Most people love a good “rags-to-riches” tale. Someone starting from the economic basement works hard and not only turns their life around—they become an enormous success. It’s a feel-good story anyone could appreciate, and it gives us all hope that, if we were suddenly down on our luck, we too could overcome and earn our way to the gilded life.

Of course, these tales are also so appealing because they’re so rare in real life.

Among the many reasons why it’s so difficult to improve your socio-economic status from the bottom is that being poor is actually very expensive. It’s not just the difficulty of trying to live with far less money—it’s that in many cases, people in low-income communities pay more for the same items and services as their wealthier counterparts.

This struggle is aptly nicknamed the “poor tax.” Like the “pink tax,” it’s not technically a tax—but it’s a financial reality that very much acts like a tax. If you want to learn more, read on, and I’ll show you several examples of how the “poor tax” makes being poor more expensive than you might realize. We’ll also list a few of the most essential things people can do to try to break the cycle of poverty.

The Hidden Costs of Being Poor

Common responses to “why is so-and-so always broke?” is that the person is a poor budgeter or that they overspend on non-essentials.

Does this happen? Absolutely. But some people simply don’t make enough money to make ends meet—and often, they’re shouldering the burden of additional costs many people don’t realize exist.

Here, we’ll try to open some eyes to ways poor people end up paying more:

1. Groceries

You can cut a lot of things out of your budget to make ends meet, but food isn’t one of them.

“Food insecurity”—not having enough access to food, or food of sufficient quality, to meet one’s basic needs—is a massive problem in America. According to the U.S. Department of Agriculture, 44.2 million people lived in food-insecure homes in 2022. And low-income families struggle with food insecurity for a number of reasons.

For one, they can’t afford to buy items in bulk, which is more cost-efficient because you’re not paying as much for packaging. For instance, a warehouse store might sell a 100-ounce can of beans for $6 (6¢ per ounce), while a grocery store might sell a 14.5-ounce can of beans for $1.50 (~10¢ per ounce). But poor families typically can’t afford a warehouse membership in the first place, and $6 might be more than they can afford to spend on that particular item in a given week anyways.

Having a smaller food budget also means you can’t always take advantage of sales. If you’re price-constrained to the point where you don’t buy something until you absolutely need it, that means you can’t buy something just because it’s suddenly more affordable. (Conversely, people with more flexible budgets tend to stock up on items during sales.)

There is also the issue of “food deserts,” where there is insufficient access to grocery stores or at least stores with healthy, affordable food. Food deserts are more common in low-income neighborhoods. Moreover, if you don’t live near many stores—particularly if you don’t have your own transportation—you often have to settle for whatever prices your nearest store charges. The alternative? Pay much more in transportation costs (fare or gas) to go to a farther store, which could possibly negate any food savings.

Related: Food Costing a Fortune? Here’s 12 Tips for How to Save Money on Groceries

2. Health Care

The U.S. has one of the world’s highest costs of health care, and one of the largest chunks of those costs is health insurance. As a result, many people are tempted to skip buying it altogether, especially if they simply can’t afford it without cutting into more immediate needs (rent, food, utilities).

Now, even insured Americans can get hit with medical debt, but it impacts the uninsured far worse. According to the Commonwealth Fund 2023 Health Care Affordability Survey:

- 32% of all respondents said they had medical or dental debt they were paying over time.

- However, uninsured people were the most likely to report having medical or dental debt, at 41%.

- Even among those with employer-sponsored insurance, the greatest cohort reporting medical or dental debt were those in the lowest economic bracket (income of less than 200% of the federal poverty level), at 44%.

Zooming out, more than half of that low-income bracket (56%) reported generally struggling with health care costs.

People without health insurance are less likely to have preventative and primary care visits, and those who postpone care are more likely to need hospitalization for chronic conditions. So not only can being uninsured be costlier over the long term—it can be deadlier, too.

Related: Frugal vs. Cheap: What’s the Difference

3. Preventative Dental Care

In the same vein, people who can’t afford preventative dental care can also risk much bigger bills (or bigger problems that go unaddressed) down the road.

An example of the cost of not having dental insurance: Last year, a friend of mine who doesn’t have dental insurance had her wisdom teeth pulled out. It cost her about $3,100 (the cheapest price she could find after calling several offices). If she had dental insurance, it likely would have covered around 50% to 80% of the cost.

Wisdom teeth are beyond your control, but preventative dental care isn’t. Whether or not you have dental insurance, getting regular cleanings, X-rays, and fillings (if necessary) is important to your health and can prevent the need for costlier procedures.

Pretend you have a cavity that’s bothering you and you don’t have dental insurance. Depending on the location where you get it done and the material used, prices vary, but the price is often between $200 to $600.

