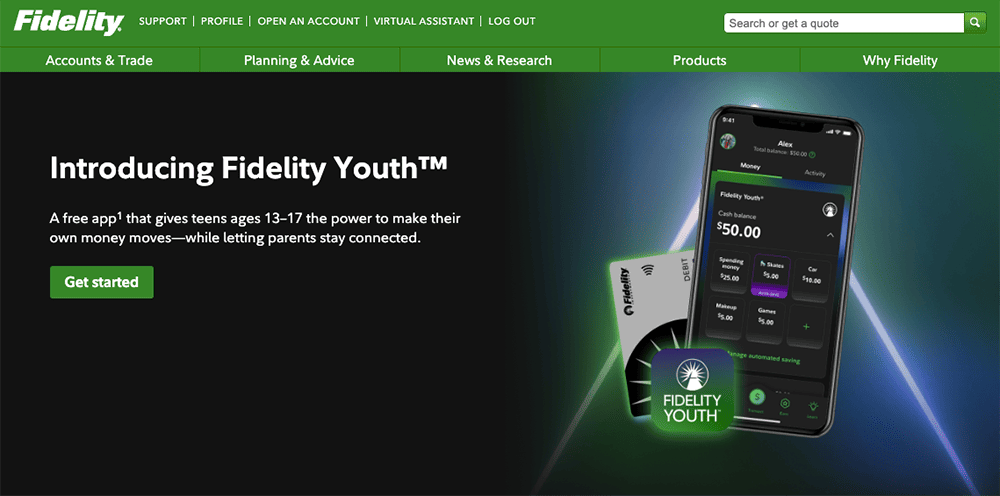

2. Fidelity Youth™ Account (Best Free Debit Card With Teen Investing)

- Available: Sign up here

- Price: No account fees, no account minimum, no trading commissions*

- Platforms: Web, mobile app (Apple iOS, Android)

- Promotion: Teens get $501 on Fidelity® when they download the Fidelity Youth™ app and activate their Youth Account; parents get $100 when they fund a new account

Is your teen interested in jumpstarting their financial future? Do you want them to build smart money habits along the way?

Of course you do! Learning early about saving, spending and investing can pay off big when you start on the right foot. And one tool that can help your teen get that jump is the Fidelity Youth™ Account—an account owned by teens 13 to 17 that’s designed to help them start their money journey. They can start investing by buying most U.S. stocks, exchange-traded funds (ETFs), and Fidelity mutual funds for as little as $1!⁴

Your teen will also get a free debit card with no subscription fees, no account fees³, no minimum balances, and no domestic ATM fees⁵. And they can use this free debit card for teens to manage their cash and spend it whenever they need.

And as for building smart money habits? You and your teen can access your account through the Fidelity Youth™ app, which has a dedicated Learn tab packed with materials developed specifically to help teens develop good financial habits. Not only will Fidelity’s interactive lessons, videos, articles, tools, and calculators accelerate their learning—but for every level they complete, reward dollars will be deposited into their account to use however they want.

Fidelity Youth™ Account isn’t a banking app, but it’s still strongly worth considering.

Controls parents want and need

A parent or guardian must have or open a brokerage account with Fidelity® to open a Fidelity Youth™ Account. For new Fidelity® customers, opening an account is easy, and there are no minimums and no account fees.

Parents and guardians have plenty of tools they can use to monitor their teen’s activity: They have online account access, can follow monthly statements and trade confirmations, and can view debit card transactions made in the account.

To make it even easier, you can set up alerts to notify you of trades, transactions, and cash management activity, keeping you firmly in the loop on actions your teen takes across the Fidelity Youth™ Account’s suite of products.

If your teen has an interest in learning about investing and taking their first steps toward building their financial journey, you should consider downloading the Fidelity Youth™ app and opening a Fidelity Youth™ Account. The account comes custom-built for their needs, which will help them become financially independent and start investing for their future.

Read more in our Fidelity Youth™ Account review.

- The Fidelity Youth™ Account is a free¹ account where teens can save, spend, and invest their own money.

- No monthly fees or account minimums to open.

- Your teen can learn to save and spend smarter with their own debit card, which features no domestic ATM fees.²

- Teens can invest in stocks for as little as $1 with fractional shares.³

- Parents can set up alerts and monitor their teen's account activity online, and through statements, trade confirmations, and debit card transactions.

- The Fidelity Youth™ app will have a dedicated Youth Learn tab to help jumpstart your teen's financial learning and build better money habits.

- No monthly account fees

- Investing feature

- Fractional shares

- Parental controls

- Comprehensive financial suite for teens

- Parent must be a Fidelity account holder

- Account balance doesn't accumulate interest

- No chore or allowance system

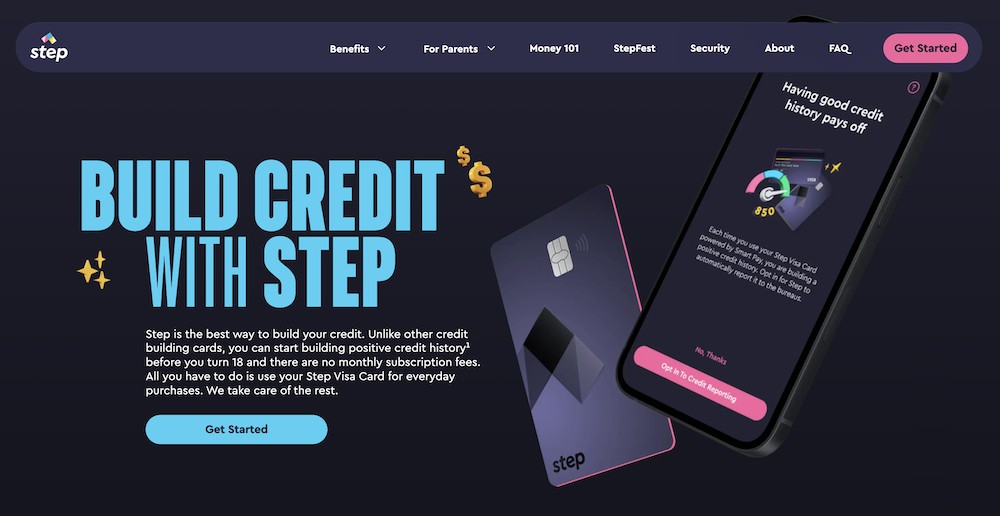

3. Step Banking (Best for Building Credit)

- Available: Sign up here

- Price: Free (No monthly fees)

The free Step Visa Card is a unique “hybrid” spending card that functions like a debit card, but also boasts some of the features of a Visa credit card—including the ability to build your teen’s credit history. In our overall review of the best cards for teens, this option truly stuck out as a one-of-a-kind product worth mentioning in this article despite it not technically being a debit card. When we personally tested the product, we found it to be a powerful option to set up teens for a strong financial future.

