If you’ve ever rented an apartment, this situational dread should feel familiar:

It’s that time of the year—your lease is up in a couple of months, and you’ve been waiting to receive that notice from the rent collection fairy that says how much more you’re going to have to pay if you sign up for another year. You’ve always been accustomed to slight annual increases, but ever since COVID, your landlord has asked for 10% more, 15% more, 20% more, or worse.

It’s financially painful—it means yet another look at your budget to determine how you’re going to make the numbers work this time around. But on top of that, it’s confusing. You look around your unit and your building and notice nothing has changed to justify these brutal hikes.

That begs the same question millions of renters have been asking themselves in recent years: “Why are rents so high?”

The Tea

One of Americans’ most acute pains of the past few years has been the growing cost of putting a roof over their heads.

Objectively, homebuyers have had it worse—a recent study showed that it’s now costlier to own a home than rent in all 50 of the largest U.S. metropolitan areas. Expect little shock from anyone who has bought a home over the past couple years. According to data from the National Association of Realtors (NAR), the national median price to purchase a single-family home surged from $266,000 in January 2020 to $394,000 in March 2024—a 48% jump in just a little over four years.

But renting hasn’t exactly gotten cheaper. Indeed, rents have shot up from $1,584 monthly in January 2020 to $1,987 in March 2024 (or a little more than 25%), according to Rent.com data. Other rent collection data sets show much more rapid growth. “In just two years, Baselane data reveals a 33% surge in average rents, underscoring the escalating challenge for renters,” says Saad Dar, Head of Business Development and Partnerships for Baselane, a real estate banking platform that helps rental property owners organize their rental finances.

We should point out that wages have improved, too. But at a roughly 22% clip across the same time frame, wage growth hasn’t matched the speed of either housing cost.

Simple math based on national figures shows renter affordability has become increasingly problematic. Data released this year from the Harvard Joint Center for Housing Studies found that roughly half of renters nationwide were spending more than 30% of their income on rent in 2022. People above the 30% threshold are considered “rent-burdened.” Because of the high level of income going toward rent, they have much less money available for other necessities, including utilities, groceries, and medications. Also, studies have found that a high rent burden is linked to poor mental health and higher rates of depression and anxiety.

In some places, this has boiled over into animus toward landlords, with some renters claiming their steep rental hikes are just brazen attempts to squeeze more profits out of their tenants. While that might be true in a few isolated cases, though, the most common cause of rent hikes is that landlords are facing the same pressure as their tenants: inflation.

The Take

When a landlord collects rent, the vast majority of that check is going toward necessary costs that are passed along from the landlord. (While estimates range widely based on the type of property, a typical return on investment is between 8%-12%.)

That means your typical rent increase is predominantly a reflection of growing costs for the landlord. And indeed, the outsized rent hikes of the past few years have come as landlords have faced down a spike in their have been faced with higher costs on a variety of fronts.

“Our data shows a significant 30% rise in rental property owners’ monthly debit card spending from 2022 to 2024—a signal of the increasing costs impacting landlords,” Dar says.

Here are some of the biggest drivers of rising rents, as gathered from public and private data sources, as well as WealthUp interviews with landlords.

Insurance

Landlords are already starting behind the 8-ball: The Insurance Information Institute says landlord insurance policies typically cost roughly 25% more than homeowners insurance policies.

“The No. 1 biggest expense is insurance,” says Bonnie Low, CEO of CBL West Real Estate Holdings LLC. “And insurance rates are skyrocketing.”

Remember: Insurance policy payouts largely go toward financing repairs of one sort or another. And since COVID, costs related to repairs have soared—materials costs are higher, and repair workers’ wages have risen as well. (Remember that 22% increase in wages we cited above? That’s also in line with data gathered by the Bureau of Labor Statistics [BLS] for the construction industry.) Exacerbating the problem is another issue whose rise greatly predates COVID: natural disasters.

“Even for landlords who are great underwriters and number analyzers, it’s hard to see disastrous events coming, like floods and hurricanes,” says Jamie Banks, CEO of Radiate Real Estate. “As those events happen, insurance goes up.”

