If you want straightforward, broad-market index funds, Fidelity’s ETF lineup has more than enough cost-effective options to pique your interest.

But if you want something more tactical and acute, Fidelity has you covered, too.

Many ETF providers specialize in either broad, blunt-force indexes or specialized funds delivering thematic, leveraged, inverse and other, more exotic strategies. Fidelity is happy to deal in both, giving it one of the more interesting fund rosters among major and niche providers alike. It also doesn’t exclusively offer indexed ETFs, either—some of Fidelity’s best ETFs are helmed by honest-to-goodness human fund managers, providing the kind of expertise that most people associate with mutual funds.

Let’s look at Fidelity’s best ETFs for 2026—a group of funds that run the gamut, from simple, passive strategies to “smart beta” indexes to actively managed products.

Editor’s Note: Tabular data presented in this article is up-to-date as of Jan. 27, 2026.

Featured Financial Products

Disclaimer: This article does not constitute individualized investment advice. Individual securities, funds, and/or other investments appear for your consideration and not as personalized investment recommendations. Act at your own discretion.

Table of Contents

Why Choose Fidelity ETFs?

Fidelity doesn’t have an enormous ETF line: As of my most recent check, it offers about 75 products.

But those 75 funds cover a lot of ground.

The best Fidelity ETFs are often very tactical, typically focused on indexes that are not your typical vanilla benchmark like the S&P 500. They also can be actively managed with an eye toward providing investors an edge.

If you’re just looking for vanilla investments, Fidelity funds might not be for you. But if you want to get a little more sophisticated than a plain-Jane index of blue-chip stocks, and instead target certain market subsets such as mid-cap stocks, growth stocks, or small-cap companies, then a Fidelity fund might be the right move.

What Is an ETF?

The letters “ETF” stand for “exchange-traded fund.” Those first two words refer to the fact that these investment products are listed on an exchange, just like individual stocks. And as anyone who is even loosely familiar with Wall street should know, the last word—fund—is a grouping of different assets including stocks, bonds, and other investments.

The most exclusive investment funds run by elite firms are definitely not exchange-traded. They’re not even publicly traded. They often have huge investment minimums of $1 million or more, and are by invitation only. Conversely, an ETF is easily tradable and transparent in its returns; it fluctuates in price during a given trading day based on its underlying assets.

Anyone can buy these funds for the price they are listed at, just like your favorite blue-chip stocks.

Related: The 16 Best ETFs You Can Buy for 2026

ETFs vs. Mutual Funds

Mutual funds—ETFs’ older cousins—trade publicly, but they do not trade on an exchange. Investors looking to buy or sell can put in orders any time they’d like, but orders are only executed once each trading day, after the markets close at 4 p.m.

Exchange-traded funds, on the other hand, move up and down just like stocks or other assets during the trading day.

Also unlike mutual funds, ETFs don’t have minimum investment thresholds—the minimum cost is just one share (or less if your broker offers fractional shares). And ETFs are different from both mutual funds and closed-end funds (CEFs)—which also trade on major exchanges—because how they’re structured makes them more tax-efficient to buy and sell.

On top of all of this, most (but not all) ETFs are index funds that are benchmarked to a fixed list of assets, and thus are passively managed. However, most (but again, not all) mutual funds are actively managed by managers based on specific investment strategies. As a result, exchange-traded funds generally have a lower average expense ratio. But this relationship isn’t universally true—some actively managed ETFs can charge more than similar passively managed mutual funds!

In other words: Just like with any other investment, when it comes to buying ETFs, do your homework before buying.

The Best Fidelity ETFs for 2026

I start virtually every review of investment funds by booting up Morningstar Investor and running a quality screen I customize for each article.

In this case, I started by narrowing down Fidelity ETFs to those that have earned a Morningstar Medalist rating of at least Bronze or better. Unlike Morningstar’s Star ratings, which are based upon past performance, Morningstar Medalist ratings are a forward-looking analytical view of a fund. Per Morningstar:

“For actively managed funds, the top three ratings of Gold, Silver, and Bronze all indicate that our analysts expect the rated investment vehicle to produce positive alpha relative to its Morningstar Category index over the long term, meaning a period of at least five years. For passive strategies, the same ratings indicate that we expect the fund to deliver alpha relative to its Morningstar Category index that is above the lesser of the category median or zero over the long term.”

As I’ve written in other Young and the Invested articles, a Medalist rating doesn’t mean Morningstar is necessarily bullish on the underlying asset class or categorization. It’s merely an expression of confidence in the fund compared to its peers.

