When you desire to increase your financial worth, you can trade your time for an income, invest money you currently have, or both. For longer-term goals, investing acts as a wiser choice because inflation will work in your favor, assets can greatly increase in value over time, and you can benefit from distributions.

Investments make your money work for you. You have access to an extensive range of financial vehicles and they vary in the levels of risk and volatility.

Read below for the best financial vehicles you should consider right now.

Table of Contents

What Are the Best Financial Vehicles?

Financial vehicles allow you to place your money into assets that aim to accomplish their stated investment objective. You have a wide variety of options available to you for meeting these needs. The best investment vehicles will meet your specific investment needs and align with your risk tolerance. Make sure you understand the risks involved with investing in specific investment vehicles before proceeding with your investment.

Consider the following financial vehicles below and if they meet your financial goals, in the short, medium or long-term.

1. Bonds (And Bond Funds)

A bond is a loan that investors give out to a government, company, or other agency. Whoever issues the bond is responsible for returning the full amount (the “principal”) by a certain date (the “maturity date”), as well as interest—typically paid on a regular basis until the bond matures.

When interest rates are high, a CD might earn more than bonds. But when rates are low, bonds might deliver a better yield.

Individual savings bonds

First, let’s talk U.S. savings bonds, which earn interest over time. However, unlike most other individual bonds, you only collect interest on a savings bond once you cash it in.

Series EE Savings Bonds

Series EE Bonds earn fixed interest rates for 30 years, and they offer a return of double the value initially purchased if held for at least 20 years.

In other words, if you hold a Series EE savings bond for at least the next 20 years, the bond will either earn enough in interest to double its initial value, or the federal government will make a one-time adjustment to the price (adding money) to honor its guarantee. (But remember: You can let it accumulate interest for up to 30 years, so you don’t have to stop at 20.)

You can cash in (redeem) your EE bond after 12 months. However, if you cash in the bond in less than five years, you lose the last three months’ worth of interest. For example, if you cash in the bond after 18 months, you only receive the first 15 months’ worth of interest.

You must spend at least $25 when buying Series EE bonds. Above that, you can spend any amount down to the penny. (Example: You could buy $152.57 worth of EE bonds.)

Series I Savings Bonds

Series I savings bonds have both a fixed interest rate, as well as an inflation-adjusted interest rate that’s calculated twice each year. The reason? Series I savings bonds are designed to protect your savings from inflation (rising prices).

Like with EE bonds, Series I savings bonds require a minimum $25 purchase, but you can select any amount over that down to the penny. But while Series I bonds also accumulate interest over 30 years, there is no 20-year value guarantee like with EE bonds.

Series I bonds also have the same redemption rules: You can cash them in after 12 months, but if you cash them in less than five years, you’ll lose three months’ worth of interest.

Bond Funds

For most investors, it makes sense to hold most bonds in the form of bond funds, whether that’s a mutual fund, exchange-traded fund (ETF), or closed-end fund (CEF). That’s because outside of U.S. savings bonds, most bonds are difficult to research and difficult to access individually.

A bond fund pays out cash distributions on a set schedule specific to the fund. Those distributions will typically be bond interest, which is taxed at your ordinary income tax rate. However, some distributions will involve capital gains from the selling of bonds within the fund, not to mention, you might generate capital gains from selling the bond fund itself. Taxes on those will be determined by capital gains tax rates.

One tax-friendly type of bond you’ll want to own through a fund is called a “municipal bond.” Investors buy municipal bonds (aka “munis”) from cities, states, counties, or towns that need to finance a public project or other activities.

These bonds are exempt from federal income taxes and usually from state and local taxes, as well, provided the investor resides in the issuing state and/or community. The headline yields on these bonds are often lower than comparable taxable bonds, but once you account for the taxes you’re not paying, they can end up yielding more.

10 Best Stock Trading Apps for Beginners [Free + Paid]

2. Individual Stocks

Compared to bonds, partaking in individual stock picking is a significantly riskier choice. Individual stocks represent portions of companies, such as Amazon or Apple. You earn money through stocks when you buy them at a certain price and sell them later when the stock price increases. In effect, using the buy low, sell high investing strategy.

