The financial aspects of real estate investing can be complicated, so it’s essential to work with a reliable bank that knows what you need.

A bank that works well for your personal banking won’t necessarily have all the features you need if you’re, say, running several rental properties or need to secure a commercial real estate (CRE) loan.

So when real estate investors choose a bank, they need to consider price, features, flexibility, and much more.

Below are the best banks that real estate investors should consider. In addition to explaining why each of these banks made the list, this piece will answer your frequently asked questions (FAQs) about how many bank accounts you need for a rental property, financial software, and more.

Best Banks for Real Estate Investors + Landlords—Top Picks

|

Primary Rating:

4.7

|

Primary Rating:

4.0

|

|

Free, no fees. Get $150 to fund a bank account and start collecting rent.

|

Standard: No monthly fees. Plus: 1 month free, then $30/mo.* Premier: 1 month free, then $95/mo.*

|

The Best Bank Accounts for Real Estate Investors + Landlords

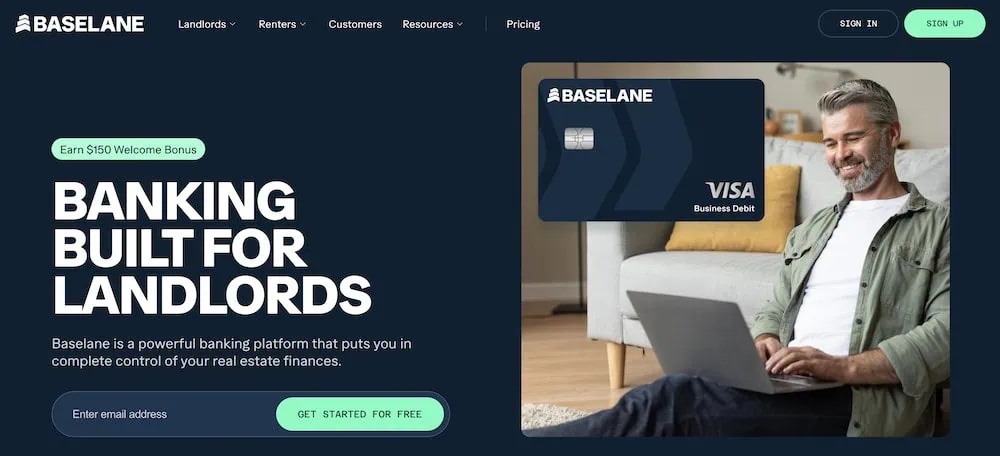

1. Baselane (Best Real Estate Investor Banking Solution)

- Available: Sign up here

Baselane is one of the most comprehensive real estate finance platforms you’ll find—a perfect financial complement for anyone trying to run a rental property business.

Baselane Banking provides landlords with a bank account that offers a competitive APY, as well as a debit card. And Baselane’s recent migration to a new sponsor bank, Thread Bank, will allow it to add several additional features to Baselane Banking, including check writing, same-day ACH payments, and FDIC insurance of up to $2.5 million (provided through the deposit sweep program with Thread Bank, Member FDIC).

Need rental property accounting help? The Baselane platform categorizes all of your expenses, and offers tools that show year-to-date (YTD) expenses, YTD revenue, and more.

I also view Baselane as one of the best rent collection apps and software for landlords. Residents can pay online with bank transfers, debit cards, or credit cards, and they have the option to set up recurring payments. Payments are sent directly to your bank accounts.

Other Baselane features worth noting?

- It partners with Lendency to provide flexible real estate loans for single and multifamily, five-plus units, portfolio loans, and more.

- It offers landlord insurance covering dwelling and liability, loss of rent, and other situations through partner Obie.

- Baselane has an artificial intelligence (AI)-powered marketplace that can connect you with the best rates for mortgages, and loans.

Interested in learning more? Sign up with Baselane today and learn how you can earn a $150 bonus, too.

- Baselane is a complete rental property financial management system.

- Baselane's bank accounts for landlords have no fees and offer high yields on all balances (up to 3.14% APY as of 9/17/2025*). Other features include check writing, same-day ACH payments, and up to $3 million in FDIC insurance.

- Baselane also offers bookkeeping, rent collection, analytics, and more.

- Special Offer ($150 bonus): Earn a $150 bonus after completing four steps with your Baselane Banking account. (1) Make a deposit of greater than $500 into a Baselane banking account within 30 days. (2) Maintain that average balance for 60 days. (3) Make more than $1,500 worth of mortgage payments within 90 days. (4) Collect more than $1,500 of rent via Baselane into Baselane Banking within 90 days.