Reinsurer Munich Re says that insurers and reinsurers paid $95 billion connected to global economic losses caused by natural catastrophes in 2023. That’s less than the five-year average of $105 billion, but above the 10-year average of $90 billion. Contributing was a series of severe thunderstorms that caused $34 billion in damage during the first half of 2023—”the highest ever insured losses in a six-month period,” according to reinsurer Swiss Re—that included 10 billion-dollar-plus events.

“We are definitely investing in a wildfire-prone area (none of our properties have been hit), and it’s driving up rates by 40% per year. It’s really dramatic,” Low says. “In the coastal areas, and the South and Eastern Seaboards, the increases are even more dramatic than that.”

“It’s not something that was factored into your [original calculations] when you bought your property, and you expect just a normal increase to be, like, $100 per year per property. But in some cases, it’s going up by thousands or even tens of thousands.”

“In my personal experience as an owner, I have seen premiums go up anywhere between 20% and 35% over the past two years alone,” says Dar, who also manages roughly 20 units.

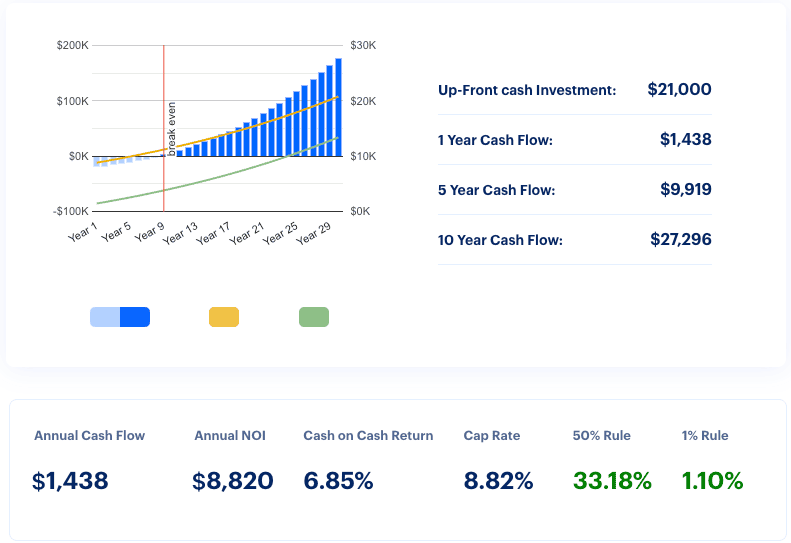

That makes a significant difference in a landlord’s math. We’ve generated a look at what a real estate investment would look like with two different monthly insurance premiums—the first at $100, and the second at $130. That 30% increase drops the landlord’s return well below the bottom of the 8%-12% return range mentioned above.

Source: Baselane Rental Property ROI Calculator

Source: Baselane Rental Property ROI Calculator

Utilities

“We also have a short-term rental and some mid-term rentals. In those cases, we provide utilities, and in some cases, we’re seeing utility prices skyrocketing,” Low says.

Consider electricity prices. According to the Bureau of Labor Statistics, the average price for electricity per kilowatt-hour in a U.S. city has jumped 30% between January 2020 and March 2024—from 13.4¢ to 17.4¢.

“We’re in [Pacific Gas & Electric] territory—they’ve been hit hard because of liability for a lot of the really big California wildfires. … [Among other steps] they have to bury a lot of the utility lines that are currently overhead because that’s where a lot of the danger is. It’s an important safety measure, but also very expensive, and that’s really causing utilities to go up.”

Taxes

“Taxes are a problem, too, because homes continue to be valued higher,” Banks says. “If taxes are a set percentage of the value, then if the value of the home has increased by 20%, taxes have increased by 20%.

WealthUp Tip: One of the biggest tax benefits of investing in real estate: MACRS depreciation.

“That’s one thing that crushes landlords. Even if they’re not trading that home—they haven’t bought, they haven’t sold—if another property has sold in the neighborhood at 25% more, that’s going to impact their assessed value from a taxation standpoint.”