Past that, I only looked at ETFs with fees that are considered “Below Average” (second-least-expensive 20% of funds in their Morningstar Category) or “Low” (least expensive 20%). As it turns out, all ETFs selected fall within that bottom 20% by fees, so they’re as cost-effective as you could want. And a handful have recently reduced their fees even further.

The rest was “dealer’s choice”: These best Fidelity ETFs for 2026 cover a variety of different strategies and investor needs. In no particular order …

Related: The 11 Best Fidelity Funds You Can Own

1. Fidelity Nasdaq Composite Index ETF

— Style: Large-cap growth stock

— Management: Index

— Assets under management: $9.4 billion

— Dividend yield: 0.5%

— Expense ratio: 0.21%, or $2.10 per year for every $1,000 invested

— Morningstar Medalist rating: Silver

I frequently start fund lists with an S&P 500 index fund, when applicable. After all, U.S. large caps are frequently recommended to build a portfolio core, and for that, it’s difficult to do better than the S&P 500!

Difficult … but not impossible.

The Nasdaq Composite Index—made up of the roughly 3,300 stocks listed on the Nasdaq stock exchange—has pummeled the S&P 500 for quite some time. On a pure price basis (which gives us a longer trail of data), the Nasdaq has outdone the S&P 500 by about 420% to 265% over the trailing 10 years, 940% to 450% over the trailing 20, and 2,190% to 1,020% over the past 30 years. The S&P 500’s underperformance isn’t as great when you include dividends … but it’s still a wide disparity.

Related: 7 Best High-Yield Dividend Stocks: The Pros’ Picks for 2026

The Fidelity Nasdaq Composite Index ETF (ONEQ) is a diversified index fund that holds much of the Nasdaq Composite, but not all. Instead, ONEQ uses statistical sampling to come up with a sizable portfolio (approximately 1,030 holdings currently) that has a “similar investment profile” to the index.

Like the index, the Fidelity Nasdaq Composite Index ETF is weighted by size, so the larger the company, the more assets are invested in that company’s stock. Thus, the biggest holdings are popular companies you might recognize: Nvidia (NVDA). Apple (AAPL). Microsoft (MSFT).

Just don’t mistake ONEQ for a complete S&P 500 replacement. The Nasdaq Composite, while technically diversified across market sectors, is even more heavily weighted in technology stocks (~50%) than the S&P 500 (~35%) right now. And while both indexes’ sector blends can and will shift over time, the Nasdaq has historically been more tethered to tech.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

2. Fidelity Enhanced Large Cap Growth ETF

— Style: Large-cap growth stock

— Management: Active

— Assets under management: $4.7 billion

— Dividend yield: 0.4%

— Expense ratio: 0.18%, or $1.80 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

Whenever you think the market’s animal spirits will take control of the wheel, the Fidelity Enhanced Large Cap Growth ETF (FELG) should be among the first ETFs to come to mind.

This Fidelity ETF focuses on the largest growth stocks on Wall Street. Managers Anna Lester, George Liu, and Shashi Naik are charged with investing at least 80% of assets in common stocks found in the Russell 1000 Growth Index, which they analyze for valuation, growth, profitability, and other factors to build a portfolio aiming to beat the Russell 1000 Growth Index.

Related: The Best Dividend Stocks: 10 Pro-Grade Income Picks for 2026

Their 115-stock portfolio, much like ONEQ, is overwhelmingly tech-heavy. Currently, more than half of the fund’s assets are currently invested in tech stocks such as Magnificent Seven firms Nvidia and Apple; consumer discretionary and communication services stocks (both of which have a number of tech-esque firms) claim double-digit weights as well.

Also worth noting is that the portfolio is almost entirely U.S.-based; less than 1% of assets are tied up in international firms.

If the economy takes a tumble, growth could fall out of favor once more. Fears of exactly that threw a wrench into FELG’s gears during the first half of 2025. But if you’re looking beyond recent turbulence and want to invest in the continued growth of leading U.S. corporations, Fidelity’s large-cap ETF is a simple and effective way to do so.

Related: 9 Best Schwab ETFs to Buy [Build Your Core for Cheap]

Featured Financial Products

Best Fidelity ETF #3: Fidelity Enhanced Large Cap Value ETF

— Style: Large-cap value stock

— Management: Active

— Assets under management: $2.6 billion

— Dividend yield: 1.7%

— Expense ratio: 0.18%, or $1.80 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

Growth is often pitted as the opposite of value—a strategy you can tap via FELG’s sister funds, Fidelity Enhanced Large Cap Value ETF (FELV).