- Free high-yield bank account

- Free online rent collection

- Same-day ACH payments

- Check writing

- Up to $3 million in FDIC insurance

- 50 states lease creation and e-sign

- Provides Zillow-sourced market values automatically

- No rental property listing capabilities

- No partial rent payment options

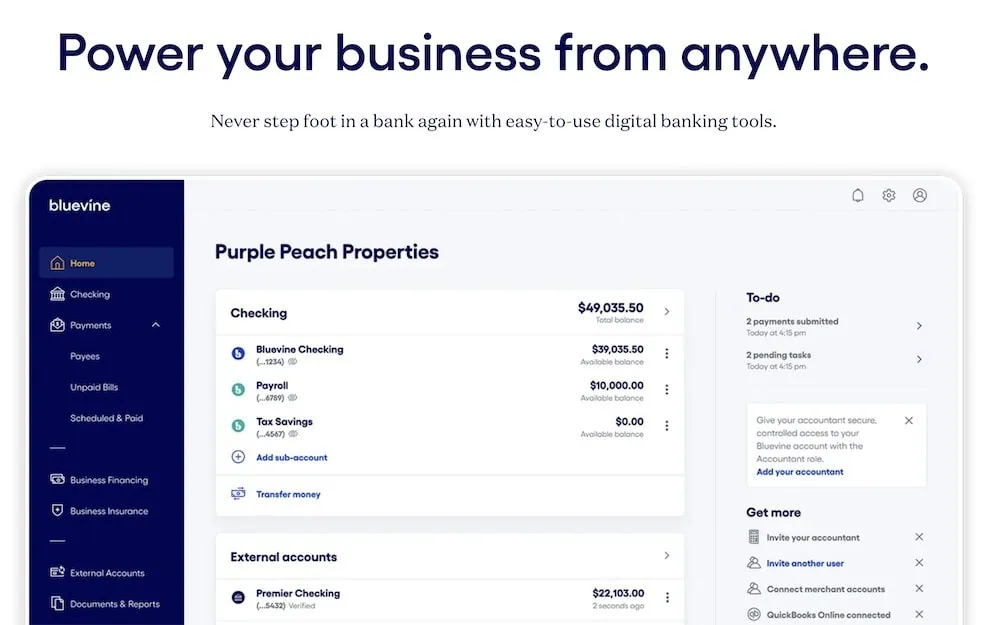

2. Bluevine Business Checking

- Available: Sign up here

Given its array of features, Bluevine Business Checking is a great fit for two very distinct types of real estate investor:

- Beginners

- More established real estate investors who need a line of credit

Bluevine isn’t a brick-and-mortar bank—it’s a fintech that provides solutions for small and midsized businesses. Its Bluevine Business Checking account is a stellar option for starters just given its favorable entry points: You can open a Standard account with no monthly fees, no overdraft fees, and no minimum balance required. The application process is quicker than many other business accounts we’ve reviewed, too.

The account itself delivers features such as the ability to receive unlimited standard ACH payments and incoming wires, automated accounts payable features, mobile check deposit, adding sub-accounts (up to five sub-accounts), secure access sharing with an accountant, and software integrations with essential programs like QuickBooks.

Bluevine also offers a variety of ways to earn money, including varying APYs on varying balance levels depending on your account level, tiered cash-back rewards with its Bluevine Business Debit Mastercard, and unlimited cash back on its Bluevine Business Cashback Mastercard.

All of the above generally makes Bluevine a great choice for small businesses. It’s a decent choice for beginner real estate investors, too, though our opinion would improve even more if Bluevine ever added industry-specific functions.

More experienced investors might be repelled by the same lack of real estate features, as well, though a few might nonetheless be drawn in by Bluevine’s business checking line of credit.

Bluevine offers a line of credit of up to $250,000, with competitive rates you can learn about by visiting the link below to get the latest offer information. (Like with any other line of credit, you only pay interest on the credit you actually use; Bluevine doesn’t charge fees for opening, maintaining, or closing the account.) The terms are somewhat tight, however. Among its minimum qualifications, applicants must have at least $40,000 in monthly revenue, a personal FICO score of at least 625, be in business for 24 months, and be in good standing with your secretary of state.

Interested in learning more or want to open an account today? Learn more or sign up at Bluevine.

- Bluevine offers cost-effective business checking accounts with a variety of features, including accounts payable automation, software integrations with programs like QuickBooks, shared accountant access, and live customer support.

- No monthly or overdraft fees, no minimum balance, and receive unlimited standard ACH payments and incoming wires.