Parents add money to this FDIC-insured account and can determine how their teen can spend. A regular Step account allows a child to have both a physical spending card as well as a virtual card in the Step app, while a Parent Managed Account only allows the teen to spend via a physical card. Either way, they can use their card anywhere Visa is accepted. Teenagers can also use their cards to withdraw money from more than 30,000 ATMs for free.

And parents needn’t fear that their teen will overdraft—they can’t spend any money they don’t have.

Further, the Step Card comes protected by Visa’s Fraud Protection and Zero Liability guarantee. That means if your teenager’s card gets lost or stolen, or misplaced and fraudulent charges crop up, you can dispute the charges within a certain time frame to avoid liability for paying.

The Step Card also boasts a great savings tool for teens. Any money up to $250,000 saved in a Savings Goal can generate 5% in annual interest (compounded and paid monthly) with a qualifying direct deposit*. And with Savings Roundup, small purchases are rounded up to the nearest dollar figure; that extra money is put toward a savings goal. (Example: Your teen buys a cup of coffee for $2.75; Step rounds up to $3.00 and puts 25 cents toward a goal.)

Step even features an “invest” function that allows teens age 13 and older to buy and sell Bitcoin for a small transaction fee. They can also earn Bitcoin (or cash) rewards when they opt into offers from companies like Hulu, Chick-Fil-A, CVS, and The New York Times. The app is not a pure crypto wallet, however—your kids currently can’t spend Bitcoin directly at vendors.

One of the most unique and powerful features of the Step card is its ability to build your teenager’s credit history. With this optional feature, Step will report the past two years’ worth of information—transactions, payment history, and more—to the credit bureaus when your teen turns 18. That can greatly improve their chances of starting adult life with a better credit score, which can help lower the cost of things like student loans and auto insurance.

Lastly Step is absolutely free: No monthly fees, no subscription fees, no account minimum fees, and no ATM fees within Step’s network of 30,000+ ATMs.

Read more in our Step review.

- The Step Visa Card is a one-of-a-kind "hybrid" spending card that can help you to build your credit history via everyday purchases, even before you turn 18.

- Earn a high 5% annual rate on up to $250,000 in your Savings Goals with qualifying direct deposits.*

- Earn points that you can redeem for cash when you use your Step Visa Card at participating merchants.*

- Buy and sell fractional shares of stocks, ETFs, and Bitcoin for as low as $1.

- Send and receive money instantly, spend with Apple and Google Pay.

- Pay allowance weekly, biweekly, or monthly.

- Track your card balance from the Step App.

- Banking services, provided by Evolve Bank & Trust, are FDIC-insured for up to $250,000.

- Helps build credit

- Free secured card for kids, teens, and young adults

- High yield on money held in Savings Goals

- Free investment account for stocks, ETFs, and Bitcoin

- Fractional investing for as low as $1

- FDIC insurance

- High-yield savings only available with qualifying monthly direct deposit*

- Can't directly deposit checks into a Step account

4. Revolut <18 (Best Banking App for Parent-Paid Bonuses)

- Available: Sign up here

- Price: No monthly fees

Revolut <18 is a prepaid debit card for kids designed to teach them money skills for life. Aimed at building healthy money habits from an early age, the unique, customizable card¹ empowers parents to have full insight into their kids’ card activity through providing instant spending alerts and parental controls.

You can choose to freeze the card, as well as set controls on how they use the cards online and with contactless payments through your Revolut app. You can also set spending limits on how much your child can use with the prepaid card.

Parents use the card and accompanying app to teach kids about earning, budgeting, saving and even investing money (depending on the plan chosen). You can also use the card to manage chores and allowance, set savings goals as a family, and help your children manage their money.

And if your child did something deserving of a reward? You can send parent-paid bonuses when they complete specific tasks. Simply add money to their digitized piggy bank through the app. You can send and receive money in seconds through Revolut’s payments feature, which allows fast transfers between account holders and also global transfers at transparent rates.

You must have a personal Revolut account before you can open a Revolut <18 account for your children. You can add up to five Revolut <18 accounts per parent account.

To learn more about Revolut <18, visit their site and open an account for yourself and your child.

- Revolut <18 is a prepaid debit card for kids designed to assist parents teach kids ages 6-17 about money. Families can handle chores and allowance, create budgets, set parental controls and more.

- Revolut <18 comes with unique, customizable cards that parents can use to set up tasks and goals to work on together as a family.

- Prepaid debit card for teens

- Parental controls

- Round-ups

- Chore and allowance management

- Customizable designs (fees apply)

- Children can't load funds, only parents can

- Parents need to have a personal Revolut account

5. Copper Card (Best for Teen Independence)

- Available: Sign up here

- Price: 30 days free. Copper $4.95/mo., Copper + Invest: $7.95/mo.

Copper Banking was founded on the belief that teens should have equal access to financial education and should be empowered to learn by doing. Now, the company is on a mission to help teenagers gain real-world experience by giving them access to their money in a way that traditional banks can’t.

The Copper app and debit card teaches your teen how to make smart financial decisions by creating a platform where parents and their children can connect. With the Copper app, you get easy snapshots of your accounts. And with the Copper Debit Card, it’s easy to shop in-store or online, including with Apple Pay or Google Pay.

Plus, users get exclusive access to engaging advice curated by a team of financial literacy experts who provide tips on how to take control of their financial future.