Conversely, you can also capitalize on downward price movements by short selling. Effectively, you sell borrowed stock at a higher price and repurchase it for less when the stock falls in value. You return the lower-priced shares to the lender and keep the difference as a gain.

Some stocks also pay dividends to shareholders. If you hold the dividend-paying stocks long enough, they can become qualified dividends and provide you with a tax-free source of passive income.

Buying individual stocks with free stock trading apps can carry a couple of advantages:

1. In particular, by using a commission-free broker like SoFi Invest to invest, you can create a portfolio of individual stocks.

2. Further, you will have more control over where your money goes and the chance to capture alpha by doing better than the general stock market.

As for disadvantages, they include:

1. increased difficulty diversifying your portfolio

2. having more responsibility to make gains, and

3. greater time commitment to screening stocks.

If you choose to invest in individual stocks, make sure to research potential stocks thoroughly with the best stock news apps and investment websites. Stocks can bring high gains when carefully selected and held for sufficient amounts of time. However, if chosen poorly, they can also result in substantial losses.

Best Brokerage Account Sign-Up Bonuses, Promotions and Deals

3. Exchange-Traded Funds (ETFs)

Exchange-traded funds (ETFs) have gained a significant amount of popularity in recent years. These financial instruments hold groups of assets (usually stocks, but also bonds or other assets) by pooling money with other investors to purchase financial instruments, benchmarks or other investment strategies laid out in an ETF’s prospectus.

Buying ETFs can quickly, cheaply and easily diversify your portfolio. However, for the best diversification, you will need to understand how multiple ETFs may overlap and have similar holdings. Investments like Vanguard’s Total Stock Market Index Fund (VTI) can comprise a portfolio’s entire equity allocation if you desire because it represents an investment in over 3,500 U.S.-listed companies.

Typically, these funds mirror established indices without active management, however, their investment strategies can differ. Further, they can also employ margin to leverage the movement of the ETF in relation to the underlying index or portfolio of holdings.

Like stocks, investors can exchange ETFs throughout the trading day. Investors can buy and sell these securities any time during market hours. If carefully selected, these funds usually consist of secure, long-term investment options. They work well under a simple, buy-and-hold strategy for building wealth over significant periods of time.

ETFs also have some major tax advantages. You only recognize capital gains tax in years where you sell an ETF and not throughout the life of the investment. When these investments produce income in the form of dividends, however, you will need to pay income tax in the year received.

4. Mutual Funds

A mutual fund is an investment company that pools money from many investors to buy stocks, bonds or other securities. The investors get the benefits of professional management and certain economies of scale. A pool of potentially millions or even billions of dollars is large enough to diversify and might have access to investments that would be impractical for an individual investor to own.

Here’s an example: An investor wanting to mimic the S&P 500 Index (an index made up of 500 large, U.S.-listed companies) would generally have a hard time buying and managing a portfolio of 500 individual stocks, especially in the exact proportions of the S&P 500 Index. Another example: An investor wanting a diversified bond portfolio might have a hard time building one when individual bond issues can have minimum purchase sizes of thousands (or tens of thousands!) of dollars.

Equity funds or bond funds will generally be a far more practical solution.