- Bluevine's business checking accounts currently offer a 1.5% annual percentage yield (APY) on balances up to $250,000 (Standard)**, a 3.0% APY on balances up to $250,000 (Plus), and a 4.25% APY on balances up to $3 million (Premier).**

- Earn 1% cash-back rewards on fuel for business travel, 4% cash back for eligible hotels and eligible restaurants for business purposes, and up to 20% cash back for a range of business services with the Bluevine Business Debit Mastercard.

- Earn unlimited 1.5% cash-back rewards on business purchases with the Bluevine Business Cashback Mastercard.

- Depositors enjoy up to $3 million in FDIC insurance.

- Receive discounts on standard payment fees, as well as free printed and mailed checks, with Bluevine's Plus and Premier accounts.

- Bonus: Earn a $300 cash bonus by meeting certain eligibility requirements.

- Up to $3 million in FDIC insurance

- Generous cash-back terms on debit card

- Business line of credit

- No real estate-specific functions

- No physical locations

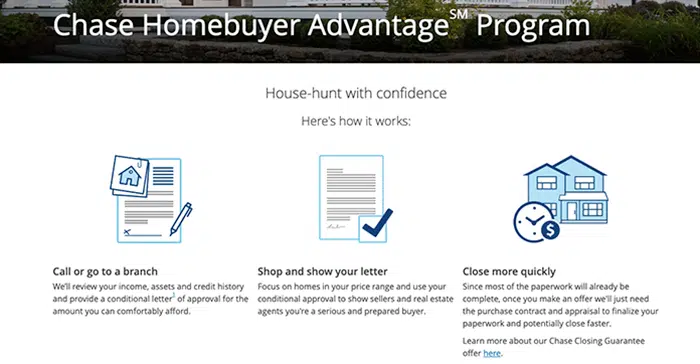

3. Chase Business Banking (Accounts Backed by “Big Four” Bank)

- Available: Sign up here

Chase is a top global financial services firm and America’s largest bank with assets of $2.6 trillion. Its clients include governments, corporations, institutional investors, and wealthy individuals.

And they can help real estate investors get mortgages for more rental properties.

With the Chase Homebuyer Advantage Program, you can have Chase review your credit history, income, and assets to give you a conditional letter of approval for how much you want to spend on your next acquisition. This letter shows real estate agents that you’re a serious buyer. When you make an offer, you can close more quickly; Chase will simply need the purchase contract and appraisal to finish your paperwork.

Meanwhile, the Chase Closing Guarantee says that if you don’t secure an on-time closing in as soon as three weeks, they’ll pay you $5,000—double the original amount they offered when they started the program in 2019.

Once you’re ready to advertise a property, you get access to Chase’s customizable marketing materials and their homebuyer education opportunities.

If you run into any financial troubles when you need to make repairs or anything else, you can get a Chase small business loan. So it’s worth considering also getting a business account with them.

Chase for Business offers useful tools, such as an unlimited 1.5% cash back on business purchases made with their Ink Business Unlimited® card and the ability to take card payments anywhere, anytime with Chase QuickAccept. Deposits are made same-day with no additional fees. If you want to give a card to your property manager or a handyman to use, you can receive Associate Debit and Employee Deposit cards upon request.

A Chase Business Complete Banking® account also makes it easy to send and receive funds through wire transfers, Chase QuickDeposit, and Chase Online Bill Pay. You can earn a $500 bonus for opening a new Chase Business Complete Checking® account online, funding the account with a minimum deposit of $10,000, maintaining the balance for 60 days and completing five qualifying transactions within 90 days of enrollment. Actions include debit card purchases, Chase QuickAccept® deposits, Chase QuickDeposit, ACH (credits), wires (credits and debits), and Chase Online Bill Pay.

The account comes with a monthly service fee of $15, but you have multiple ways to waive the fee, including maintaining a minimum daily balance or making purchases on your Chase Ink Business® credit card.

- Chase Business Complete Checking® is part of Chase Business Complete Banking®, which allows companies to accept payments from anywhere in the U.S.

- Do your business banking anywhere in the country via Chase's massive network of 4,900+ local branches and 15,400 ATMs.

- Meet with our team of bankers for business insights, or go to our online Resource Center to find helpful information.

- $5,000 in no-fee cash deposits per statement cycle.

- Special offer: $500 for new customers.**

- Unlimited debit card purchases and Chase ATM transactions

- Accept fast payments through the Chase Mobile app

- Just 20 fee-free monthly teller and paper transactions

- No interest on account balance

4. Stessa Cash Management (Property management platform and banking)

Available: Sign up here

When you bank with Stessa through its Stessa Cash Management product, you can open an unlimited number of free business bank accounts. You can choose to open several rental property bank accounts to have a separate account for each rental property. These accounts have no monthly maintenance fees, no inbound wire fees, and no minimum balance requirements.