Let’s say you ignore the pain because you can’t afford a filling. Eventually, the pain worsens and when you finally see a dentist, you find out you need a root canal. The average cost of a root canal, without insurance help, is $600 to $1,600—potentially much more than it would have cost to get the filling right away.

Related: 10 ‘Frugal’ Habits That Aren’t Actually Saving You Money

4. Laundry

Another aspect of life in which low-income people pay more is doing laundry.

Anyone who has gone from using the laundromat to their own in-home appliances knows how much easier their lives became as a result. But they might not have realized they probably came out financially ahead, too.

This involves a little math, but …

- The average cost of doing a load of laundry at home (so, electricity, water, laundry supplies, etc.) is roughly $1.40.

- The average cost of doing a load of laundry at the laundromat is roughly $3.10.

- If you do the U.S. average 300 loads of laundry per year, you pay $420 per year at home, and $930 per year at the laundromat. So you save $510 per year by doing your laundry at home.

You’ll note that these numbers don’t factor in the cost of buying a washer and dryer. Well, you can purchase a low-end washer and dryer set for roughly $1,000, so it would take just two years ($510 annual savings x 2 years) to offset the difference—everything after that is pure financial upside.

But that’s no help to a person who can’t save $1,000 to buy a washer and/or dryer, or doesn’t have accommodations big enough to store those appliances.

Low-income people not only miss out on this cheaper cost of doing laundry—they also lose time. That includes the time of doing laundry at the laundromat rather than multitasking at home, and the time it takes to drive (or ride the bus) to and from the laundromat. And that time really is money; it could be spent picking up more hours at work or even doing a side hustle.

Related: Consumers Are Drawing the Line at These Too Expensive Products + Services

5. Transportation

The cost of getting yourself from A to B is one of the biggest line items in a family budget.

Research published by the Bureau of Transportation Statistics shows that in 2022, transportation was the second highest household expenditure, eating up 15% of budgets on average. But transportation costs hit much harder for low-income households, which spent an average of 30% of their after-tax income on getting there and back.

Part of that is because of the low income itself. But it also has to do with various aspects of vehicle ownership.

For one, many households can buy new cars outright, or at least finance them at decent rates. However, lower-income households often can only afford used cars, which traditionally are financed at higher rates. And used cars usually don’t have the benefit of warranty coverage, so owners typically have to start paying for repairs much sooner than new-car owners.

Public transportation is a great, affordable option in some cities. But it’s not widely available everywhere. And in some places, it’s cost-prohibitive. So some people are stuck between paying high public transportation rates or buying a car at usurious rates.

Even situational costs are different. Wealthier households typically have more than one car, so if one car does break down, they can simply use a different car until the first one is repaired. But many low-income households have just one car—so if that car breaks down, they’re looking at either public transportation costs or expensive ride-share fees until they get their vehicle back.

Related: Always Buy the Cheapest Versions of These Products

6. Banking + Credit Card Fees

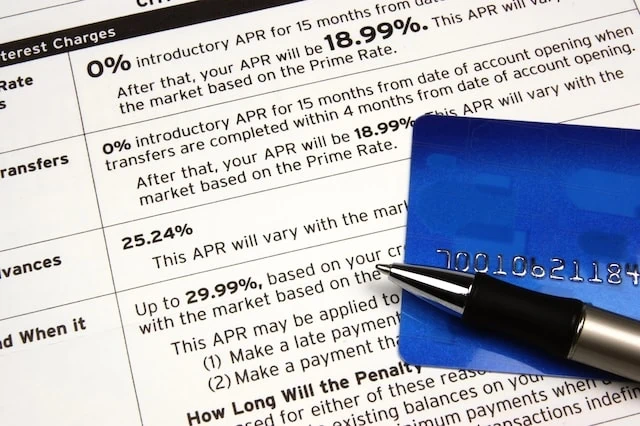

Banking is exceedingly more expensive for people with low incomes thanks to numerous factors.

Overdraft fees disproportionately impact low-income households for obvious reasons—people with higher incomes are better able to maintain sufficient fund balances—and they’re extremely punitive.

Per the Consumer Financial Protection Bureau: “CFPB research has found that people who pay more than 10 overdraft fees per year end up paying nearly three-quarters of all overdraft fees, and on average, these frequent overdrafters paid $380 in overdraft fees during the year.” After all, if you have so little money that you can’t avoid an overdraft fee, a $35 overdraft fee is going to substantially deepen the hole you need to climb out of.

If there’s any good news about overly high overdraft fees, it’s that a White House proposal could bring them down to earth.

But poor people face other banking issues. Poor people are more likely to run out of cash on hand and need to pay out-of-network ATM surcharges. People who need to take a cash advance from a credit card typically pay 3% to 5% of the total amount of each advance. Late fees and high interest rates can also disproportionately weigh on low-income households.

And many households simply go unbanked. When they do, they sometimes have to rely on payday lenders, which charge much higher interest rates than traditional banks and are frequently referred to as “financial quicksand”.