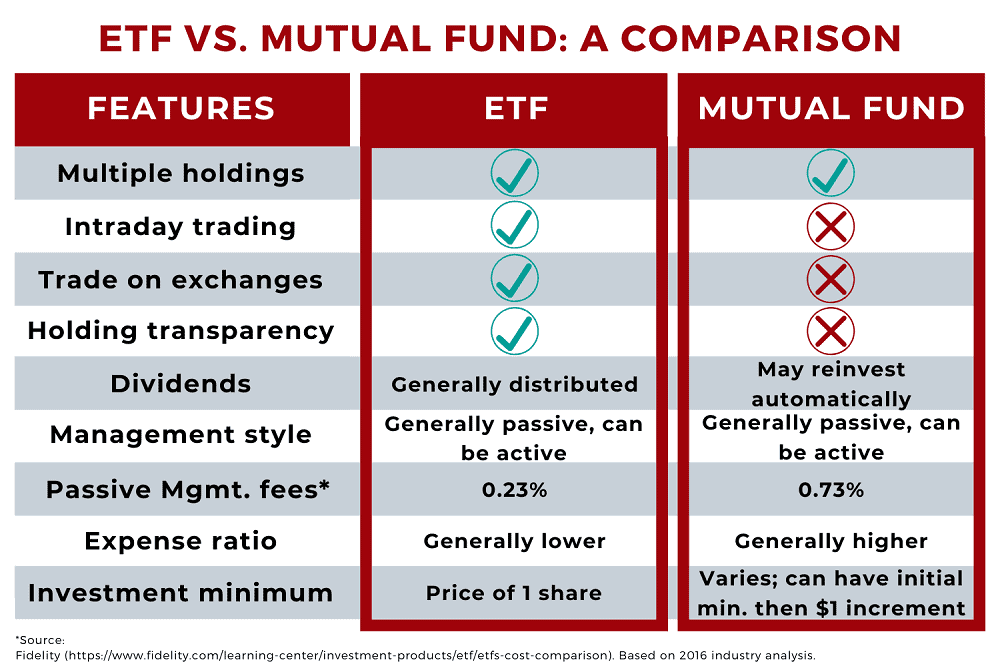

How Do ETFs and Mutual Funds Compare?

Mutual funds—ETFs’ older cousins—trade publicly, but they do not trade on an exchange. Investors looking to buy or sell can put in orders any time they’d like, but orders are only executed once each trading day, after the markets close at 4 p.m.

Exchange-traded funds, on the other hand, move up and down just like stocks or other assets during the trading day.

Also unlike mutual funds, ETFs don’t have minimum investment thresholds—the minimum cost is just one share (or less if your broker offers fractional shares). And ETFs are different from both mutual funds and closed-end funds (CEFs)—which also trade on major exchanges—because how they’re structured makes them more tax-efficient to buy and sell.

On top of all of this, most (but not all) ETFs are index funds that are benchmarked to a fixed list of assets, and thus are passively managed. However, most (but again, not all) mutual funds are actively managed by managers based on specific investment strategies. As a result, exchange-traded funds generally have a lower average expense ratio. But this relationship isn’t universally true—some actively managed ETFs can charge more than similar passively managed mutual funds!

In other words: Just like with any other investment, when it comes to buying ETFs, do your homework before buying.

5. Cryptocurrency

As many millennials found out at the end of 2017 and 2021, cryptocurrency markets come jam-packed with volatility. First with bitcoin, and now with “altcoins.” However, investing in cryptocurrency has lucrative potential and many investors think crypto represents the future.

Undoubtedly, you’ve likely heard stories of people who have made considerable gains in the crypto markets. While I don’t recommend putting all of your money in this type of investment vehicle (or even a significant amount), you might consider:

— investing in cryptocurrencies,

— lending your crypto assets, or

— funding crypto-linked investments

Investing in crypto in any of these manners can make a great addition to your portfolio because of the potential of above-average returns. I walk through each option briefly below.

6. Certificates of Deposit (CDs)

Certificates of deposit (CDs) are federally insured savings accounts which come with a fixed interest rate for a predetermined amount of time. CDs are insured in the United States up to $250,000 and are one of the safest short-term investment vehicles you can have. The interest rate typically comes higher than you would earn with the same amount of money in a high-yield savings account and the longer you loan your money, the more you earn.

This investment vehicle is best for money you know you’ll need at a fixed date in the future, such as a wedding or home down payment. These aren’t designed to be short term investments and if you take money out before the term length is over, you’ll face a penalty. CDs don’t have as high of a return as other options, but you’ll know exactly how much you’ll make. You can open certificates of deposits with most banks.

Best CD Alternatives to Consider

7. Money Market Accounts

Money market accounts, also referred to as money market savings accounts or money market deposit accounts, are similar to online savings accounts.

However, you usually aren’t allowed to withdraw money more than six times each month. Sometimes you are also required to have a more substantial minimum amount in the account than required for savings accounts. In exchange for the lack of flexibility, these accounts offer higher interest rates than savings accounts.

Don’t confuse money market accounts with money market mutual funds or money market funds as these are different. Money market funds aren’t insured by the FDIC or NCUA, unlike savings accounts or money market accounts.