Materials

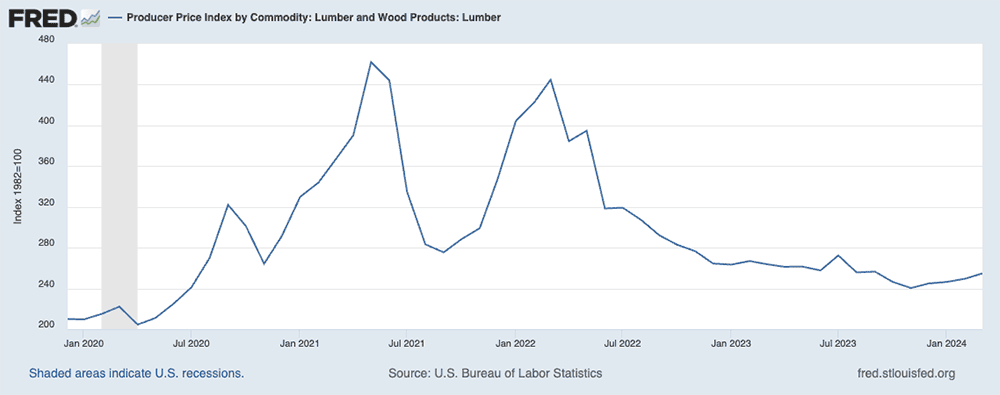

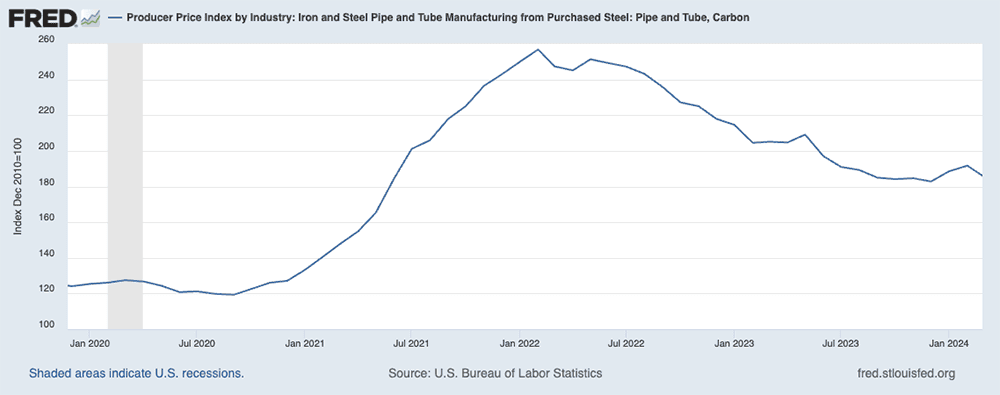

One of the most widely reported drivers of housing prices in the first couple of years after the start of the pandemic was materials. A combination of demand and choked-up supply lines sent essential homebuilding materials like lumber and copper skyward.

“We saw the cost of raw materials skyrocket,” Low says. “MDF (medium-density fiberboard), the board you use for paneling, went from $14 per sheet to $40 per sheet to $100-plus per sheet in two to three months. It stayed really high for months. And it eventually started trickling down, but it never got back to pre-pandemic prices.”