You might as well call them twins. FELV and FELG have the same management team, and have the same mandate to invest at least 80% of assets in a Russell 1000 index—this time the Russell 1000 Value—with the aim of topping that index.

But the end result is a completely different portfolio.

Related: The 10 Best-Rated Dividend Aristocrats Right Now

Fidelity Enhanced Large Cap Value ETF has a much wider holdings set of 325 value stocks at present. The leaders are much somewhat different—financials and industrials top the list, though technology is up there, too—and sector breadth is much better. You do indeed get value, too … at the very least, relative to growth. Fidelity Enhanced Large Cap Value’s components collectively have a price-to-earnings (P/E) ratio of 16 and price-to-sales (P/S) of 2.0. Fidelity Enhanced Large Cap Growth, meanwhile, has a portfolio P/E of 26 and P/S of 6.6.

And as is common in value-oriented funds, you also get more income—FELV’s 1.7% dividend yield is ahead of the S&P 500 Index, and leaps and bounds better than the 40 basis points you’d earn through the FELG. (A basis point is one one-hundredth of a percentage point.)

Make Young and the Invested your preferred news source on Google

Simply go to your preferences page and select the ✓ box for Young and the Invested. Once you’ve made this update, you’ll see Young and the Invested show up more often in Google’s “Top Stories” feed, as well as in a dedicated “From Your Sources” section on Google’s search results page.

4. Fidelity Small-Mid Multifactor ETF (FSMD)

— Style: Small- and mid-cap stock

— Management: Index

— Assets under management: $2.0 billion

— Dividend yield: 1.3%

— Expense ratio: 0.15%, or $1.50 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

Financial experts routinely say to make U.S. large caps the core of your portfolio, but they also frequently advise investors seeking out growth to allocate some of their funds to small- and/or mid-cap stocks*.

Why? Well, the easiest explanation is the business rule of large numbers, which basically says that it’s a lot easier to double your revenues from $1 million than it is to double them from $1 billion. The smaller the company, then, the easier it is to demonstrate growth. On the flip side, though, small- and mid-cap stocks don’t enjoy some of the benefits their larger brethren do—their cash holdings aren’t as substantial, they have less access to capital, and their product lines often aren’t as diversified—making them riskier to invest in.

Related: 9 Best Fidelity Index Funds to Buy

One way to defray that risk is by spreading your money out across many of these stocks, which you can do through funds such as the Fidelity Small-Mid Multifactor ETF (FSMD). While it’s more common to find funds that invest in either small caps or mid-caps, FSMD is a “SMID” fund that invests in both. And it does so through a “multifactor” lens, which means stocks are selected based on four factors:

- Value (examples: low P/E, low P/S)

- Quality (examples: stable earnings, strong balance sheets, low debt)

- Positive momentum signals (examples: moving average, Relative Strength Index)

- Low volatility compared to the broader market (examples: low beta, standard deviation)

The end result is a roughly 80/20 small/mid blend of just under 600 stocks that is well diversified across sectors and attractively valued compared to basic small- and mid-cap indexes. Also, you’re minimally exposed to single-stock blowups; FSMD currently invests less than 1% in each and every one of its equity holdings.

* There are different ways to define “cap” levels. We’re adhering to Morningstar’s definition, which says the largest 70% of companies by market capitalization within a fund’s “style” are large caps, the next 20% by market cap are mid-caps, and the smallest 10% by market cap are small caps.

Related: The 12 Best Vanguard ETFs for 2026 [Build a Low-Cost Portfolio]

5. Fidelity High Dividend ETF

— Style: Dividend stock

— Management: Index

— Assets under management: $8.4 billion

— Dividend yield: 2.9%

— Expense ratio: 0.15%, or $1.50 per year for every $1,000 invested

— Morningstar Medalist rating: Silver

If you want to prioritize dividend stocks, consider the Fidelity High Dividend ETF (FDVV).

This index fund holds a focused list of only about 120 or so stocks, but it’s one of the best Fidelity ETFs because of its selectivity.

Related: The 10 Best Dividend ETFs [Get Income + Diversify]

Some dividend funds will “reach” for yield by hyperfocusing on headline yield numbers while ignoring potential signals of poor quality. However, FDVV zeroes in on the very best dividend payers based on consistency of distributions, a strong history of payouts, and expectations that they’ll continue to grow those cash distributions going forward.