When we reviewed the Copper banking product, we found the following features to be most important:

Copper Banking features

- Send/Request: Teens and parents can easily send and receive money at the touch of a button.

- Spend: Spend using Apple or Google Pay, or using the Copper Debit Card.

- Withdraw: Access your money from more than 55,000 fee-free ATMs.

- Monitor: Get a snapshot of all your teen’s spending in an easy-to-read dashboard.

- Save: Gain quick snapshots of your kid’s savings and helpful tips on how to save even more. Set up savings buckets and save for the things that you want.

- Learn: With the help of Copper’s team of financial literacy experts, gain bite-sized tips on how you can maximize your money and prepare yourself for your financial future.

The basic Copper account includes the above banking features. With Copper + Invest, your teen also gets access to automatically curated smart portfolios built with their preferences in mind. (We like the guardrails they provide to get your teen started with investing.) Your child is given a questionnaire that helps Copper determine a portfolio based on their age, income, net worth, investment objective(s) and investment horizon. Copper then recommends one of three ETF portfolios—Moderately Aggressive, Aggressive, and Extra Aggressive—made up of thousands of stocks. Parents can review the portfolio to ensure it matches with not just your child’s preferences, but your family’s. (Portfolios can be changed later on by accessing the Support chat.)

Much like many other apps we’ve reviewed on WealthUp, your child doesn’t need much money to begin their investing journey with Copper. They can begin investing for as little as $1, then add more contributions down the road. Copper will automatically rebalance the portfolio as needed to make sure it always keeps up with your teen’s investment preferences.

Copper is available to kids 6 years and older.

Read more in our Copper Banking review.

- Copper is the digital bank and debit card for teens built with the mission of creating a financially successful generation.

- Send/Request: Teens and parents can easily send and receive money all at the touch of a button.

- Spend: Pay with a digital wallet via Apple Pay or Google Pay or use the physical Copper Debit Card.

- Monitor: Get a snapshot of all your spending in an easy-to-read dashboard.

- Save: Gain quick snapshots of your savings and helpful tips on how you can save even more. Set up savings bucks and save for the things that you want.

- Learn: With the help of Copper's team of financial literacy experts, learn more about how to maximize your money and prepare yourself for your financial future.

- Allowance administration

- Financial education resources

- Network of 55,000-plus fee-free ATMs

- No chores tracking or assignment

- No parental controls beyond notifications

6. GoHenry (Best for Customer Service)

- Available: Sign up here

- Price: 1 month free. Individual: $4.99/child/mo. Family: $9.98/mo. for up to 4 children

GoHenry is a financial solution for minors that includes an app, prepaid debit cards, and even financial lessons. Parents are given an online account that’s linked to, and allows them to oversee and manage, individual accounts for each of their teens via both the GoHenry app and the online account portal.

Each teenager will receive their own GoHenry debit card; you can choose from 45 different designs or create your own customized card for $4.99. Each card is governed by parental controls you can set for your children.

What’s nice about GoHenry is that teens can only spend whatever money is available on the card—and thus parents don’t need to worry about costly overdraft fees or their kids accruing debt.

When you open a GoHenry account, you should receive your teen’s debit cards in the mail seven to eight business days later. Once you do, you can set up events such as automatic weekly allowance transfers into your teenagers’ accounts, real-time spending alerts, and one-off or weekly spending limits. You can also keep your teens’ spending in check by choosing the stores where your teens can shop, and even blocking/unblocking the card as needed.

With time, the controls provided by the app and the guidance you offer can help your teens develop good money habits around earning, saving, spending, and giving.

But the GoHenry card really stuck out in our assessment as one of the best debit cards for teens from a customer service perspective. When we checked with their customer service, they offered everyday phone availability, email access, and social media engagement, ensuring users can solve their problems quickly and with little hassle. One small nit we found was reduced hours of customer service representative availability compared to our last annual check when they offered 24/7 support. Still, GoHenry’s customer service is admirable compared to its peers.

GoHenry has no minimum age requirements but recommends starting at age 6 or older.

Learn more by reading our GoHenry debit card review.

- A financial app and debit card designed to give young people ages 6-18 a bright financial future.

- Kids can earn allowance, complete chores, set savings goals, give to charity, and bank with GoHenry.

- Use the app to build a solid financial education.

- Among the best customer service in kids' debit cards, offering everyday phone availability, email access, and social media engagement.

- Limited-Time Offer: Get $5 in free allowance for activating your GoHenry account.

- Parental controls at store category level

- Can implement chore and allowance system

- Financial literacy resources

- Customized card for $4.99

- High price point for multiple children

- No paired investment account

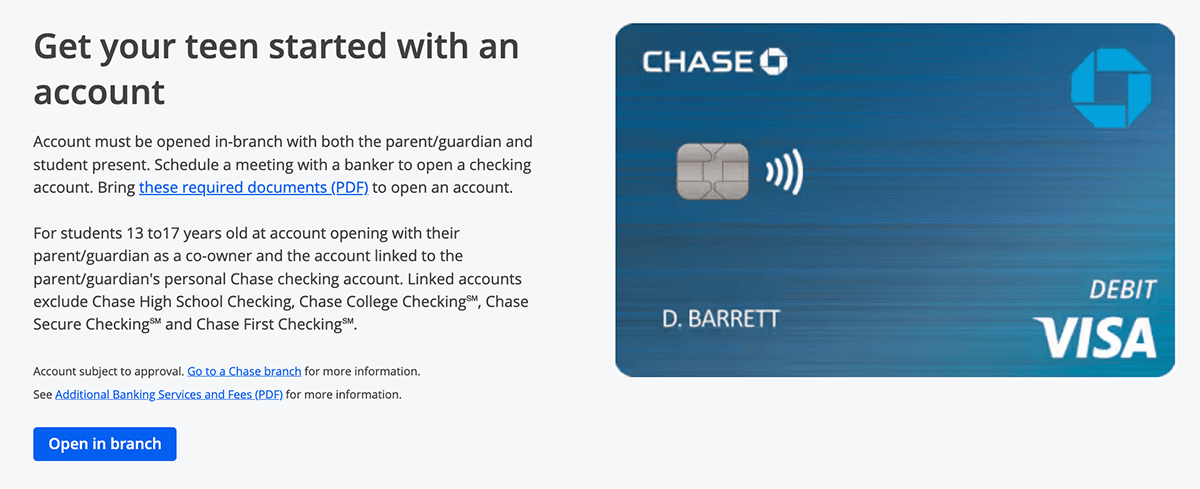

7. Chase High School Checking (Best Teen Checking from a Mega-Bank)

- Available: Get your code here, then sign up in a branch

- Price: No monthly fees

- Special offer: $125 when you open an account1

Chase High School Checking℠ is an account tailor-made for parents who want their teen to build money independence and enjoy the benefits of banking with a large national bank, but also want to keep an eye on their teen’s finances as they learn the ropes.