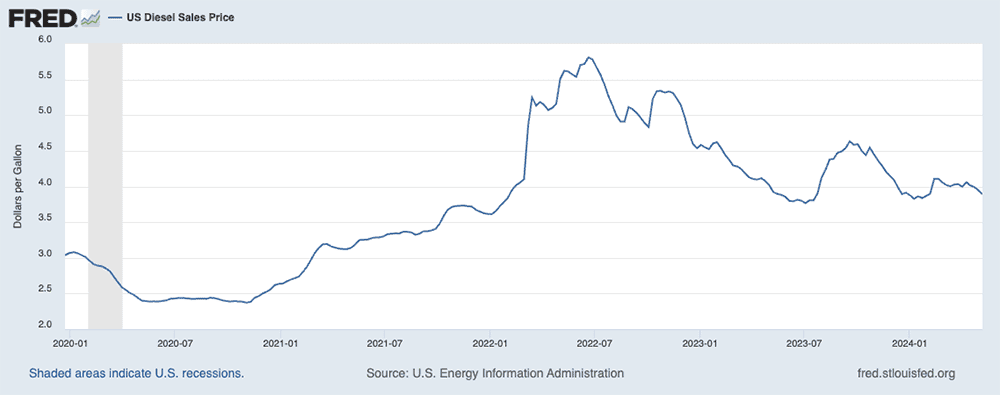

That’s largely been the story of materials broadly—an initial jolt in prices followed by an eventual retreat in prices. But the extent of those pullbacks has varied across building-critical components. A few examples:

Source: Federal Reserve Bank of St. Louis

While those prices were most directly tied to the prices that traditional homeowners bore, renters felt the sharp end of the stick, too. Higher materials prices raised the costs of multifamily and single-family new builds, too, as well as the costs of potential repairs and maintenance—all reflected in rents.

Services

Banks also pointed out that some of the above pressures were passed along to them in the form of higher services prices, too.

Lawn-care professionals started charging more. Pest control and other specialized services raised prices to reflect not just higher wages but also the growing costs of their core chemicals. Any businesses that required bonding and insurance endured higher costs, which were passed along in their pricing.

“Cleaner prices are going up, too,” Banks says. “There are more furnished properties out there, and cleaners are saying, ‘If I can get $10 or $20 more from another landlord, maybe I’ll go work with them.’

“Maybe it’ll only be a nominal 5% increase in costs per servicer, but if every one of your costs is increasing across the board, you’ll hurt.”

Other Factors

The landlords we talked to mentioned a couple other costs that some tenants might not realize are contributing to higher rents—or at least might not realize how significant those contributions are.

Amenities: “If one building has a gym that also needs serviced and cleaned, that’s going to add to the expenses,” Banks says. “More multifamily buildings are expected to have electric vehicle (EV) charging, and that will drive up [the] price—I know because I have an EV, and the cost to install an EV charger is expensive. Even smart locks—a renter can put in a code, use a fingerprint, even a keycard—you’ll see these especially in A-class buildings, and they’re expensive. They could run $200 to $250, and you have to install them across 200 units.”

WealthUp Tip: Another amenity landlords might consider: video intercom systems

The cost of turnover: “A turnover is when someone leaves and the unit has to be readied for the next person to come in,” Low says. “You have a renter in there for one or two or three years. Hopefully you’ve done an inspection once in a while. But even if they do a really good job cleaning it themselves—because when they come out, they want their security deposit back—there are usually so many things that need to be repaired, replaced, touched up or deep-cleaned that it can drive the cost of that turn into the thousands of dollars.”

In a survey conducted by Lemonade in November 2022, American landlords and tenants were asked about their relationships. Surprisingly, the study revealed that 79% of American renters considered a landlord who was rude about repairs worse than a landlord who consistently raised the rent (65%). From a landlord’s perspective, 79% considered a tenant who pays their rent on time to be exceptional. The next three important categories were maintaining cleanliness (74%), adhering to property rules (72%) and being employed (60%).

Conclusion

To be clear: Predatory landlords exist, and they’re a plague on both renters and the industry’s reputation. But like with most things, the truth lies somewhere in the middle—in this case, somewhere between the accusations of greedy landlords making fat stacks by juicing rents, and full-throated defenses of the industry that claim property managers can’t even make a buck anymore.

The middle ground here rests in cold, boring accounting. The inflationary environment of the past few years has left almost no corner of the economy untouched, and certainly not real estate, as the data clearly demonstrates. Landlords aren’t taking more of a cut than they did before—they’re just continuing to flow costs through to tenants as they always have. And those costs have been on the rise.

Like what you’re reading but not yet a subscriber? Get our weekly financial insights and updates delivered to your inbox every Saturday morning by signing up for The Weekend Tea today! You can also follow WealthUp on Flipboard for more great advice and insights.