Top holdings currently include some of the aforementioned mega-cap tech stocks, but also “Big Four” bank JPMorgan Chase (JPM), payment processor Visa (V), Big Oil titan Exxon Mobil (XOM), and consumer staples mainstay Philip Morris International (PM).

This Fidelity ETF lives up to its name, boasting a yield that’s well more than twice the broader market’s. It’s also worth noting that Morningstar upgraded this fund from Silver to Gold near the end of 2025, citing its sound investment process and low fees.

Related: 8 Best Stock Picking Services and Subscriptions

6. Fidelity MSCI Information Technology Index ETF

— Style: Sector (Technology)

— Management: Index

— Assets under management: $16.9 billion

— Dividend yield: 0.4%

— Expense ratio: 0.084%, or 84¢ per year for every $1,000 invested

— Morningstar Medalist rating: Bronze

Sector-specific funds are another way to take a step beyond core holdings and truly differentiate your portfolio.

Related: The 9 Best ETFs for Beginners

Among the most popular options is the Fidelity MSCI Information Technology Index ETF (FTEC), a popular technology-sector ETF that includes about 290 tech stocks. This goes well past the 70 or so stocks held by other tech ETFs that limit themselves to only S&P 500 firms. You also get healthy exposure to mid-cap stocks and even small-sized companies.

Naturally, though, this cap-weighted fund is heaviest in Silicon Valley companies. NVDA, AAPL, and MSFT alone account for around 45% of assets, meaning these three stocks wield much, much more influence over the fund’s performance than other FTEC holdings.

But if you want to look at the glass as half-full, you can consider these mega-caps a strong foundation for FTEC to help smooth out some of the volatility that smaller technology names might experience.

Related: 11 Best Investment Opportunities for Accredited Investors

7. Fidelity MSCI Health Care Index ETF

— Style: Sector (Health care)

— Management: Index

— Assets under management: $2.9 billion

— Dividend yield: 1.4%

— Expense ratio: 0.084%, or 84¢ per year for every $1,000 invested

— Morningstar Medalist rating: Bronze

Many investors are drawn to the health care sector because of its lower risk profile and consistency. After all, one of the few certainties in life is that we’ll all get sick eventually, and need care as we age.

Related: 8 Best Schwab Retirement Funds [High Quality, Low Costs]

If this approach appeals to you, the Fidelity MSCI Health Care Index ETF (FHLC) is one of the best Fidelity ETFs to buy. The fund holds roughly 335 stocks across the pharmaceutical, biotechnology, medical device, health insurance, and other industries. Currently anchoring this Fidelity health care fund is Big Pharma name and weight-loss drug leader Eli Lilly (LLY) at 13% of assets. Other top holdings include diversified health care firm Johnson & Johnson (JNJ), biopharma stock AbbVie (ABBV), and insurance giant UnitedHealth Group (UNH).

In short: FHLC is a simple, effective, and cost-efficient way to play the health care sector.

Featured Financial Products

8. Fidelity Enhanced International ETF

— Style: International large-cap stock

— Management: Active

— Assets under management: $6.9 billion

— Dividend yield: 3.0%

— Expense ratio: 0.28%, or $2.80 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

Like with FELG and FELV, Fidelity Enhanced International ETF (FENI) involves a team of human managers investing at least 80% of assets in an index’s components—in this case, the MSCI EAFE index of developed-market stocks—while trying to do better than the index itself.

There are numerous ways to diversify a portfolio, and geographic differentiation is one of them. While U.S. markets have historically done much better than most of the world over time, they’re not bulletproof—and having exposure to the rest of the world’s stocks could prove advantageous should America go through any localized swoons (see: 2025).

Related: Retirement Plan Contribution Limits and Deadlines for 2025 + 2026

Lester, Liu, and Naik also helm this Enhanced Fidelity ETF. Their 335-stock portfolio is more than 90% large-cap in nature, and virtually all of their holdings are domiciled in either Europe or Asia, with Japan, the U.K., France, and Germany taking up the largest slices of the spotlight.

This is also a high-yield dividend ETF. Blue chips like Swiss pharmaceutical firm Novartis (NVS) and Japanese automaker Toyota (TM) help drive a yield of 3.0% that’s almost three times more than what similarly built U.S. large-cap index funds have to offer.

Do you want to get serious about saving and planning for retirement? Sign up for Retire With Riley, Young and the Invested’s free retirement planning newsletter.