This checking account for teens (ages 13-17 at account opening) lets your teen enjoy the convenience of mobile banking through the Chase Mobile® App, as well as a debit card that can be stashed in a virtual wallet, or used to withdraw cash from Chase’s massive nationwide network of 16,000 ATMs.

With Chase High School Checking℠, your teen can …

- Use direct deposit to get paid from their summer job, or use Chase QuickDeposit℠ on their phone to remotely (and securely!) deposit physical checks from odd jobs or birthdays.

- Build their savings hassle-free with Autosave, which automatically transfers money from checking to savings.

- Use Zelle® (through the Chase Mobile® app) to send and receive money from friends and family—even if they don’t bank with Chase.

- Have their Chase High School Checking℠ convert into a Chase Total Checking® account when they turn 19.

Meanwhile, parents can stay in the know through account alerts.

Chase High School Checking℠ accounts must be opened in a physical branch, using a coupon code you can receive from Chase here. A parent or guardian must be present, and will be the account co-owner. Students should bring at least one primary ID and one secondary ID.

The parent must have an existing qualifying Chase checking account, which will be linked to the High School Checking account. Among the accounts that qualify is Chase Total Checking®:

- Chase Total Checking® also grants access to 16,000 Chase ATMs and more than 4,700 branches as well as a $300 sign-up bonus when you set up direct deposit within 90 days of coupon enrollment. You can pay $0 in monthly fees, subject to meeting certain conditions2.

Learn more and get your code for Chase High School Checking℠ here.

- Chase High School Checking℠ is a free checking account that helps teens learn financial independence through the Chase Mobile® App and a Visa debit card.

- Enjoy features such as Autosave (automated saving), QuickDeposit℠ (mobile deposit), and account alerts for parents.

- Zelle® lets you send money to (and receive money from) friends and family as long as they have an eligible account at a participating U.S. bank.

- Teens must sign up in a physical branch with a parent or guardian that has an existing qualifying Chase checking account.

- Age requirement: 13-17 at account opening.

- Annual percentage yield (APY): None

- Minimum deposit: None

- Minimum balance required: None

- Special offer: Get $125 when you sign up.¹

- No monthly fees

- Mobile app

- Sign-up bonus

- 16,000-plus fee-free ATMs

- Limited parental controls

- No APY

- Tight age restrictions

- Must sign up in a physical branch

What Is a Debit Card for Teens?

Children generally can’t open their own bank account until they reach the age of majority in their state—often 18 years old. Thus, parents often look for other paths, such as opening a sub-account from their own bank account so they can provide their children with a card to use. Even then, your child still must be at least 13 years old before receiving a card.

Unfortunately, these accounts might not come with the custom spending controls, parental oversight, or feature-filled mobile apps provided by many new banking apps and debit cards for kids. These apps provide numerous controls over your children’s spending, including spending notifications, limiting where your child can use the card, and even allowing you to quickly lock and unlock the card. And in many cases, you simply fund your teen’s debit card, so it effectively functions as a prepaid debit card.

Traditional banks or prepaid debit cards might not allow you to accomplish this beyond maintaining the account balance at a certain level.

Which Banks Provide Debit Cards for Teens?

Banks understand the importance of building lifelong relationships with their customers. Doing so lowers client acquisition costs while also building a financial connection for all of life’s future financial needs.

This is why Chase First Banking℠ has established teen checking accounts with debit cards available to kids. Both come with additional features above and beyond standard bank accounts which work to educate kids on money.

The Chase First Banking℠ bank account is exclusively for Chase checking customers. This means you first need to open a qualifying checking account like the Chase Total Checking℠ or Chase Secure Banking℠ products before opening a Chase First Banking℠ for your child.

This kid checking account with a debit card helps parents teach their teens and kids about money. The account manages to do this by giving parents the control they want and kids the freedom they need to learn.

What Features Should the Best Debit Cards for Teens Provide?

Choosing the best debit cards for teens can be a tough task because you’ll want the best of both worlds: usability and safety features.

On the one hand, teens need to learn how to manage their money. So you’ll want features such as ATM withdrawal limits, access to your teen’s account for establishing spending controls, lockable cards, and more.

But you also want a debit card your teens will actually want to use. That means limited or no monthly fees or overdraft fees, rewards programs, instant money transfers, direct deposit availability, even a card that allows your child to earn interest—and likely more on top of that.

To help you determine what might matter most when you’re making your decision, here are all of the features you should look for when perusing debit cards that your teen can use.

1. Direct Deposit

Perhaps one of the most sought-after features for teens’ debit cards is direct deposit.

Direct deposit is an automated transfer of money, typically from an employer to a person’s bank account. This is an excellent feature you want your kids to have, because your child’s paycheck will go directly into their account. That beats being handed an envelope from work that’s later handed over to Mom and Dad to manage.

A few debit cards for teens even allow free early direct deposit if they open a premium checking account. This allows teens to get paid up to two days faster than with regular direct deposit.

Yes, it’s important to instill a sense of delayed gratification in your children to build up their money management skills. But most of us can agree that you shouldn’t have to wait for your hard-earned money to hit your bank account—kids included.

2. Reloading

Along the same lines, you want your prepaid debit card for teens to be reloadable.