8. Real Estate

There are several advantages to real estate investments. These appreciating assets hedge against inflation, have several tax advantages and can provide a predictable cash flow. One common real estate investment vehicle is a real estate investment trust (REIT).

REITs are companies that own, and usually operate, income-producing real estate. They can possess a variety of commercial real estate, from apartment buildings, to hospitals, to hotels, and more. A benefit to REITs is that they tend to be uncorrelated with stocks, meaning when one part of your portfolio is down, these may be up. You make money from dividend payments and can sell your shares for profit when their value increases.

Another way to make money through real estate is by investing through an online investment company, such as Fundrise. With a minimum of only $10, FundRise helps you invest in a diverse portfolio of real estate projects. While any type of investment holds an inherent risk, Fundrise takes a conservative approach with the intention of having the ability to withstand long periods of economic distress.

Qualified Purchaser vs. Accredited Investor

9. Health Savings Account (HSA)

If you currently use a high-deductible health insurance plan, a health savings account is an extremely valuable investment vehicle. It carries a triple tax advantage because contributions are tax-deductible, returns realized are tax-free, and you aren’t taxed on withdrawals for qualified medical expenses.

However, if you withdraw funds and use them for something unrelated to medical purposes before age 65, you’ll have to pay a 20% penalty. Past age 65, you can make withdrawals for any reason and don’t pay a penalty. You’re never forced to take distributions and unused money in your HSA rolls over each year indefinitely.

To qualify to open an HSA, in addition to being under a high-deductible health insurance plan, you can’t receive Medicare or be claimed as a dependent on anybody’s tax return. Ask your preferred insurance provider if they offer health savings accounts.

10. Fine Art

Fine art is an incredible asset, already used by the billionaire class for centuries. In fact, contemporary art specifically has outpaced the S&P 500 by 136% over the last 27 years, while also outpacing real estate and gold during inflationary periods. Plus, contemporary art has a low correlation to stocks, meaning it can still go up even when stocks are crashing. Like in 2022, when art had one of its best years on record despite a massive correction in tech stocks like Apple and Meta.

Even better, investing in this contemporary art is easy, thanks to a fintech company based in Manhattan’s financial district. This company, called Masterworks, allows everyday investors to buy a small slice of $1-$30 million paintings from iconic artists like Banksy and Basquiat. Masterworks buys the art, stores it, and holds it until it appreciates in value. When they sell it again, you get a prorated portion of any profit. They’ve passed $49,000,000+ in art sold so far, the net proceeds paid out to genius investors who know diversifying means looking beyond just stocks and bonds.

Of note, art can take years to sell. So this should only serve as a long-term investment in your portfolio. Fine art can involve significant risk and therefore should not represent the primary investment in your portfolio. Investing in fine art carries no guarantees that you’ll make a large profit.

However, it can be a great addition to a well-rounded investment portfolio, especially if you’re passionate about art.

11. Fine Wine

If you enjoy wine, investing in fine wine might be a satisfying investment for you. Because wine doesn’t have much connection to the stock market, it can work well as an alternative investment option to diversify your portfolio. Over the last 40 years, wine has outperformed the S&P 500 and was only down five of those years.

While fine wine can be lucrative, it can also be tricky to buy and resell on your own. It’s easy to buy a falsely advertised wine as well as difficult to keep wine stored optimally. The app Vinovest makes investing in wine simple. They certify the authenticity of wine, store it in optimal conditions, carefully transport it to buyers, and purchase insurance to cover every bottle.

All you must do is open an account, choose your investment style (based on level of risk), fund your account, and watch your portfolio perform. You can sell your wine or decide to have them ship it to you so you can enjoy it yourself.

12. Retirement Accounts

Retirement accounts are always some of the best types of investment vehicles and the sooner you open these accounts, the better. The most popular types of retirement accounts include:

— Traditional 401(k). Typically offered to employees who work for large, for-profit businesses. Most notably, these commonly offer contribution matches (up to a designated percentage).

— 403(b) plans. 401(k) equivalent used at nonprofit, tax-exempt businesses.

— 457 plans. Version of 401(k) plans used by government employees. Some have extra perks.

— Traditional IRA. An individual retirement account that anyone with earned income can open and deduct contributions from their taxable income.