9. Fidelity Total Bond ETF

— Style: Core bond

— Management: Active

— Assets under management: $24.1 billion

— SEC yield: 4.5%*

— Expense ratio: 0.36%, or $3.60 per year for every $1,000 invested

— Morningstar Medalist rating: Gold

Another popular and well-established Fidelity fund is the Fidelity Total Bond ETF (FBND). This is an actively managed bond fund, run by an eight-person team, that holds about 4,450 debt securities. At present, that portfolio deals out more than four times the S&P 500’s yield.

Related: 7 Low- and Minimum-Volatility ETFs for Peace of Mind

The title of this Fidelity ETF says it all. FBND holds a variety of bonds rather than focusing on one particular slice of the fixed-income pie. As far as debt types go, government bonds are the biggest slice at 39%; corporate debt and securitized debt each make up 29% apiece. The tiny remainder sits in cash. And some of those corporate bonds are below investment-grade (aka “junk”), so they’re riskier, but they offer super-sized yields to compensate.

An important number to note is duration, which currently sits at six years. Duration is a measure of interest-rate sensitivity; FBND’s duration of 5.8 years implies that for every 1-percentage-point rise in interest rates, the fund would experience a short-term decline of 5.8%, and vice versa. The actual calculation is more complex; this is just a simplification that helps investors understand that the greater the duration, the greater the risk.

Want to put the wisdom of this asset manager’s experts to work in your portfolio? FBND is one of the best Fidelity ETFs to do just that.

* SEC yield reflects the interest earned across the most recent 30-day period. This is a standard measure for funds holding bonds and preferred stocks.

Related: The 7 Best Gold ETFs You Can Buy

Learn More About These and Other Funds With Morningstar Investor

If you’re buying a fund you plan on holding for years (if not forever), you want to know you’re making the right selection. And Morningstar Investor can help you do that.

Morningstar Investor provides a wealth of information and comparable data points about mutual funds and ETFs—fees, risk, portfolio composition, performance, distributions, and more. Morningstar experts also provide detailed explanations and analysis of many of the funds the site covers.

With Morningstar Investor, you’ll enjoy a wealth of features, including Morningstar Portfolio X-Ray®, stock and fund watchlists, news and commentary, screeners, and more. And you can try it before you buy it. Right now, Morningstar Investor is offering a free seven-day trial and a discount on your first year’s subscription when you use our exclusive link.

Do Fidelity ETFs Include Actively Managed Funds?

Yes. Many of Fidelity’s mutual funds made a name for themselves thanks to strong active management. And the Fidelity Total Bond ETF (FBND) is a good example of how this strategy can be put to use in exchange-traded Fidelity funds. As of this writing, Fidelity had 44 actively managed ETFs, including the likes of FBND, Fidelity Blue Chip Growth ETF (FBCG), and Fidelity Small-Mid Cap Opportunities ETF (FSMO).

Related: The 7 Best Mutual Funds for Beginners

Fidelity also has funds like the Fidelity High Dividend ETF (FDVV), which are labeled as “strategic beta” funds. That’s because they take an underlying index but put additional screening methodology on top to provide a more curated list of holdings.

You’ll certainly find passive, indexed ETFs among Fidelity’s funds. But there are certainly actively managed funds, too.

Does Fidelity Have ESG ETFs?

Yes. A few Fidelity funds focus around environmental, social, and governance (ESG) topics, with a heavy lean toward the “E.”

For instance, the Fidelity Clean Energy ETF (FRNW) holds companies involved in solar, wind, or other renewable resources. And the Fidelity Electric Vehicles and Future Transportation ETF (FDRV) invests in electric-vehicle and EV component makers; however, the fund also homes in on autonomous-vehicle firms, which can (but don’t necessarily have to) focus on environmental friendliness.