Normal debit cards allow you to spend money held in the linked account. However, reloadable debit cards for teens allow your kids to spend the money loaded on their specific debit card.

You can periodically add money to your teen’s card balance on reloadable prepaid cards, allowing them to spend the money when they need it.

These cards, under normal circumstances, can charge fees for loading or using a card, and they might also incur other one-off or monthly fees.

The reloadable prepaid debit cards for teens mentioned in this article can also assess certain fees, though the circumstances differ. Some charge a cash reload fee, for instance, but don’t charge for transferring funds onto the reloadable card’s balance through a bank or debit card transfer.

3. Mobile App

Let’s be real: In today’s modern world, everything is increasingly online—and that includes banking and finance.

Is it more complicated for parents? Sure. But it’s not without its upsides. Many parents and guardians find that banking mobile apps make it much easier to keep track of their children’s spending. In fact, you could argue that, nowadays, the mobile app is one of the most important banking features.

Think about all the parental controls you can find on some debit cards’ mobile apps: spending limits, controls on where kids can use their cards, restricting card use at certain times of the day, spending notifications, even the ability to lock down the card. Moreover, mobile apps often include things like lessons, quizzes, and videos teaching kids about financial responsibility at an early age.

Kids certainly have to love the convenience, too.

Teens can open their own checking account (with the help of a parent), earn money to deposit into the account, then can access the funds to make purchases—all from a mobile app. Kids can always see their funds in their account with the push of just a few buttons, and they can easily keep track of their spending.

4. No Overdraft Fees

Since overdraft fees are typically the most expensive fee associated with a bank account, an excellent feature to look for when choosing prepaid cards or debit cards linked to a bank account is no overdraft fees.

Most prepaid debit cards can avoid overdraft fees by declining any charges when the bank account carries an insufficient balance. (For instance, if your teen is trying to buy Robux and the account doesn’t have enough money, the transaction is declined on the spot.) The Greenlight card, for instance, doesn’t have issues with overdraft fees because you can’t spend money not already loaded onto the card.

However, cards have other ways for parents and teens to avoid overdrafts—and thus overdraft fees. For instance, parents may be able to monitor and even control their children’s spending directly from the app, keeping them from spending a predetermined amount in any time period or location.

You can even avoid overdraft fees with some traditional banks, which might choose to decline charges on the debit card if they exceed the account balance.

5. Low Monthly Fees

One downside of many debit cards for teens—not all, but many—is monthly account subscription fees paid to open and maintain the account.

These fees exist for a reason: It’s how banks make money.

Banks typically make money by taking the deposits held on account and lending them to borrowers. They charge an interest rate to the borrower at a higher rate than they borrow from the depositor. This difference, called the net interest margin, accounts for the lion’s share of bank earnings.

However, teens will typically have low account balances, providing little financial upside for the bank. Hence commonplace monthly (or annual) fees for teens’ debit cards and checking accounts. Some banks also try to generate additional income from things such as account minimum balance violation fees, overdraft fees, and other fees.

That’s not to say you should avoid all debit cards for teens that charge monthly fees. But it does mean that you should consider what value-added services you’re getting, and whether they’re above and beyond what you can get from accounts that charge no fees whatsoever.

Parental controls, robust mobile experiences, and card rewards are among the things that can provide parents with a more attractive value proposition and justify those fees.

6. Free ATM Withdrawals

One particularly tricky subject for online-only banks who offered teen debit cards was how to offer cash to depositors without physical locations to provide fee ATM withdrawals.

Traditional banks naturally could offer free withdrawals at their own ATMs. But many leaders in the online-only space partnered with large ATM networks to negotiate fee reimbursements when their customers pull money out of those machines.

So now, teens can often receive “free” ATM withdrawals (after the reimbursement) all over the nation.

Before you sign up, ensure that your teen’s debit card has free ATM withdrawals. Also, determine how much they can withdraw and deposit on their own, and whether parents have any control over those limits.

7. No Minimum Balance

The best debit cards for teens don’t have minimum balances.

The nice thing about having no minimum balance requirement is that you’ll likely avoid another type of fee: a minimum balance fee that kicks in if you’re under the threshold.

But for many parents, there’s more to it than avoiding another monthly fee: They also want convenience with little to no maintenance required on what’s likely to be a very small amount of money going into and being held in the account.

8. Parental Controls

Parental controls are among the most pivotal features you’ll need in a debit card for teens.

If your card offers controls, they should be easy to set up, customizable, and suited to any parent’s needs. Parents should be able to choose what notifications they want, set spending limits, determine which merchants kids can visit, and even lock and unlock a teen’s card.

Parental controls aren’t always about limiting, however. They might also include automated allowance payments, setting chores to complete, spending notifications (online and off), and being able to see spending reports.

These parental controls are one of the biggest differences that set apart debit cards for teens, and regular products offered by a traditional bank.

9. Spending Limits

When you sign up for a credit card as an adult, chances are you’ll be given a credit limit. You might start with $500 or so in the beginning, if you don’t have a strong credit history, but you can eventually work your way up into the thousands or even tens of thousands of dollars.

But it might not make sense to give your teens that much financial freedom—at least not until they’ve had a chance to develop strong money skills.

That’s why one of the most important parental controls is the ability to set spending limits.

Parents can often set spending limits by time, whether that’s over a day, week, or month. For example, parents can set limits of $25 per day for teens to spend on things they want and need. In some cases, debit card companies will let you be even more granular, setting spending limits on types of spends/withdrawals (say, restaurants, or ATMs), and even setting spending limits for specific individual stores.

While cash is the ultimate spending limit—you can never spend more than you have—debit cards with spending limits help instill a cash-based mentality in an increasingly cashless society.

10. Online Spending Controls

Also in the same vein, you’ll want to make sure that your teens’ debit cards allow you to control how money is spent online.

In addition to being able to white-list physical vendors, check to see if your card allows you to control how your teen spends money online, whether that’s allowing spending in certain categories, or even being able to cherry-pick individual online retailers.

11. Security + Cybersecurity Features

Also extremely important are security and cybersecurity features for the physical card and account.