Related: Enough With Deceptive Drip Pricing: How You’re Being Tricked + How to Stop It

7. Housing

Most people are aware that people with lower incomes are less able to afford the cost of buying a home. That means renting in perpetuity, which means never really owning the place in which they live.

But even when they can afford a home, lower-income households might still end up paying more.

For one: People who don’t make much money often have more difficulty saving for a significant down payment (if any). Not only does a smaller, or no, down payment make it harder to successfully bid on a home, but that’s also more money that’s being financed—which means more money paid in interest over time.

Also, a person’s debt-to-income ratio can factor in the interest rate offered; someone with high income and/or a better credit score likely will pay less for a similar-priced home than someone with low income and/or bad credit.

People with less money also sometimes have to settle for fixer-upper homes in low-income areas. And if substantial renovations become necessary, they might end up having to pay far more overall than they can afford.

Related: 10 Items You Should Always Buy Used

8. Higher Education

Higher education costs in the United States can be astronomical. While some fortunate undergrads get their college tuition paid for by their parents, others have to take out student loans—and doing so creates a significant additional financial burden.

To obtain a college degree, the average public university student borrows roughly $33,000, according to the Education Data Initiative. On a 10-year payback period at a 6% interest, that comes out to nearly $11,000 in additional interest payments.

In other words, people who can’t afford college upfront have to pay an extra $11,000 for the privilege.

If there’s any good news here, it’s that many students from low-income families can qualify for college financial aid. They can find out how much by filling out the Free Application for Federal Student Aid (FAFSA).

Related: Feeling Thrifty? Save Money at Thrift Stores

9. Job Opportunities

If you don’t earn much, a quick way to improve your situation would be to get a better-paying job, right?

OK. Let’s say you work a minimum-wage job and barely make ends meet. And let’s say you get an interview for a company offering a very livable salary.

What happens if they can only interview on a day you’re supposed to work? You might not have any paid personal, vacation, or even sick days. At best, you’d miss out on a day’s wages. But if your current job is understaffed—or if you just have a crappy boss—you might have your job threatened for missing a shift. An interview is not a guarantee you’ll be hired, so many people in that situation won’t risk their current hours or job.

There are other hurdles that narrow potential opportunities, too. What if you need to wear a nice suit to interview for that job? A person with higher income might already own a suit or have the income to spare—a person barely making ends meet probably won’t.

People with low incomes also might not be able to afford relocation, so that can eliminate a lot of opportunities outside their current city. And people without a financial safety net might not want to risk a job offer by negotiating a higher salary, so even while they might improve their income situation, they might earn far less than what another candidate might have been able to negotiate up to.

Related: 10 High-Paying Jobs that Will Hire You Without a College Degree

10. Car Insurance

All states except New Hampshire, South Carolina, and Virginia require drivers to have a minimum amount of auto liability insurance—and South Carolina and Virginia require those without car insurance to pay an uninsured motorist fee.

That means in most states, if you’re caught driving without insurance, you have to pay a fee. Depending on the state, a first offense might cost anywhere between $50 to $1,500.

If your state’s fee is low, it might seem worth the risk to simply not carry auto insurance. But fees aren’t the only punishment you need to worry about—you might have your license, registration, or both suspended, which can make getting to work much more difficult. You might even face jail time.

In other words: Being too poor to afford auto insurance means either cutting back on other necessities or taking massive risks by simply doing your daily driving.

Related: 10 Items You Should Always Buy New

Breaking the Cycle of Poverty

Once you’ve started paying the “poverty premium,” it can be challenging to stop. As you improve your financial situation, there are a few key actions you should do and some you should strictly avoid.

- Don’t use payday loans. Payday loans, which are known for short terms and high interest rates, can end up doing more harm than good for your financial situation. Pretend you got a two-week payday loan to tide you over until your next paycheck. It wouldn’t be uncommon for it to have a $15 per $100 fee, which equates to an APR of nearly 400%! If you desperately need money, you’re better off doing any number of things, including borrowing money from family friends, personal loans, or (while still not ideal, but better) cash advances.

- Weigh the value of employee benefits. While a job’s pay rate is important when choosing a job, don’t underestimate the value of benefits. If Job A pays minimum wage, but also offers health and dental insurance, that might actually be a better financial choice than Job B, which offers 50¢ more per hour but with no benefits. Other benefits matter, too. Paid time off can make it more cost-efficient to manage your health, miss a day of work for your sick kid, or get your car repaired. Access to unemployment insurance, which you usually can’t get through gig work, could be a much-needed safety net, too.

- Take advantage of services. Don’t be too proud to use the services available to you. If you were laid off from your job, there is nothing wrong with applying for unemployment benefits. You might be eligible for food assistance, housing aid, and more. To learn more about governmental programs that might help you, visit USA.gov’s benefits center.