Related: The 7 Best Fidelity Index Funds for Beginners

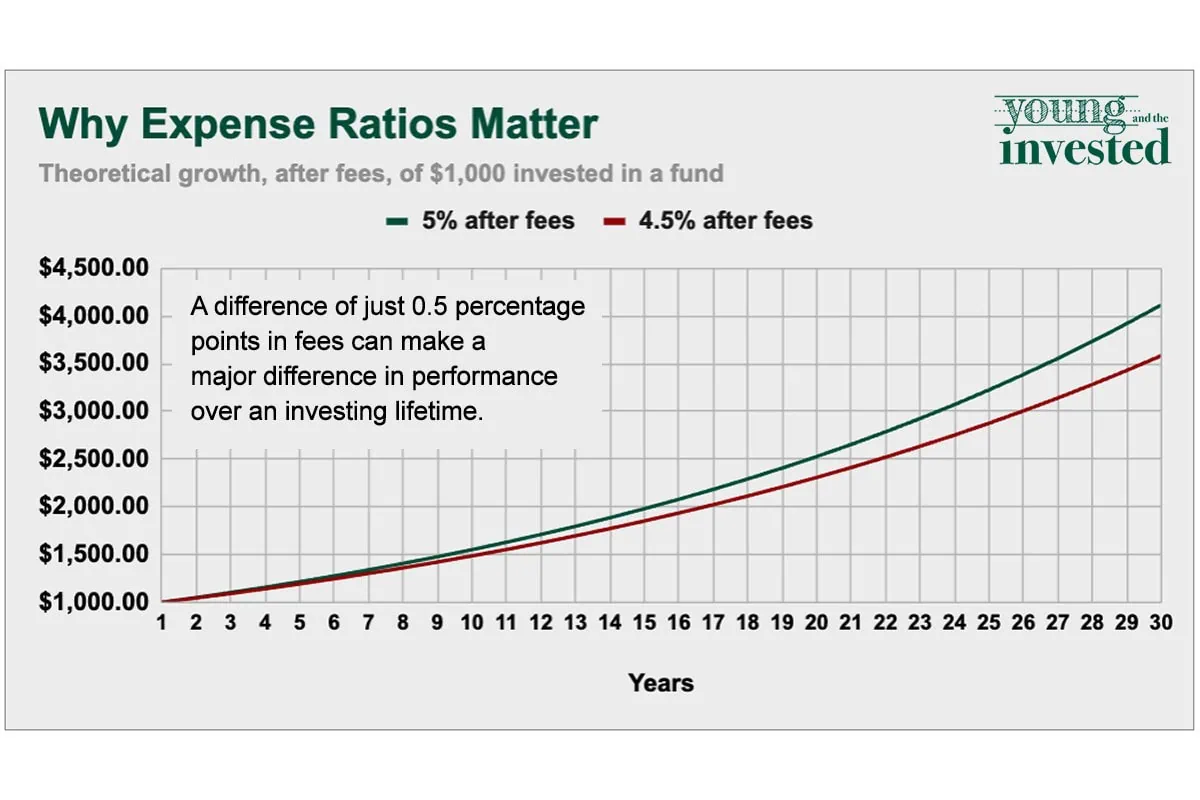

Why Does a Fund’s Expense Ratio Matter So Much?

Every dollar you pay in expenses is a dollar that comes directly out of your returns. So, it is absolutely in your best interests to keep your expense ratios to an absolute minimum.

The expense ratio is the percentage of your investment lost each year to management fees, trading expenses and other fund expenses. Because index funds are passively managed and don’t have large staffs of portfolio managers and analysts to pay, they tend to have some of the lowest expense ratios of all mutual funds.

Related: 10 Best ETFs to Beat Back a Bear Market

This matters because every dollar not lost to expenses is a dollar that is available to grow and compound. And over an investing lifetime, even a half a percent can have a huge impact. If you invest just $1,000 in a fund generating 5% per year after fees, over a 30-year horizon, it will grow to $4,116. However, if you invested $1,000 in the same fund, but it had an additional 50 basis points in fees (so it only generated 4.5% per year in returns), it would grow to only $3,584 over the same period.

Related: Best Vanguard Retirement Funds for a 401(k) Plan

Want to talk more about your financial goals or concerns? Our services include comprehensive financial planning, investment management, estate planning, taxes, and more! Schedule a call with Riley to discuss what you need, and what we can do for you.

Related: The 10 Best Dividend ETFs [Get Income + Diversify]

We love exchange-traded funds (ETFs) because they can provide one-click access to hundreds, even thousands of stocks, while charging often minuscule fees.

One way to put that low-cost diversification to work? Collecting dividends. But trying to choose from literally hundreds of income-producing funds could take up a lot more time than you have. So let us help you narrow the field—check out our list of 10 top dividend ETFs.

Related: 15 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if you’re looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.

Please Don’t Forget to Like, Follow and Comment

Did you find this article helpful? We’d love to hear your thoughts! Leave a comment with the box on the left-hand side of the screen and share your thoughts.

Also, do you want to stay up-to-date on our latest content?

1. Follow us by clicking the [+ Follow] button above,

2. Subscribe to Retire With Riley, our free weekly retirement planning newsletter, and

3. Give the article a Thumbs Up on the top-left side of the screen.

4. And lastly, if you think this information would benefit your friends and family, don’t hesitate to share it with them!