Teens might be old enough to have learned about responsibility, but they still lose things—and they’re probably going to lose a debit card. That’s going to turn into a hassle if it happens with a traditional bank’s card, but with the best debit cards for kids, it shouldn’t be as bad. Many of these cards offer single-touch/swipe locking and unlocking of the card from your app if it’s misplaced or stolen.

Other security features can include EMV chips in the card, mobile apps with fingerprint identification or facial recognition, even multi-factor authentication (MFA) for a secure banking experience.

12. Additional Security Features

Some more premium debit cards offer a host of additional security features.

Greenlight is a standout in this space, offering features including:

- SOS alerts to emergency contacts and/or 911 with a single tap

- Family location sharing on your device’s Greenlight app

- Roadside assistance

- Insurance protection on your cell phone

- Purchase protection on lost and stolen items

- While many of these features aren’t necessarily central to a banking experience, they can certainly make a difference for parents looking for the optimal all-around solution for their family.

13. Savings Goals

One really important money management feature that many parents want for their teens is savings goals.

In general, teenagers can benefit enormously from the virtues of saving. Saving from an early age can enforce the idea of delayed gratification—the idea that accomplishments can be just as (if not more) satisfying when they’re worked for and earned over time.

Also, saving can help instill responsibility in your teen. It’s a building block to understanding what it means to budget, diversify their financial resources, and even invest for better returns.

The best accounts, then, help teach your teens how to save money by setting up savings goals—though they’ll often call them by a number of different terms, be they “goals,” “categories,” “pods,” etc.

Having savings goals that appear right alongside their spending money will show your teen how money is parceled out. So they’ll learn that they can still spend some money in the here and now, but they can’t go out of control without risking their longer-term priorities.

14. Investing Features

If you want your teenager to take a big leap in their financial literacy, you might want to consider teen banking services that also include investing features.

Investing features vary widely by offering. Some companies allow your teen access (typically through a parent-controlled account) to numerous vehicles, from stocks to mutual funds to exchange-traded funds (ETFs). Others offer limited investment options by design, ensuring your child can only invest in a handful of suitable, diversified products.

The latter is important because it prevents kids and teens from stock trading in more speculative names. Most people at this point are well-aware of 2021’s market mania over GameStop and other “meme stocks” after a Reddit subforum promoted these stocks—leading to well-publicized gains for some, but also punishing losses for others.

Some apps, such as Greenlight, allow stock investing, but teens must get parental approval before any trade is placed. Greenlight specifically not only allows parents to approve or deny trades, but even has an option that sparks conversations about why their teen arrived at their stock choice. (Further, Greenlight also limits your ability to buy and sell companies with at least $1 billion in market capitalization, potentially avoiding penny stocks and other risky names.)

15. Financial Literacy Tools

Financial literacy tools are vital for teens.

Yes, on its own, a debit card or a bank account can help grow your teen’s understanding of finances. But apps that can actually populate lesson plans and educational videos can do so much more for fostering smarter spending.

Life gets busy. Keeping track of your finances can be time-consuming. That’s true, not just for you, but for your teens too. That’s why it’s helpful for apps to deliver information, whether that’s delivering insights based on your spending history, budgeting tools to help you manage your money, even “money missions” that give children goals to achieve.

These all help teens with managing their own money, as well better understanding the ins and outs of their own personal finance.

Even if it’s not a feature you seek out, take a few minutes to look through an app’s financial literacy tools and navigate through the available libraries of resources.

16. Rewards Programs

Who doesn’t love to get more from spending more?

Believe it or not, some debit cards have gone so upstream that they offer rewards programs just like traditional credit cards. In some cases, these programs might just be points that can be redeemed for future purchases, while some cards even offer pure cash back!

As your children grow up and have more responsibility for their own expenses, these types of debit cards might be perfect to teach them how to manage money responsibly without using an expensive credit line or overdrafting. These points can also encourage teens to save up for larger purchases, gifts or other important expenses.

17. Round-Ups

Acorns popularized it; a lot of other companies have copied the round-up app model ever since.

A “round-up” is just a fancy term for rounding up your purchase to the next dollar amount.

The idea here is genius and really straight-forward: Small amounts of money, regularly saved, will eventually add up, resulting in much larger savings down the road. But how do you get children to make these little saves, one after another? Round up money from purchases they’re already making!

For what it’s worth, round-ups are a great savings tool for any age group. At a young age, it introduces people to the idea of saving and investing in an easy-to-understand format that doesn’t overwhelm or confuse them. But even for teens and adults, it’s a set-it-and-forget-it way to work toward savings goals. Win-win!

18. FDIC Coverage

Ideally, any banking account for your child should carry Federal Deposit Insurance Corporation (FDIC) coverage, which is insurance that protects against the loss of a depositor’s funds (typically up to $250,000) in case of bank failure.

Hopefully, it’s something that will never come into play. But if you’re looking for financial peace of mind, look for this feature when you’re seeking out a debit card to give to your child.

Pros and Cons of Teens’ Debit Cards

Getting your teen a debit card is a quick pathway to a lot of financial pros, such as instilling financial responsibility and giving them more financial independence. But nothing is perfect—certainly not a spending tool for your kids—so it’s important to understand and consider the possible downsides of plastic for your teen.

Here are some of the more salient pros and cons of children’s debit cards:

Pros

- No carrying cash. If your teen has cash, and that cash gets lost or stolen, that money is gone. But if your child loses their debit card, they’re out a card—but their money will still be sitting safely in their account.

- Consumer protections. Federal consumer protections provide some backing against purchases you didn’t make and against liability for paying if made in error or through a stolen card. You don’t get those with cash, either.

- Security. The security of debit cards extends well beyond the practicality of the plastic card itself. Features such as EMV chips, password-protected accounts, and multi-factor authentication, are all ways to ensure that minors are spending safely and their money is protected.

- Parental controls. Parents can also protect their kids through various controls on their teens’ bank accounts, debit cards, and/or prepaid debit cards. Some cards allow you to limit spending within certain time periods, at certain types of vendors, and even at individual stores. But even an occasional low-tech look at your teen’s bank statements can tell you more about their spending habits.