Your Stessa bank account seamlessly integrates with Stessa’s rental property software. Your Cash Management card lets you tie purchases directly to a property.

The software lets you access your portfolio from anywhere, collaborate with others, and organizes all of your important real estate documents. It also lets you automate income and expense tracking, run unlimited monthly reports (new cash flow, capital expenses, etc.), and export tax-ready financial documents.

Additionally, it helps onboard tenants and lets them set up recurring online rent payments to be deposited into your bank account.

When you’re ready to expand, Stessa has the resources you need to scale. Through Stessa’s parent company, Roofstock, you can look through a curated selection of property listings to find your next investment. Roofstock can also help you sell your property or portfolio.

Stessa is free, but there are optional paid premium services including mortgage financing and market research. For instance, you can access instant online mortgage quotes within your Stessa account. You can also get fast landlord insurance quotes from Obie via your account.

- Stessa makes rental property finances simple by providing your portfolio's performance through an informative dashboards and reporting.

- Create financial statements, perform bookkeeping tasks and manage your money through an FDIC-insured account that offers a competitive 2.14% APY* for free users or 3.67% APY for Pro users (as of 9/19/2025) and has no maintenance fees or other hidden fees.

- Account holders can earn 1.1% cash back on debit card purchases.*

- Use Stessa to collect rent on autopilot.

- You can even use Stessa's parent company, Roofstock, to buy and sell investment real estate.

Related Questions About the Best Banks (and Bank Services) for Landlords + Real Estate Investors

Naturally, making the most out of a business bank account isn’t just about who you bank with or your account’s features—it’s what you do with it. Here are some questions about how landlords and real estate investors alike can maximize their business account’s potential.

Should You Use a Separate Bank Account for Your Rental Property?

Yes, it’s wise to use a separate bank account for your rental property. Doing so will significantly simplify your business.

Having a separate account will keep your personal and business funds separate, rather than commingled. This protects your personal assets, simplifies income and expense tracking, and makes tax season easier. (Trust us: Your CPA will thank you.)

Some real estate investors have both a checking and savings account for their rental property. The checking account is for all income and expenses, while the savings account might store security deposits or funds for emergency repairs.

Should You Use Separate Bank Accounts for Each Property?

Whether you should use separate bank accounts for each property depends on your personal situation.

If you have just a couple of properties or are using accounting software, you might be fine with just one rental property bank account. However, if you have multiple legal entities, you should obtain separate rental property bank accounts for each legal entity.

Many landlords find it easier to have a different business account for each of their rental properties, while some find it requires too many transfers.

Should You Separate Your Personal and Business Finances?

Rental property owners should always have separate personal and business accounts. Having a business bank account makes it easier to track income and expenses.

You want to be able to know in an instant how much of your money is set aside for business and how much can be spent on personal expenditures.

When tax season arrives, you’ll save yourself (and your CPA!) a headache by not needing to weed through transactions in your personal account to find the ones applicable to your business. Products like those from Baselane and Stessa help with this.

Do These Accounts Offer Rental Property Accounting Software?

Yes, Baselane and Stessa both offer rental property accounting software.

Baselane categorizes all of your expenses and can quickly show you your YTD revenue, YTD expenses, and more.

Stessa organizes your real estate documents and automatically tracks your income and expenses. You can run an unlimited number of reports on capital expenses, cash flow, and more.

Are There Fees on Business Bank Account Options?

It depends. Some business bank accounts charge fees but waive them if you meet a minimum funds level in your account.

For example, a LendingClub Bank Tailored Checking account charges no fee if your average monthly balance is at least $500. However, if you consistently have a lower balance, LendingClub will charge a $10 monthly fee.

Other bank accounts waive fees if you use enough of their features. Other accounts are entirely free and you only pay if you sign up for premium services.

Carefully consider which bank account(s) deliver the best value for your needs.

How Can I Track Business vs. Personal Expenses for Real Estate Investments?

It’s important to always be up-to-date on the state of your business finances. The two easiest ways to track business vs. personal expenses are to have separate bank accounts and use software to track and organize all of your expenses.

Preferably, your business bank account comes with a free debit or credit card.

You can get financial software for your rental properties for free; some of these services will even generate financial reports for you.

Do Any of These Bank Accounts Offer Assistance With Online Rent Collection?

Yes: Baselane and Stessa both make online rent collection simple.

With Baselane, tenants can pay rent online with credit cards, debit cards, or bank transfers. They can also set up recurring payments, so rent is always on time.

Stessa also lets residents pay rent online and set up recurring payments.