— Roth IRA. An individual retirement account which makes you pay taxes upfront.

— Roth 401(k), 403(b), 457 plans. Largely the same as their non-Roth counterparts, except you pay taxes upfront and not when you take distributions.

Some retirement accounts, such as 401(k), 403(b), and 457 plans, are tax-deferred. This means you do not pay taxes on these funds until you withdraw money during retirement. Other retirement accounts, such as Roth IRAs, have you pay taxes the year you contribute. Any interest or capital gains earned grow tax-free.

You don’t pay any taxes in retirement when you withdraw from Roth accounts. You can have both types of investment accounts as long as you do not exceed yearly contribution limits. If you can afford to contribute to multiple retirement accounts, especially in early adulthood, it can accumulate into significant savings later.

Best Investment Vehicles to Consider Right Now

Diversification is vital when it comes to investments. Make sure to have a combination of safer investments (such as bonds, CDs, or retirement accounts) as well as riskier investments that may yield higher returns (such as stocks, cryptocurrency, or more alternative investments).

You may also want to make sure that some of your investments are easy to turn into cash in case of an emergency (though this shouldn’t replace an emergency fund). The best investment vehicles are usually the ones you start earliest. So, don’t delay in opening accounts for your future self now.

FAQ#1: What Is an Index Fund?

Simply put, a “fund” is a basket of securities (think stocks or bonds) that allows you to put a broader strategy to work via one single holding. An “index fund” is a more specific type of fund: one that’s guided by a simple benchmark (an “index,” which is governed by certain rules) to meet that strategic goal.

There are literally thousands of index funds out there, all with different approaches. But whether you’re talking about a stock market index fund linked to a popular benchmark (like the Dow Jones Industrial Average) or whether you’re talking about bond index funds tied to U.S. Treasuries, the basic approach is the same: The fund simply holds a group of securities that are tied together by some rules and some common thread.

FAQ #2: How Do Index Funds Compare to Actively Managed Funds?

It might sound counterintuitive, but one of the biggest advantages to investing in index funds is the fact that they are “passively managed.” That’s in contrast to “actively managed,” in which one or more human beings determine what stocks, bonds, or other securities to hold.

Why is that an advantage?

The first major benefit is that a simple and passive approach saves you on fees. There is no overpriced fund manager making trades based on gut instinct—just a fixed list of holdings like the 30 components of the Dow or the 500 companies in the S&P 500. Low-cost index funds can charge just a few dollars per year in fees for investors with $10,000 or less, versus tens if not hundreds of dollars for actively managed funds.

The second big benefit to investing in index funds vs. actively managed funds is that passive management has historically delivered better performance.

One of the most powerful stats comes from investing data provider S&P Dow Jones Indices, talking about the performance of large-cap funds, which are funds that invest in larger companies. Emphasis ours:

“[In 2021], large-cap funds continued their underperformance for the 12th consecutive calendar year, as 85% of active large-cap funds trailed the S&P 500.”

Clearly it’s not just the cost savings that make index funds appealing, but this potential for better overall returns, too.

15 Best Investing Research & Stock Analysis Websites

Being a discerning investor is, for better or worse, all about the homework. If you’re “doing it right,” you’re culling through useful information regularly on stock analysis websites, stock news apps, research reports and other valuable information.

Being a data-driven investor myself, I love these kinds of tools. So let me share with you my favorite investment research software, stock research websites and informational apps.

WealthUp’s Winningest Tech Stocks for 2024

The technology sector is always in a state of rapid change, so finding the best tech stocks for any year is no easy task.

So, how do you separate the best tech stocks to buy now from the fad stocks trading on short-lived news trends? And how do today’s small technology stocks become tomorrow’s tech giants? We’ll discuss that in our overview of the best tech stocks for 2024.

10 Best Long-Term Stocks to Buy and Hold Forever

As even novice investors probably know, funds—whether they’re mutual funds or exchange-traded funds (ETFs)—are the simplest and easiest ways to invest in the stock market. But the best long-term stocks also offer many investors a way to stay “invested” intellectually—by following companies they believe in. They also provide investors with the potential for outperformance.

So if your’e looking for a starting point for your own portfolio, look no further. Check out our list of the best long-term stocks for buy-and-hold investors.