- Learn about budgeting. Many of the best debit cards for teens let you set your child up with a weekly or monthly allowance and explain that money has to last them for a period of time. This will help them to understand the concept of saving for a rainy day, and how to make their money last while balancing their wants and needs.

- Establish an emergency fund. Because these accounts often come with a paired app that allows your teen’s earnings to fall into different buckets (e.g., saving, spending, giving, investing), you can also work with them to set up and fund an emergency account for themselves. An emergency fund is one of the best long-term investments a young adult can make, as it will follow them into the real world when they finally “leave the nest.”

- Open a custodial Roth IRA. You won’t find this feature often, but it’s an interesting one to note. Many parents will use these cards not just to handle chores and allowance, but also for banking paychecks from their kids’ first jobs. That means kids can contribute toward Roth IRAs, locking in low tax rates now to fund a secure retirement later. Parents can match all money earned by their child and contribute this up to the amount of income earned by the child during the tax year, leaving the child to spend their earnings how they want. For example, if your child earns $1,500 during the summer as a lifeguard at the neighborhood pool, you can contribute $1,500 to a custodial Roth IRA and let them keep their earnings to spend as they wish. You can’t both contribute the funds above their earnings, but you can possibly split it between your child and yourself. Maybe $750 of their money goes into the IRA and $750 of your money goes in as well.

Cons

- Easy spending. A debit card does allow a teen to easily spend their money. Debit cards are accepted virtually everywhere—in person and online. In fact, most parents worry that their kids will quickly blow through their money with a debit card. Therefore, if you do open a teen debit card, consider one with parental controls and/or spending limits.

- Monthly fees. One characteristic of most teen-specific debit cards and prepaid debit cards is that they come with monthly or annual fees to offset all the perks. This can act as a significant hurdle when you consider the top option for you, so make sure you understand all fees you’ll end up paying every month.

- ATM fees. Some cards will incur a fee when your child needs to withdraw from an ATM. Look for cards that either allow for fee-free transactions or reimburse ATM fees.

- Reload fees. Some cards charge reload fees to add money back onto the prepaid card.

- Investing expenses for custodial accounts. Not all cards above come paired with an investing interface but some do. Some of these charge account fees for opening a custodial account and maintaining.

Teen Debit Cards vs. Teen Prepaid Cards

The primary difference between a standard debit card and a prepaid debit card is that the former is connected to money in an account at a bank or a credit union, whereas the latter requires you to reload money on the card to be able to use it.

A standard debit card is attached to a bank account, typically a checking account. The account is typically funded through means such as Automated Clearing House (ACH), direct deposit, or otherwise depositing earnings into your account. You can also deposit cash into your bank account without incurring a fee.

When you go to spend with the card, charges are made against the balance in your account. If you spend more than the balance, you’ll “overdraft” your account, and many banks charge overdraft fees in response.

A prepaid debit card is a “stored value” card funded by loading money onto the card. And typically, if you want to load a card using cash, you’ll incur cash reload fees.

The upside of a prepaid debit card is that you can’t be charged overdraft fees. If you’re at risk of overspending your account, the card transaction will simply be declined.

What to Do Before Getting a Debit Card for Teens

Take these things into consideration before opening a debit card for your teenager:

- Monthly fees. The best debit cards for teens typically will have low or no monthly fees.

- Major card networks. The best cards for your child will be backed by a major credit card network—companies like Amex, Mastercard, Visa, and Discover. This will allow your teenager to use the card as credit or debit at a wide variety of locations.

- Parental controls. An online account that not only lets you see where cash flows and when it changes hands, but also lets you monitor your child’s spending habits, is a smart investment for both security purposes and the ability to teach your teen strong money management skills.

- Prepaid card. To start, you might want to consider a prepaid debit card. You can also tie a new card to your existing accounts as another authorized user. The new card will access those accounts as your teen spends.

- Credit scores. There are various ways to load money onto a debit card for teens. For example, you could purchase a convertible credit card for kids and put the money that your teen wants into it; however, make sure you pay off your balance every month to avoid interest charges. (Not to mention, not paying off your monthly balance might be bad for your own credit score.)

Can a 13- to 17-Year-Old Have a Prepaid Debit Card?

Banks and credit unions have different policies about the minimum age required for an account holder to open an account and have a connected debit card issued.

Some financial institutions start at 8, 11, 12, or even as old as 16. Other banks offer cards directly targeting parents with young kids or teens.

Parents should decide which prepaid card or traditional account works best for their needs—but be extremely careful to read the rules and restrictions governing how old your teen must be to hold the product.

Is a Debit Card for Kids Just as Good for Teens?

Yes, debit cards marketed for kids can work for teens. But how you ultimately decide on a card for your teen will involve different considerations than if you’re selecting one for a younger child.

Some parents prefer looser overall controls for their maturing children, while others want the ability to adjust controls over time as their teens learn important lessons. They’re also going to be more conscious of perks such as reward points, cash back, and parent-paid interest—after all, at a certain age, that debit card becomes less of a learning tool and more of a way for your child to get more from their money.

If you want to have maximum oversight of your teen’s spending, consider a prepaid debit card for teens that features parental controls and spending notifications. If you want them to have more freedom, however, consider a banking app or regular debit card designed for teens.

Are Debit Cards for Teens Safe?

Yes. Teens’ debit cards are generally considered safe because of four major features.

First, most of these debit cards for teens come with an FDIC-insured account, so no matter what happens to the bank, you’ll get your money back. Federal Deposit Insurance Corporation (FDIC) insurance provides up to $250,000 worth of protection per set of accounts at a single institution to millions of bank account holders across the United States.

That means if you have multiple accounts at one bank which total more than $250,000, you will need to transfer the excess to other banks to receive that same level of FDIC insurance.

Many kids likely won’t face such a situation, so you can have peace of mind knowing your child’s account and card are fully insured (up to $250,000).

Second, most debit cards have a multitude of security features that protect the card when you have it … and when you don’t.

For instance, most debit cards secure transactions using EMV microchips. They also protect your money with other features including password protection, fingerprint identification, and/or facial recognition. Some even require multi-factor authentication (MFA) where you, say, enter a code sent to the linked phone number on the account to start your secure banking experience.

Third, debit cards offer consumer protections that cash simply doesn’t.

One major advantage to a prepaid card over cash is the liability and fraud protection you have from federal law—if someone fraudulently uses your debit card, your financial institution can make you whole. Some cards even offer purchase protections on broken, lost, and stolen goods.

Lastly, there’s … well, you.

Believe it or not, you can do a lot to protect your personal financial information. Here are a number of responsibilities that adults should teach their teens when using a debit card:

- Safeguarding your PIN number

- Storing your card in a safe place

- Not waving it around while in public

- Not disclosing account information to people who don’t need to know it

- Keeping a safe and secure password not containing common words or phrases like “password”

- Limiting your use of ATMs to branded bank networks

- Not using public wireless access to place purchases on your card

Ask not just what your debit card can do for you, but what you can do for your debit card.

What Documentation Do You Need to Open a Debit Card for Teens?

The federal government requires these financial services companies to “know” their customers using a specific protocol called “Know Your Customer,” or KYC. This widely used electronic check of identity and information complies with regulatory obligations established by the U.S. Patriot Act of 2001.

The process verifies your identity at the time of account sign-up through matching your name, address and date of birth against a public records database like one available through one of the three major credit reporting bureaus.

This check does verify your information to establish you are who you say you are. This check does not constitute a credit check—your credit score, and your teen’s eventual credit score, will not be impacted in any way. So while you might see a notification indicating a financial service has verified your address, don’t worry: Your credit has not been “dinged.”

Depending on how long you’ve lived at your current residence, and in the event you’ve only been able to meet a partial match based on public records databases, you might need to upload additional information. This might entail uploading a copy of your driver’s license or state-issued ID. The information you provide in your initial account application to a debit card provider should match these documents.

Once you have uploaded this information, it can take anywhere between 24 and 72 business hours to verify this information. You should receive an email from the service provider notifying you about whether you passed, clearing you to open the account.

Do Teen Debit Cards Offer Contactless Payments?

As a result of COVID-19, many card providers have accelerated the ability of their cardholders to use contactless payments technology.

This includes debit cards for teens.

Many of the cards listed in this article may be used for making contactless payments and purchases in stores. Before making your first contactless purchase, however, you might need to use the traditional chip and PIN functionality, verifying the card works.

At this point, you should be able to use the card contactlessly for future purchases, but you still might face maximum transaction limits.

For more details about contactless payments and payment maximums, be sure to contact your provider or read the terms of service.

Disclosures

Chase High School Checking℠

1 Your teen gets $125 when you open a new Chase High School Checking℠ account together with qualifying activities within 60 days of coupon enrollment. Your child can receive only one new checking account opening related bonus every two years from the last coupon enrollment date and only one bonus per account. To receive the bonus: 1) Open a new Chase High School Checking account, which is subject to approval; AND 2) Complete at least 5 qualifying transactions within 60 days of coupon enrollment. Qualifying transactions include: debit card purchases, online bill payments, Chase QuickDeposit℠, Zelle®, or ACH credits. After your child has completed all the above requirements and the 5 qualifying transactions have posted to their account, we’ll deposit the bonus into their new account within 15 days. To receive this bonus, the enrolled account must not be closed or restricted at the time of payout. Eligibility may be limited based on account ownership. Bonus is considered interest and will be reported on IRS Form 1099-INT (or Form 1042-S, if applicable).

2 Account subject to approval. Monthly fee waived for any month in which you have electronic deposits of $500 or more made to this account, or a balance at the beginning of each day of $1,500 or more in this account, or an average beginning day balance of $5,000 or more in any combination of this account and linked qualifying Chase checking, savings, and other balances.

Revolut <18

1 Customized cards may require fees.

Terms and Conditions for Fidelity Youth™ Account

The Fidelity Youth™ Account can only be opened by a parent/guardian. Account eligibility limited to teens aged 13-17.

* $0.00 commission applies to online U.S. equity trades and exchange-traded funds (ETFs) in a Fidelity retail account only for Fidelity Brokerage Services LLC retail clients. Sell orders are subject to an activity assessment fee (from $0.01 to $0.03 per $1,000 of principal). Other exclusions and conditions may apply. See Fidelity.com/commissions for details. Employee equity compensation transactions and accounts managed by advisors or intermediaries through Fidelity Institutional® are subject to different commission schedules.

¹ Limited Time Offer. Terms Apply. Before opening a Fidelity Youth™ Account, you should carefully read the account agreement and ensure that you fully understand your responsibilities to monitor and supervise your teen’s activity in the account.

² The Fidelity Youth™ app is free to download. Fees associated with your account positions or transacting in your account apply.

³ Zero account minimums and zero account fees apply to retail brokerage accounts only. Expenses charged by investments (e.g., funds, managed accounts, and certain HSAs) and commissions, interest charges, or other expenses for transactions may still apply. See Fidelity.com/commissions for further details.

⁴ Fractional share quantities can be entered out to 3 decimal places (.001) as long as the value of the order is at least $0.01. Dollar-based trades can be entered out to 2 decimal places (e.g. $250.00).

⁵ Your Youth Account will automatically be reimbursed for all ATM fees charged by other institutions while using the Fidelity® Debit Card at any ATM displaying the Visa®, Plus®, or Star® logos. The reimbursement will be credited to the account the same day the ATM fee is debited. Please note, for foreign transactions, there may be a 1% fee included in the amount charged to your account. The Fidelity® Debit Card is issued by PNC Bank, N.A., and the debit card program is administered by BNY Mellon Investment Servicing Trust Company. These entities are not affiliated with each other, and Fidelity is not affiliated with PNC Bank or BNY Mellon. Visa is a registered trademark of Visa International Service Association, and is used by PNC Bank pursuant to a license from Visa U.S.A. Inc.

⁶ Venmo is a service of PayPal, Inc. Fidelity Investments and PayPal are independent entities and are not legally affiliated. Use a Venmo or PayPal account may be subject to their terms and conditions, including age requirements.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917